The Return of the Bond Vigilante... in Japan

Interest-Rates / Global Debt Crisis 2013 May 14, 2013 - 02:53 AM GMTBy: Jeff_Berwick

On April 11th we went public stating that shorting Japanese Government Bonds (JGBs) was an effective means of, "Profiting from The End Of The Monetary System As We Know It" (TEOTMSAWKI).

On April 11th we went public stating that shorting Japanese Government Bonds (JGBs) was an effective means of, "Profiting from The End Of The Monetary System As We Know It" (TEOTMSAWKI).

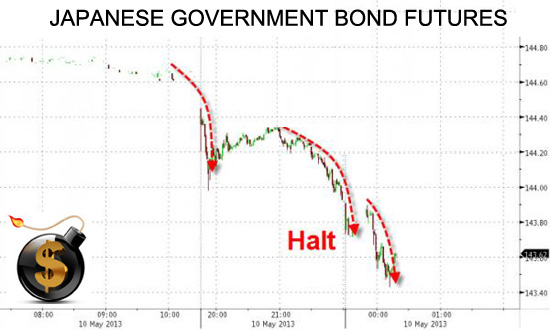

Less than a month later, on May 10th, after a month replete with numerous halts of the market over intraday crashes JBGs had their worst day in the last five years. Yields rose higher by 11bps to 70bps in the 10 year bond and ended up 10 basis points higher on the day.

And, of course, the value of the bonds is inverse to the interest rate. That is a 16% rise in the interest rate level in a matter of hours. That is a massive move in the bond market.

AN ACCIDENT WAITING FOR A PLACE TO HAPPEN

Traders should take note of Japanese Government Bond prices. On April 4th the Bank of Japan made the announcement that they intended to DOUBLE the money supply and buy government bonds roughly equaling $80B a month. Does this number sound familiar? It should since the US Federal Reserve’s own quantitative easing program is roughly $85 B a month. An important data point to remember here is that the Japanese economy is only 1/3 the size of the US economy, but its own quantitative easing program equals that of the US. To say Japan is “doubling down” on the same failed policy approach it has taken for the last 20 years would be a bit of a misnomer. This is Japan’s “all in” move as I try to keep the gambling metaphor rolling. A gamble is exactly what this is, a very big gamble with no precedent in economic history.

What are the consequences of rapidly increasing government spending, monetizing $80B a month in debt, and flooding the market with yen? It is hard to miss the headlines as the Yen on the futures exchange is now trading at below 100 yen to the USD for the first time in four years.

Here is some news that you won't read in the mainstream financial papers. Japanese Bonds are trading lower now than they were after the April 4th Bank of Japan (BOJ) announcement that they would buy a massive amount of JGBs. Huh? How can that happen? If the BOJ announced they would be a huge BUYER of Japanese Government Bonds, then how can the price be going down? Well it has. Since the April 4th announcement, 10 year Japanese Government Bond futures have hit downside circuit breakers no less than 7 times as sellers overwhelmed the market with orders.

THE RETURN OF THE BOND VIGILANTE

Why are bonds trading lower? Think about this from a prudent lender’s point of view and you will have your answer. If I give you yen, and you give me a security (bond) that says you will give me back my yen with interest in 10 years, then why would I sit with that security and let you pay me back with a devalued currency? Well, in Japan bondholders appear to be speaking with their market participation. Bond holders are doing exactly what they should be doing. Bond holders should be liquidating bonds and converting money out of yen into non-yen denominated securities and investments (note all the M&A activity from Japanese companies in the last seven months as the smart money runs and not walks out of Japan and the yen).

How can the savers in Japan be sitting idly by and watching the purchasing power of their savings being destroyed? We are on the first chapter of a very ugly time in Japan where policy makers decisions will strain the very social fabric of the country. We will have a front row seat to the failings of the Keynesian economic philosophy. It will not be pretty for Japan. And it could very well be the first major event in TEOTMSAWKI.

SURVIVING AND PROFITING FROM TEOTMSAWKI

We have many strategies to survive TEOTMSAWKI including things like precious metals, preferably with a significant amount of them internationalized to protect from political risk (see Getting Your Gold Out Of Dodge) and foreign real estate, such as at Galt's Gulch in Chile.

Those are mostly defensive.

In order to profit from TEOTMSAWKI we also have speculative bets on things like gold mining stocks. We also think that shorting Japanese Government Debt could bring spectacular returns over the coming years.

HOW TO SHORT JAPANESE GOVERNMENT DEBT

The tricky part to making massive gains with shorting JGBs is that you need to understand all the risks and intricacies of the futures market. Very, very few people have enough experience to do this safely and we don't recommend you do it on your own.

We suggest you use an expert like a financial advisor or broker, but only if they truly are experts in the field. Most brokers and advisors do not know how to trade these markets to limit risk and many people can lose their shirts if it is done wrong.

That's why we suggest you look to an expert to manage this trade. We've identified one of the most suitable as being Tres Knippa of ShortJapanDebt.com. Not only is he an expert futures trader, but he intricately follows and focuses solely on shorting Japanese government debt and operates managed accounts for suitable clientelle.

For TDV subscribers we'll be conducting an in-depth interview with Tres this week to lay out all the risks and rewards.

What we are seeing in Japan may be the first return of bond vigilantes to the bond markets since the 1970s and we'll be watching closely as things progress for the first major crack towards TEOTMSAWKI... and hoping to profit immensely from it.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.