Gold's Hypnotic $1000 Price Target and the Outlook for Precious Metal Shares

Commodities / Gold & Silver Stocks Feb 24, 2008 - 12:56 AM GMTBy: Clif_Droke

There is a lot of fear circulating around the Internet concerning gold/silver and the gold/silver stocks. As contrarians, that's exactly what we like to see. It lets us know the prevailing trend (up) is still intact and that higher prices are likely to be seen before the next interim top is in.

There is a lot of fear circulating around the Internet concerning gold/silver and the gold/silver stocks. As contrarians, that's exactly what we like to see. It lets us know the prevailing trend (up) is still intact and that higher prices are likely to be seen before the next interim top is in.

The fear in the PM stocks among the “dumb money” trading public almost perfectly mirrors the optimism shown by the “smart money” traders who have recently been buying the PM stocks with both hands in anticipation of another leg up in the momentum market for the gold stocks. Take for instance the latest readings in the CBOE Gold Index put/call open interest.

After several days of reading of 0.70 to 0.74, which are high neutral bordering on bearish readings, the smart money turned bullish again last week and for the last three consecutive trading days the put/call ratio has been 0.18. That's the same extremely low open interest ratio levels we saw from November 21, 2007 through the end of December. And how did the CBOE Gold Index itself perform during this period? It rose from a low of 160 to a high of just under 210 in a matter of weeks.

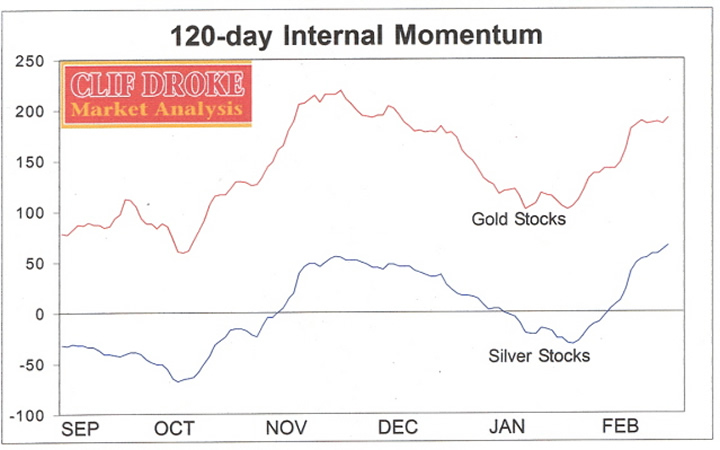

Another thing that's good to see is that silver has once again taken the lead from gold. That's one of the hallmarks of a strong momentum market in the precious metals sector. By “taking the lead” I'm referring to the internal momentum structure of the two market segments. The dominant interim 120-day internal momentum indicator for silver shares is actually outperforming the 120-day momentum for the gold stocks. Check out the momentum chart below and you'll see what I mean. This chart measures the rate of change in the number of gold and silver shares making new highs and new lows. This is one of the best ways of knowing the demand for gold and silver stocks since the new highs/new lows capture the last increment in the demand for stocks.

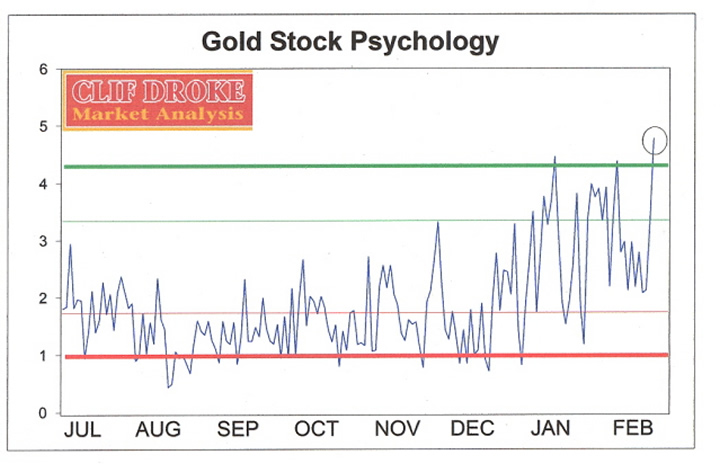

Another measure of demand for gold shares is the Gold Stock Psychology indicator. This gauges the flow of money into the big blue chip names like Barrick Gold, et al, which are always favored by the “smart money” traders, versus money flows into the smaller cap shares favored by the public. Whenever blue chip gold stock volume outpaces small cap or junior mining share volume by a ratio of 3:1 or greater it typically means higher prices ahead for the blue chip gold shares. That in turn is supportive for an overall buoyant environment for the broad gold/silver stock market as reflected by the XAU and HUI indices.

Then there is the price of the yellow metals itself. Gold has become one of the most attractive momentum plays right now and is attracting its share of trend and momentum traders. Normally this would be a concern from a contrarian standpoint, and at some point in the not too distant future this will be a legitimate concern. For now, at least, the momentum looks strong enough to keep the uptrend intact as gold traders reach for the mythical $1,000/oz. level. Which leads us to our observation for the week…

Is there such a thing as self-fulfilling prophecy in the financial market realm? Many years of close observation and first hand experience argue in favor of the affirmative.

Take the subject of “hypnotic” price targets for example. I call them hypnotic because they capture the imagination of the public at large and investors become so enchanted by them they end up, wittingly or unwittingly, turning them into reality through the combined momentum of their enthusiasm.

Remember back in the late 1990s when everyone was talking about the Dow reaching the mythical 10,000 level? At first only a handful of die-hard perma-bulls were talking about Dow 10,000. Their enthusiasm proved infectious, however, and before long newsletter writers, talking heads and legions of investors were abuzz with predictions that the Dow would indeed reach 10,000.

After what seemed an interminably long time – the Dow twice exceeded the 9,000 level in the spring and summer of 1998 before tumbling 20% in the fall of that year – the Dow finally succeeded in reaching the much ballyhooed 10,000 level in 1999.

Another example of a “magical” upside price target becoming self-fulfilling prophecy would be $100/barrel oil, which was only a recent fulfillment. It wasn't long ago (March 2005) that Goldman Sachs first made its controversial forecast of $100/barrel oil.

Within a short time of this prediction, the momentum crowd began chanting the mantra of $100 oil and before long they had everyone believing it as being inevitable. And indeed it proved to be. The $100 mark was reached in less than three years of when the prediction was first made.

More recently we have seen another example of a hypnotic price target in the making: $1,000/oz. gold. Will this benchmark psychological level be reached in the gold market before all is said and done? I have no doubt that it will.

Experience teaches that once a major round-number price target becomes an obsession among millions of investors, it must of necessity be reached before the bull market can end. It's almost as if the collective psyche of the investing public refuses to budge until the magic number has been reached. Only then can the frenetic masses breathe a sigh of relief.

A study of mass hypnosis shows that constant repetition frequently brings about the desired objective. In other words, a strongly held emotional belief – regardless of whether it is well founded – tends to become reality at some point.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is the author of several books on financial markets, including “Channel Buster: How to Trade the Most Profitable Chart Pattern.” For more info visit www.clifdroke.com .

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.