Economic Stimulus Packages Overdosing Could Ignite Hyperinflation

Economics / Stagflation Feb 15, 2008 - 01:09 PM GMTBy: Peter_Schiff

In perhaps one of biggest ironies to ever to come out of Washington, this week Congress simultaneously pilloried major league baseball players for using artificial stimulants to pump up their performance while passing legislation to do just that to the national economy. Am I the only one laughing?

In perhaps one of biggest ironies to ever to come out of Washington, this week Congress simultaneously pilloried major league baseball players for using artificial stimulants to pump up their performance while passing legislation to do just that to the national economy. Am I the only one laughing?

In reality, the current slump in the U.S. economy is simply the come down from years of financial doping in the form of skyrocketing home values and easy credit. Rather than reaching for yet another syringe, Congress should ask Americans to do what it demands of ballplayers: play within their natural means. Unfortunately in the case of the economy, the patient is already so juiced up that further doses may not only fail to stimulate but may result in a trip to the emergency room.

As the widely praised “economic stimulus” bill was signed into law, the only dissent heard was from those saying the plan did not go far enough. Speaking for those unheard voices who disagree with the strategy entirely, I believe the most significant aspect of the plan is that it creates a new and improved method for delivering inflation.

As the widely praised “economic stimulus” bill was signed into law, the only dissent heard was from those saying the plan did not go far enough. Speaking for those unheard voices who disagree with the strategy entirely, I believe the most significant aspect of the plan is that it creates a new and improved method for delivering inflation.

Previously, the government has largely relied on interest rate stimulus to keep the economy humming. In this method, money supply growth, also known as inflation, is channeled through the banking system. The Fed makes cheap credit available to banks, which then lend out the new funds or use them to acquire higher yielding assets. As a result, asset prices, such as stocks, bonds and real estate, have been bid up to bubble levels. However, the inflationary impact on consumer prices occurs with a considerable lag.

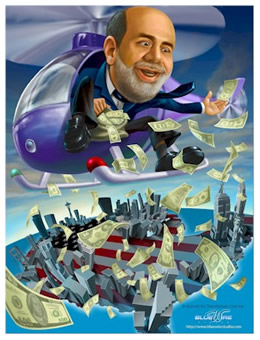

Now that rate cuts alone are proving insufficient, mainly because banks are now so over-loaded with questionable collateral and shaky loans that few can consider acquiring more assets or extending additional credit (no matter how cheap such activities can be funded), the Government is opting for a more direct approach. By printing money and mailing it directly to the citizenry, the “stimulus plan” cuts out all of the financial middle men and administers the inflation drug directly to consumers.

If simply printing money could solve financial problems, the Fed could send $10 million to every citizen and we could all retire en masse to Barbados . However, more money chasing a given supply of goods simply pushes up prices and does nothing to improve underlying economics. Since this new money will go directly into consumer spending, without first being filtered thought asset markets, the effects on consumer prices will be far more immediate.

This politically inspired placebo will do nothing to cure what ails our economy. The additional consumer spending will merely exacerbate our imbalances, allow the underlying problems to worsen, and put additional upward pressure on both consumer prices and eventually long-term interest rates as well. The failure of the stimulus plan to cure the economy will cause the Government, and the Wall Street brain trust, to conclude that it was simply too small. Their next solution will be to administer an even stronger dose.

My prediction is that over the course of the next few years, successive doses of even larger stimulus packages will fail to revive the economy. As the recession worsens and the dollar drops through the floor and consumer prices and long–term interest rates shoot thought the roof, politicians and economists will look for scapegoats. Few, if any, will properly attribute the problems to the toxic effects of the stimulus itself.

However, like all drugs, the biggest danger is an overdose. In monetary terms an overdose is hyperinflation, which will surely kill our economy. It is my sincere hope that before we reach that “point of no return,” a correct diagnosis is finally made. When that occurs, the stimulants will be cut off, and the free market will finally be allowed to administer the only cure that works: recession. If that means we lose some speed on our fastball, so be it. Maybe we could use a few months in the minor leagues to get back to basics. While we may not like the economic side effects of stopping cold turkey, it sure beats carrying our money around in wheelbarrows!

For a more in depth analysis of the inherent dangers facing the U.S. economy and the implications for U.S. dollar denominated investments, read my new book “Crash Proof: How to Profit from the Coming Economic Collapse.” Click here to order a copy today.

By Peter Schiff

Euro Pacific Capital

http://www.europac.net/

More importantly make sure to protect your wealth and preserve your purchasing power before it's too late. Discover the best way to buy gold at www.goldyoucanfold.com , download my free research report on the powerful case for investing in foreign equities available at www.researchreportone.com , and subscribe to my free, on-line investment newsletter at http://www.europac.net/newsletter/newsletter.asp

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.