Silver Premiums, Demand & Shortages

Commodities / Gold and Silver 2013 Apr 09, 2013 - 05:36 PM GMTBy: Jeff_Berwick

Back in 2008, silver fell from over $20 per ounce down to below $10. This was a stomach-turning experience for those who had begun investing heavily in the metal.

Back in 2008, silver fell from over $20 per ounce down to below $10. This was a stomach-turning experience for those who had begun investing heavily in the metal.

I heard reports of bullion dealers in the US who simply were not selling Monster Boxes of Silver Eagles. Physical metal was hard to find in spite of the price collapse.

That nadir didn't last for long as silver obviously rebounded magnificently, teasing its old psychological record of $50 an ounce. Realistically, it took some time for silver to crescendo amid increased demand arisen from The End Of The Monetary System As We Know It (TEOTMSAWKI).

So, realistically, one could expect that silver would thus consolidate over a similar amount of time. And it did. Still is...

Even today, just under $30, silver has represented a formidable store of value since 2008 - and before - if you can stomach the sheer weight of the devil's metal. (You're probably a HomeGrowner.)

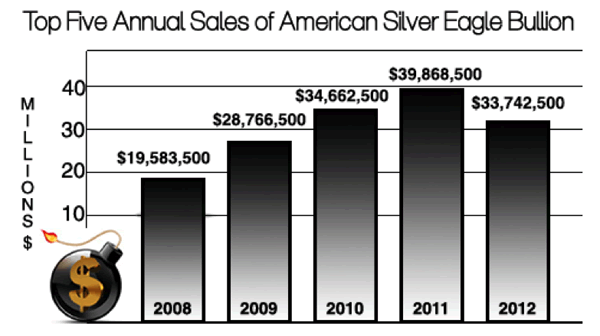

Because it has been such a formidable store of value, demand has remained, and many mints in the world can't keep up.

So, it makes sense that coin premiums are now rising.

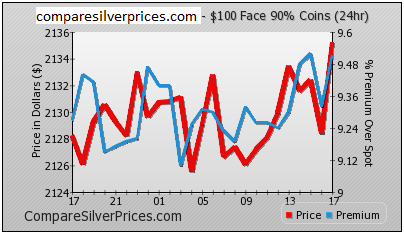

Most recently, junk silver has dried up, and premiums have risen to over 10% on a silver retail product that oftentimes has traded at around spot. Compare Silver Prices nicely demonstrates the premium rise in just the past 24 hours (the website's algorithm tracks silver premiums):

We'll explain further the premium rise in the coming issue of The Dollar Vigilante Newsletter, but for the purpose of today's blog, let's look at where this mess all started (at least in recent, recent history).

The Beginning Of Bretton Woods' End: 1971

French President Charles De Gaulle first forced the US's hand on its pre-1971 obligation to convert French-held dollar reserves to gold. In some ways, this was the first post-World War II hint of the fragility of the Bretton Woods system. The US fairly quickly cut the tie between the dollar and gold, as we’ve covered extensively.

Können wir unser Gold zurück?

Although reported heavily in January, Germany’s been looking to get its gold back for awhile – since about 2010. This information has basically gone down the memory hole, though. The US has heretofore ignored Germany.

According to mainstream sources, Germany is looking to repatriate 674 tons of gold by 2020. Germany wishes to hold just 50 percent of gold reserves in Frankfurt by then. Post-World War II, once all the Nazi party oligarchs had gotten their loot, the official story goes as such: Germany began amassing gold reserves thanks to growing exports to the US. They kept the gold in the US to protect themselves from the “Evil Empire,” the Soviet Union.

Prior to reunification in 1990, 98 percent of Germany’s gold was stored abroad. Now, Germany wishes to store half of its gold domestically.

Podemos tener la espalda de oro?

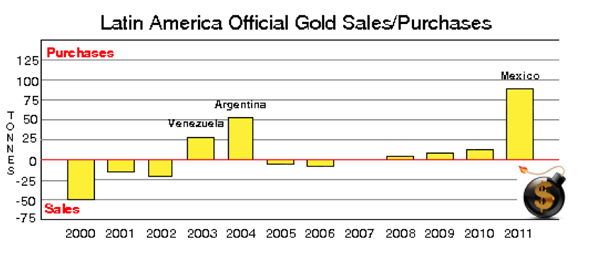

The Mexican government Audit Office issued an official statement last month urging the Bank of Mexico to audit the gold it is "storing" at the Bank of England. The auditors directed the Bank of Mexico to "make a physical inspection with the counterparty that has the gold under its custody, in order to be able to verify and validate its physical wholeness and compliance with the terms and conditions of dealing with this asset." According to GATA, the actions of the Mexican government Audit Office are thanks to a long campaign by Guillermo Barba, a Mexican civil activist and investigative journalist.

The Government Audit Office concluded that 95% of the gold reserves at the Bank of Mexico are stored with other government, with 99% of this gold abroad stored at the Bank of England. Never before has the Mexican central bank inspected the gold it purchased nor does it hold a list of all the gold bars stored with London.

Demand For Precious Metals, A Precursor For A Rise in Premium

It’s not just France, Germany, and Mexico that has moved towards repatriating its gold. Switzerland’s campaign to repatriate its gold has almost reached the necessary 100,000 signatures to begin the process; the Netherland has talked gold repatriation, as has Ecuador (repatriating 1/3rd of gold reserves) and Azerbaijan.

Makes sense none of these governments would want their gold in the US. After all, in January the US Mint notified the public:

Authorized Purchasers,

The United States Mint has temporarily sold out of 2013 American Eagle Silver Bullion coins. As a result, sales are suspended until we can build up an inventory of these coins. Sales will resume on or about the week of January 28, 2013, via the allocation process.

Please feel free to call us if you have any questions.

Regards,

Jack A. Szczerban

Branch Chief, Precious Metals Group

Department of the Treasury

United States Mint

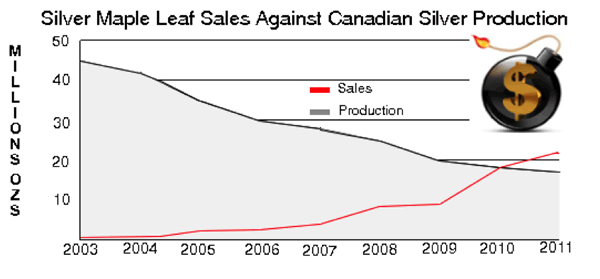

And then the Commonwealth nation of Kanada’s Royal Kanadian Mint began allocating and limiting the quantity of sales of the popular Silver Maple Leaf, .999.

The silver shortage spanned North America.

Oh wait…except for La Casa de Moneda de Mexico (the oldest mint in the Americas), with a full supply of 2013 silver coins.

One can only imagine it is a matter of time before Mexico starts getting the Polish treatment.

With fear and anxiety unrelieved by stock market highs, people will continue looking towards hard assets. This demand will in turn lead to higher and higher premiums. It might not matter one day what the price of silver is. Its premium on physical might double that easy. That is, if you can get physical silver at the retail level.

When I was on Fox's Varney & Co last week for BitcoinATM, Varney told me I would appreciate that he was going to read the gold price for the day. Actually, I could care less what the gold price is day-to-day. Really, the gold price is just the dollar price in terms of gold. Dollar Vigilantes know, in the long term, where that is going.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.