What's Going on with Inflation Today... and What to Do About It

Economics / Inflation Jun 14, 2013 - 11:10 AM GMTBy: DailyWealth

Dr. David Eifrig writes: Every month, about 300,000 Americans celebrate their 65th birthday. This is the age most of us think of when we hear "retirement."

Dr. David Eifrig writes: Every month, about 300,000 Americans celebrate their 65th birthday. This is the age most of us think of when we hear "retirement."

The arch nemesis of those newly minted retirees is inflation.

Most folks looking to retire need safe investment income. This traditionally comes from owning bonds, which pay a fixed rate. But if your income stream is fixed... and the price of goods and services shoots higher... your cash stream is worth less. If you're relying on that income for your retirement, you could be in trouble.

So what is inflation doing right now... and how worried should you be about it?

Some economists define inflation strictly as the supply of money... how much money exists. And you can see the logic... the more money available, the more money assets can command.

But to me, that seems like an academic argument. What matters to me is price inflation... how much I am paying for the things I need. And the amount of money in the economy is only one factor driving price inflation.

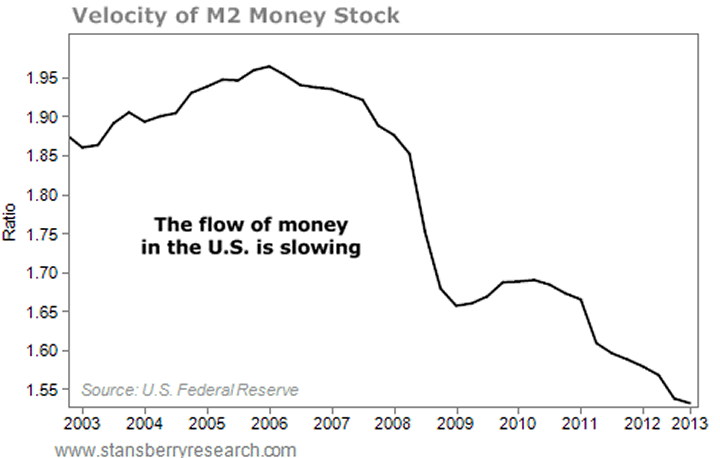

A more important factor determining price inflation is how quickly money is moving through the economy – the so-called "velocity."

As subscribers of my Retirement Millionaire newsletter know, the money velocity reflects the amount of money individuals and businesses have to spend on consumption or investment relative to the money available for banks to lend.

Here's how the money flow looks right now...

As you can see, U.S. money isn't moving around that well. There's still fear in the U.S. on the part of lenders and people with money looking to invest.

Another factor for price inflation is rising interest rates. After all, if it costs businesses more to borrow, they'll pass a lot of those costs on to the consumer. But the Federal Reserve, which controls short-term interest rates, won't raise interest rates until it considers inflation a threat...

The most recent U.S. Bureau of Labor Statistics Consumer Price Index (CPI) shows prices declined 0.2% and 0.4% in March and April, respectively. Remember, that's at a time when Treasury rates have ticked up.

Some people object to the use of the U.S. government's CPI, citing shadow statistics. Others complain about how the CPI uses adjustments that don't reflect real life. I'm as skeptical of government information as anyone. But the CPI figures match the other gauges I watch...

Several important commodities are down from a year ago. Coffee, sugar, and cotton are all down more than 50% from last year. Corn and hog prices are even. Cattle, lumber, and oats are slightly higher than a year ago. The benchmark commodity index is down a little over the past eight years. (See the "Market Notes" column below.)

All of this tells me inflation – real-world price inflation – remains a distant concern.

Again, I'm as skeptical of the government as the next guy. I believe there are many reckless policies in place that could eventually produce a crisis. But as investors, we have to deal with the current facts.

And right now, since the facts show inflation is a distant concern, I'm still comfortable recommending various fixed-income investments, like municipal bonds. Paired with blue-chip stocks, these vehicles will continue to provide retirees a great way to invest after they're 65.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

P.S. If you're willing to do a small amount of work, you may be interested in some alternative ways I've found that will help you generate investment income. These strategies don't generate lots of banking fees, so you're probably not going to hear about these opportunities from your broker or money manager. But if you're willing to do a bit of work, the presentation about these ideas could forever change the way you look at investing. Click here to see it.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.