Taking the Blinkers off the Gold Analysts

Commodities / Gold and Silver 2013 Jun 21, 2013 - 06:50 PM GMTBy: Jan_Skoyles

Since the middle of April we have all heard the gold bear cry of ‘it’s over, gold is done with…the bubble has burst.’ But not many of these so-called expert commentators have really looked into the strength of demand in the East.

Since the middle of April we have all heard the gold bear cry of ‘it’s over, gold is done with…the bubble has burst.’ But not many of these so-called expert commentators have really looked into the strength of demand in the East.

Jeff Nichols wrote in a note to investors recently that he believed gold bears ‘have a fairly provincial view and limited understanding of gold’s increasingly bullish long-term fundamentals.’ He went onto define ‘provincial’: ‘they are ignoring more than half the world.’

I couldn’t agree more.

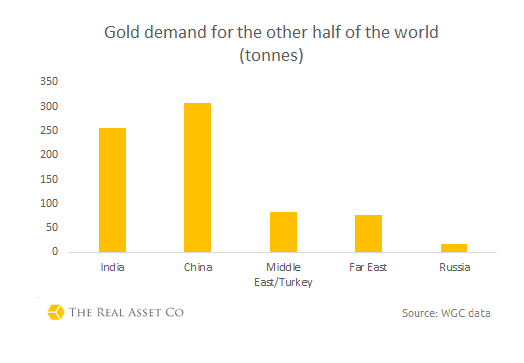

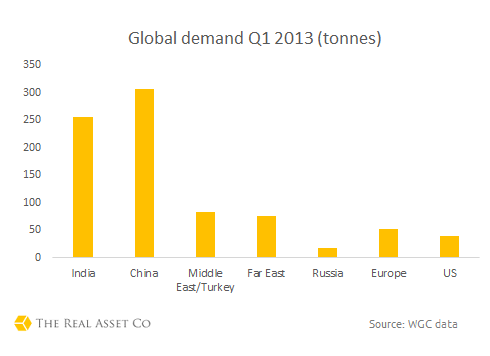

Total physical gold demand for that half of the world in Q1 this year was over 740 tonnes.

Comparing these official figures, to those in the West it seems odd that analysts believe the hunger for gold is quickly disappearing.

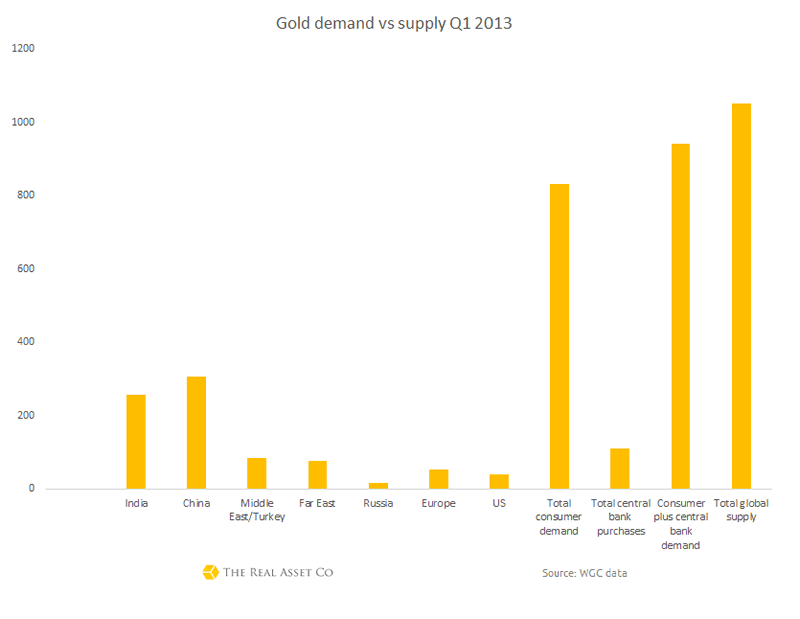

That’s just investment demand. Central banks in the ‘ignored’ part of the world shopped up a storm as well, purchasing 109.2 tonnes in Q1, for the seventh consecutive quarter central bank purchases were over 100 tonnes.

Some central banks embraced the price fall; recent IMF data shows that in April/May Russian holdings climbed 8.4 metric tonnes to 990 tonnes, Kazakhstan’s hoard increased by 2.6 tons to 125.5 tons and Turkey’s holdings increased by 18.2 tonnes.

Not including recent central bank purchases, consumer and central bank demand very nearly equalled total global gold supply in the first quarter of the year.

Many could argue however that the gold price fall hadn’t occurred when these figures were taken. In light of this, recent demand is even more impressive, particularly in the two shining lights of the gold market, India and China.

In India, for example 300 tonnes was imported between April and May. June to July expects to see this fall to 90 tonnes, even if this low numbers is the trend across the summer months, it will still top those import figures seen in the first quarter.

But India, will lose its crown as the world’s largest gold importer this year as China is expected to import between 900-1000 tonnes.

Will the Eastern bull survive?

Given developments in some Eastern countries, both economically and in the gold market, it is understandable that many believe earlier levels of gold demand are unsustainable.

India’s increase of import duty on gold is one example of when the gold bears do pay attention to physical gold demand. When the Indian government announced that they were increasing the import tax on gold from 6% to 8%, in order to fight the current account deficit, everyone said this would remove some of the underlying support for gold, thereby adversely affecting the gold price.

At present gold prices in India have not benefitted from this week’s fall, thanks to the weak rupee and the import duty.

According to reports Indians looking to buy gold are waiting for further falls, Ashok Mittal, chief executive officer of Emkay Commodities, told Business Standard, “Indian consumers will wait for to gold fall further and our view is that RBI (Reserve Bank of India) may not let the rupee trade so low and will take steps [to manage this]. These will make gold cheaper for Indian consumers.”

Whilst gold imports are estimated to fall by 25 – 30% as a result of government efforts to slow gold demand, you can bet there will be increasing numbers of reports covering gold smuggling. One asks how the authorities will manage this as well as checking those Indian citizens who fly in from the Middle East.

Of course, it seems too good to be true to present an argument based on illegal behaviour and unofficial figures. But one must consider how easily citizens of a country will switch to a dramatically devalued paper currency when all they have ever saved in is gold.

Discussing his country’s obsession with gold in relation to balancing the deficit, novelist Chandrahas Choudhury wrote the following:

“As the late Indian economist IG Patel, who wrote extensively in the 1950s on India’s gold obsession and ways in which to mobilize the hoarded wealth, once said: “In prosperity as in the hour of need, the thoughts of most Indians turn to gold.” The evidence from the last few years suggests that when steeply rising prices, and a debilitating current account deficit that raises the cost of other goods, come up against a powerfully entrenched cultural reflex, it’s not always the laws of economics that win out.”

It depends whose economics you follow, but either way Choudry and I both agree that gold will win this battle.

China is where the real action is

In China it is virtually the opposite story to anywhere else in the world. Yet it is so quickly dismissed by ‘experts’ that one wonders if there is an ulterior motive. Recent concerns over manufacturing levels and this week Shibor, have led many to conclude that gold will find little support in the increasingly troubled country.

One of the many ‘indicators’ that the gold price could no longer find support was because of a fall in imports from China. Whilst China’s gold imports fell from April to March, the month’s imports were still amongst the highest on record.

However, unlike India and Vietnam (whose government heavily controls the gold market), the government has no incentive to control gold, thanks to the balance of payments surplus. In fact the government are almost falling over themselves to facilitate gold investment.

Earlier this month two newly approved Chinese gold-backed exchange-traded products were announced. Hua An Asset Management, a firm behind one of the new products, expects to raise between 2 billion and 3 billion yuan, (USD326 m to USD489 m) for the new gold fund. Analysts see little reason why this isn’t achievable, given the strong Asian demand for gold.

Many may be baffled why the Chinese, at this point in the gold’s price cycle, are looking to launch two new ETFs, let alone one. Particularly as gold-backed ETFs in the West continue to see huge outflows.

The initial target of $489 m is nearly 4 times larger than the initial holdings in the SPDR gold trust, the world’s largest ETF based in the US, yet analysts do not expect the Chinese gold-backed ETF to have such an impact on the global gold price. This may be because Chinese investors are known to want to own physical gold, yet similar products have proved popular in India who have a similar sentiment to gold ownership.

Despite these new paper gold products, demand for physical in China, remains strong. The gold market is expected to continue booming this year, as vice-chairman of the China Gold Association told gold mining conference attendees yesterday: “Chinese demand for gold will remain robust because people are getting wealthier and investment choices are limited…Per capita gold holdings in China are little more than 5 grams, compared with the average 20 grams in developed countries, so there’s huge potential as long as the economy is growing…”total demand this year is likely to be in the range of 900 to 1,000 tonnes.”

They want physical gold as a store of wealth, in the face of rising inflation and they are prepared to pay the price for it.

Premiums

At the beginning of June Bloomberg reported on premiums jumping four-fold on the SGE as investors rushed to take immediate delivery of gold bullion. “In the 12 months through April 12, before the rout, spot gold in China traded at an average premium of $7.22 an ounce to the global price, according to the Shanghai Gold Exchange. The premium averaged $33 an ounce from mid-April through May.”

Premiums have been reported in the majority of Eastern countries since April. Vietnam has seen 20% premiums thanks to strict government gold controls.

Vietnam’s 20% however is nothing compared to those seen in some stores in China. Ned Naylor-Leyland estimates that coin, bar and jewellery shops have been selling at 24% premiums. A reduction (not removal) in the premium saw a frenzied rush to buy gold in Shandong earlier this week.

These ever-present, and increasing premiums are leading many to now speculate over the ‘two-tier’ gold market. Where prices appear to be set in the paper gold market, ie COMEX, but it’s another story when it comes to physical gold.

We all know which markets is ultimately boss – the physical one.

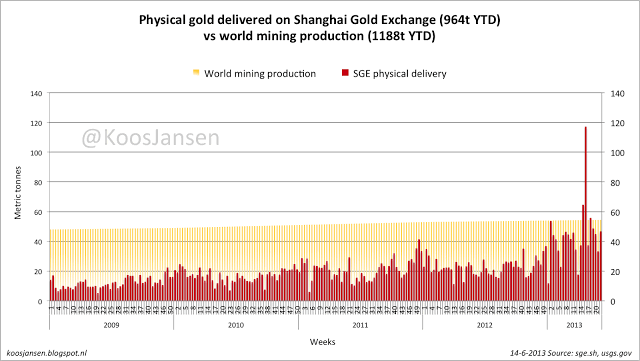

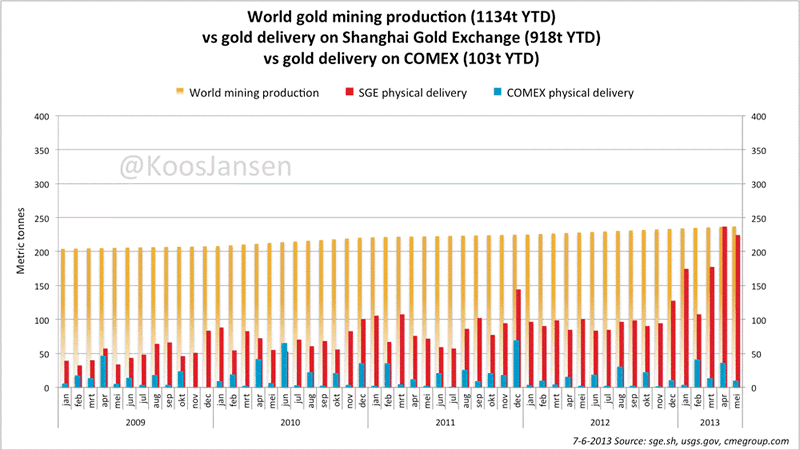

In the graph below, courtesy of Koos Jansen, we can see that the demand for physical tonnes to be delivered on the Shanghai Gold Exchange is reaching global production levels.

Compared to COMEX, these levels of delivery are huge:

On COMEX total gold delivered didn’t even meet 10% of global gold production, meanwhile delivery from SGE was nearly 100% of total world gold mining production. Consider these figures now with those presented at the beginning of this article, global physical gold demand is now likely to have surpassed total supply for this year.

All driven by that ignored part of the world.

We have been exploring price discovery in other research and the SGE is an area we intend to cover.

So for now let me leave you with the question, ‘should we be ignoring the other gold market?’

I think not. Gold prices set in major Western markets may be in retreat, but dampened demand is certainly not omnipresent across the globe. The pace of increasing premiums in Asia mean physical gold prices are booming, whilst physical gold cannot be delivered quick enough.

There is only so much time left before the paper gold bugs can no longer keep the price down and geographically blinkered analysts have to open their eyes.

How long can we ‘ignore’ this part of the gold market? Join in the debate in our G+ Community

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals. The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2013 Copyright Jan Skoyles - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jan Skoyles Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.