Essential Parts of an Elliott Wave Trade

InvestorEducation / Elliott Wave Theory Jul 12, 2013 - 03:16 AM GMTBy: EWI

Three steps may sound simple enough. Yet if you have any experience trading, you know that nothing about trading is easy. Education is imperative. So is preparation.

Three steps may sound simple enough. Yet if you have any experience trading, you know that nothing about trading is easy. Education is imperative. So is preparation.

Senior Analyst Jeffrey Kennedy knows that it takes skill, discipline and courage to execute a successful trade. His new book, Visual Guide to Elliott Wave Trading (coauthored with Wayne Gorman), picks up where Frost and Prechter's classic textbook Elliott Wave Principle leaves off: It gives you the perfect blend of traditional textbook analysis and real-world application.

According to Kennedy, there are three key components of a successful trade:

- Analyze the price charts.

- Formulate a trading plan.

- Manage the trade.

In this excerpt (Part 2 of 3), Kennedy shows you how to make a trading plan based on an opportunity in Caterpillar (CAT). You can read part 1 Analyze the Price Charts here >>

Part Two: Formulate a Trading Plan

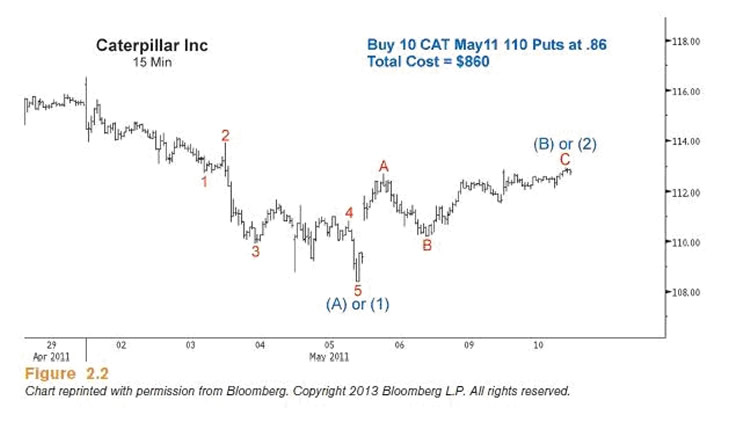

In Figure 2.2, I chose to trade this setup using options, specifically, by purchasing 110 puts on May 10, 2011, at 86 cents apiece. These options were scheduled to expire on May 20, 2011, so there were only eight trading days left on these puts. Considering that these options were to expire in just a matter of days, this kind of trade is extremely risky, and only the most seasoned and risk-aware trader should consider doing it.

Since the initial sell-off in CAT from 116.55 to 108.39 transpired in four days, here was my thinking at the time: If the next wave down proved to be wave (3), then I would see prices fall farther in a shorter period of time; if the upcoming decline proved to be a (C) wave, then the upcoming sell-off would most likely be shallower and take more time. Even if CAT were to unfold in wave (C) and take twice as long as the initial decline, it would still trade roughly at $104.81, the level at which waves (C) and (A) would be equal by options expiration.

Again, it is important to understand that due to waning premium, an options trade should not be taken with the idea of holding the trade over a long period of time for a sizable move down. The idea was simply to catch a short-term move below the May 2011 low of 108.39 over three to five trading days.

Be sure to come back for part 3: Manage the Trade

The Ultimate Wave Trading Crash Course Put yourself on the fast track to applying the Elliott Wave Principle successfully with a FREE one-week primer: The Ultimate Wave Trading Crash Course. Learn the basics with 5 FREE trading lessons from EWI Trading Instructor and Senior Analyst Jeffrey Kennedy -- including insightful excerpts from his Amazon No. 1 Bestseller, Visual Guide to Elliott Wave Trading. |

This article was syndicated by Elliott Wave International and was originally published under the headline The 3 Essential Parts of an Elliott Wave Trade [Book Excerpt Part 2 of 3].. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.