Silver $100, Yes, But When?

Commodities / Gold and Silver 2013 Nov 09, 2012 - 05:43 AM GMTBy: DeviantInvestor

There are many predictions for the price of silver. Some say it will crash to nearly $20, and others proclaim $100 by the end of 2012. The problem is that some predictions are only wishful thinking, others are obvious disinformation designed to scare investors away from silver, and many are not grounded in hard data and clear analysis. Other analysis is excellent, but both the process and analysis are difficult to understand. Is there an objective and rational method to project a future silver price that will make sense to most people?

There are many predictions for the price of silver. Some say it will crash to nearly $20, and others proclaim $100 by the end of 2012. The problem is that some predictions are only wishful thinking, others are obvious disinformation designed to scare investors away from silver, and many are not grounded in hard data and clear analysis. Other analysis is excellent, but both the process and analysis are difficult to understand. Is there an objective and rational method to project a future silver price that will make sense to most people?

Yes, there is!

I am not predicting a future price of silver or the date that silver will trade at $100, but I am making a projection based on rational analysis that indicates a likely time period for silver to trade at $100 per ounce. Yes, $100 silver is completely plausible if you assume the following:

- The US government will continue to spend in excess of $1 Trillion per year more than it collects in revenue, as it has done for the previous four years, and as the government budget projects for many more years.

- Our financial world continues on its current path of deficit spending, debt monetization, Quantitative Easing (QE), weaker currencies, war and welfare, ballooning debts, and business as usual.

- A massive and devastating financial and economic melt-down does NOT occur in the next four to six years. If such a melt-down occurs, the price of silver could skyrocket during hyperinflation or stagnate under a deflationary depression scenario.

Still with me? I think most people will accept these simple and rather obvious assumptions.

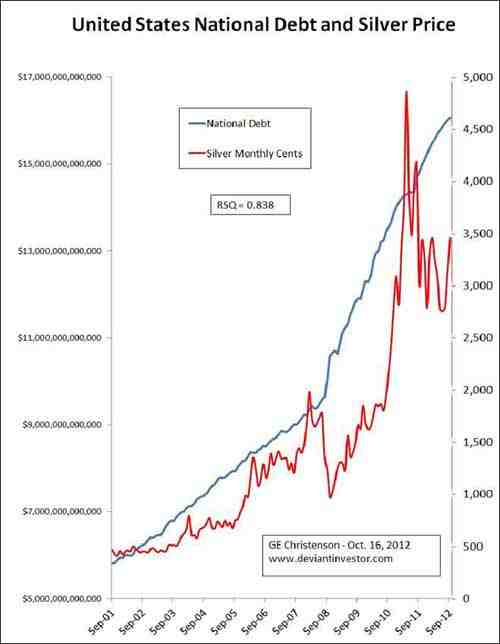

Many individuals find it difficult to believe any projections for silver, either higher or lower, because silver is hated, loved, often ignored, and seldom recognized as another currency. However, most people know that the US government national debt is huge and will grow much larger during the next decade. Examine the following graph:

National debt is plotted on the left axis - yes, it was larger than $16 Trillion as of September 30, 2012. Silver is plotted on the right axis. The data covers an 11 year span from September 2001 through September 2012. This period includes the time after the stock market crash of 2000, the game-changing events of 9-11, the real estate crash, and the new bull market in commodities. Each month represents one data point. Note the similarity between the two trends. The statistical measure R-Squared for this 11 year period of monthly data is 0.838 - quite high. R-Squared increases to about 0.90 if national debt is correlated to the monthly price of silver after it has been smoothed with 9 month moving average.

This expansion in the national debt is a simple proxy for expansion of the money supply and the devaluation of the dollar. The exponential growth rate for the national debt averaged over this period is 9.7% compounded annually, while the rate averaged over the last five years is 12.3%. The exponential growth rate for silver is a bit larger - about 20% per year compounded annually. I attribute this larger rate, in excess of 12.3%, to the realization that silver is a competing currency, mining supply is growing slowly, most governments are aggressively "printing money," industrial demand is increasing, and some investors are actively buying silver. In short, demand is increasing while the realization that silver is still an undervalued investment and cannot be "printed" at will (like dollars and euros) has reached the awareness of individual investors. I believe it is very likely that national debt and the price of silver will continue their 11 year exponential growth trend.

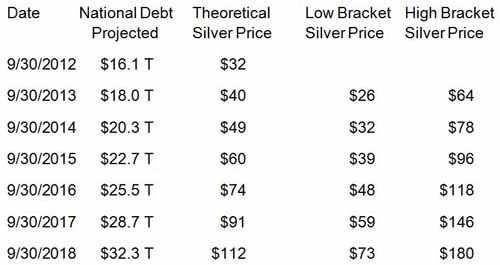

Since silver correlates relatively closely with national debt, we can use national debt as a clear, objective, and believable proxy to model the future price of silver. Extend national debt and silver prices forward for the next six years based on the exponential increase from the last five years, and the result is the following table. Bracket silver prices, high and low, based on past annual volatility of roughly +60% and -35%. You can see from the graph that silver prices are very erratic - silver rallies too far and too fast, and then crashes to absurdly low levels. These stunning rallies and crashes have happened for at least 35 years and probably will continue throughout this decade.

Whether or not prices and crashes are manipulated, and there seems to be credible evidence to indicate such, the "big picture" view is that silver has rallied from about $4 to nearly $50, crashed back to about $25, and is set to rally to well over $100 in the next few years. The week to week movements will become even more extreme so focus on the long-term trend to reduce anxiety and fear.

As you can see, this projection for silver prices indicates that silver could reach $100 as soon as late 2015, with a theoretical projected price of $100 about 2017. The price of silver is about $32.00 as of November 1, 2012.

The next graph shows the price of silver, on a logarithmic scale, with high and low trend lines. The horizontal line at $100 shows the earliest and latest dates at which the trend lines project silver will reach that price. Those dates are 2015 through late 2017, which are consistent with the above projection based on the tight correlation to the national debt. The important realization is that $100 silver is just a matter of time - say three to five more years - depending on the level of QE "money printing," inflationary expectations, dollar devaluations, fiscal insanity, government deficit spending, wars, and welfare. We have been warned!

Conclusion

We may be skeptical of price projections for silver, but projections for national debt are quite believable. Since the correlation is very close, future silver prices can be projected, assuming continuing deficit spending, QE, and other macroeconomic influences. A dollar crash or an unexpected bout of congressional fiscal responsibility could accelerate or delay the date silver trades at $100, but the projection is reasonable and sensible. Silver increased from $4.01 (November 2001) to over $48 (April 2011). A silver price of $48 seemed nearly impossible in 2001, yet it happened. An increase from about $32 (October 2012) to $100 (perhaps in 2015 - 2016) seems much easier to believe, especially after Bernanke's recent announcement of QE4-Ever. Read We Have Been Warned.

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2012 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.