Stock Market Short-term Top

Stock-Markets / Stock Markets 2013 Jul 23, 2013 - 10:25 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected (after this bull market is over), there will be another steep decline into late 2014. However, the severe correction of 2007-2009 may have curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - SPX continues to progress according to its structure. After a brief consolidation, the bull market has resumed its uptrend and has already created new highs in the leading indices. A short-term top is brewing.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

AFTER PAUSE ... SHORT-TERM TOP!

Market Overview

The pause mentioned last week was over by Tuesday -- just enough to fulfill the structure requirement. The uptrend then resumed, met the specified target early Thursday - creating a new all-time high for SPX -- and spent the rest of the day as well as Friday consolidating instead of selling off. This suggests that the projection will be exceeded by a few points before we reach the top of the move (possibly on Monday). As we will see, all the technical indicators are warning of a top and are ready to initiate a short-term sell signal.

Structure: "Intermediate wave V is now in full swing, but we may be at the top of a wave of lesser degree."

That wave of lesser degree was minute wave iii which was followed by minute wave iv which made its low on Tuesday, followed by minute wave v. Minute wave v is almost complete and needs only one more little wave to come to an end. This would also mark the completion of minor 3.

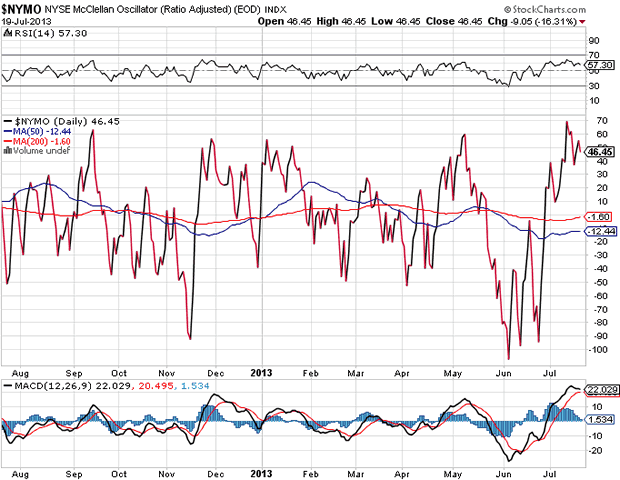

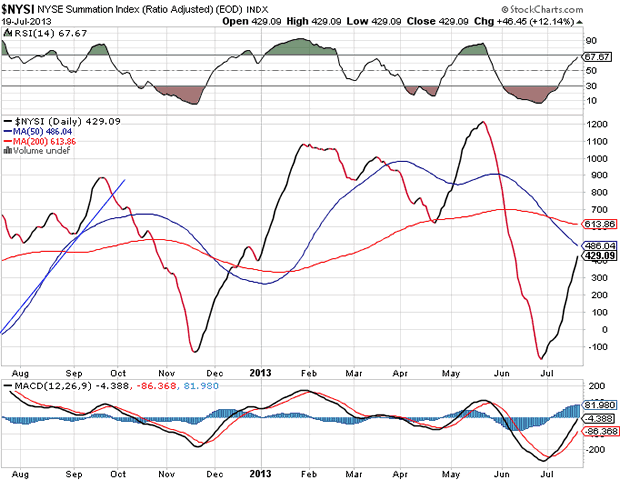

Breadth: The McClellan Oscillator remains overbought and is beginning to show some minor negative divergence. When it corrects, the Summation Index should pause or slow its rate of ascent as the market also experiences a minor correction.

P&F and Fibonacci projection: "There is a P&F projection to 1692 which could bring about the completion of minor wave 3 of intermediate V." This projection has been reached but should be exceeded by a few points.

Support/resistance zones: The SPX reached a new all-time high on Thursday. Resistance will be created by reaching P&F and Fibonacci projections. Congestion between 1672 and 1684 should offer short-term support.

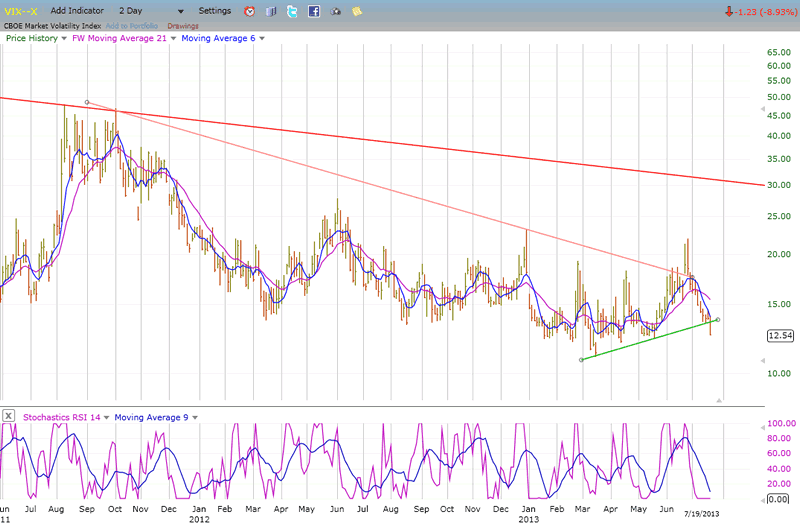

Sentiment: The SentimenTrader remains at a slightly elevated reading of 60. VIX Closed the week at 12.54 which is a new low since it peaked at 21.91.

Chart Analysis

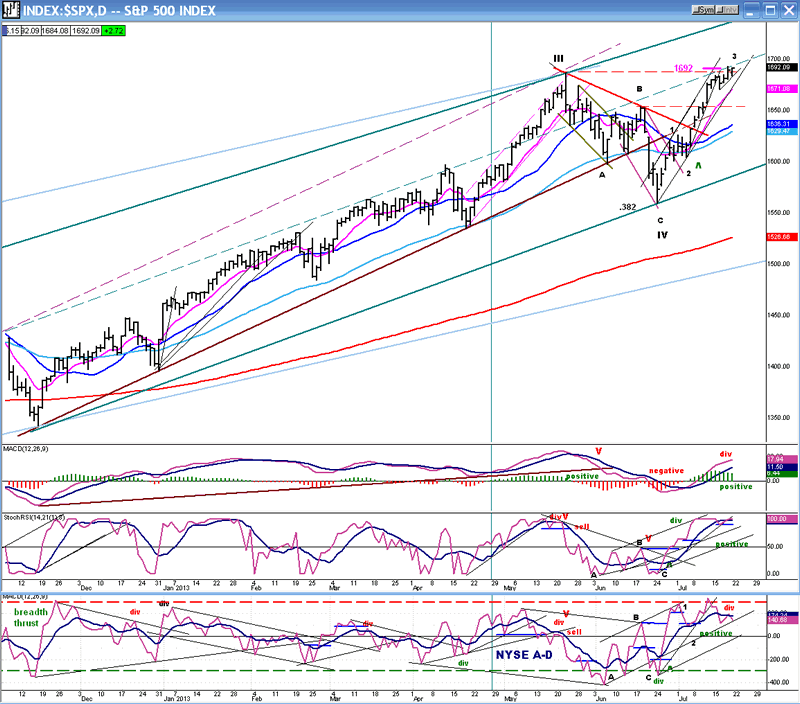

The following is a daily chart of the SPX (courtesy of QChart). After completing intermediate wave IV correction, SPX started to rally, pausing briefly below the red trend line drawn across the tops and the trend line from the 1343 low. Then, it went past both quickly, rising above 1655 -- the former top of wave B - and confirming a new intermediate uptrend. Our attention can now focus on estimating the top of minor wave 3. Based on everything that I see, it is only a few points away.

Looking at the price chart, the index reached is price momentum peak when it came very close to the top of the narrow up-channel. From that point on, it started to trade across the channel at a much reduced angle of ascent. This is surely the type of deceleration that precedes breaking out of a rising channel. It shows up best in the indicators, especially the lower one (breadth oscillator) which reached its highest point about a week and a half ago and has started to correct.

The price turned down briefly a week ago, then made a new high. When it turns down the next time, it should reverse the middle indicator as well, and cause it to decline until it reaches the zero line. If it remains neutral or only slightly negative, this would be the time to look for the start of the next uptrend.

The MACD is also beginning to roll over and the histogram is starting to decline. Now that all the indicators are waving a red flag, we can anticipate a short-term reversal which would correspond to the top of minor wave 3 and the beginning of minor wave 4.

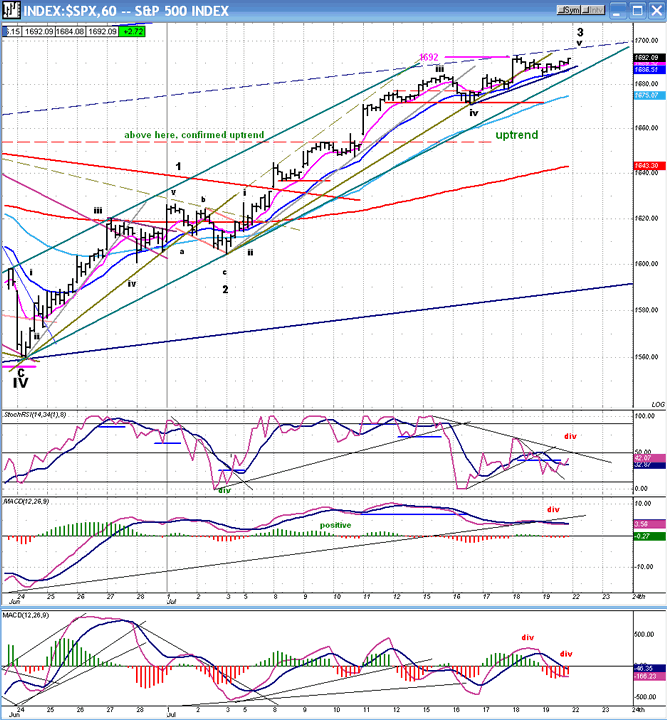

The hourly chart (also courtesy of QChart) focuses on intermediate wave V from the point of its inception at 1560. On this time frame, the deceleration in price is even more obvious. Since the two-day pause, prices have risen at a lesser angle, broken a secondary trend line, and are now approaching the lower line of their main channel.

Structurally, we can count four short waves constituting what is probably minute wave v, with the fifth one starting on Friday. When it is complete (probably over the next few hours of trading) a reversal should take place which will not only break the short-term trend line but the channel line as well, and mark the beginning of minor wave 4.

Deceleration and divergence is far more visible on this chart than it is on the daily chart, especially in the indicators. As you would expect, the lower (breadth) indicator is the one which shows them the most. But the other two are almost as bad and reflect a market which is within hours of rolling over. If we manage to open higher on Monday morning, indices should not remain positive for long.

Cycles

"The 7-8 week cycle may bottom during the week of 7/22, and it could mark the completion of minor wave 4."

We are one week closer, so the decline may be over by the end of next week -- unless the cycle extends into an 8th week.

Breadth

The McClellan Oscillator and Summation Index appear below (courtesy of StockCharts.com).

The McClellan oscillator reached overbought a few days ago and has started to decline. Its RSI and MACD have done the same. This has not yet had a pronounced effect on the Summation Index which is still rising, but its own RSI and MACD have also started to lose upside momentum. It would take a strong resumption of the NYMO to keep them from rolling over, and this is not likely! Instead, a correction is expected in all of the above.

Sentiment Indicators

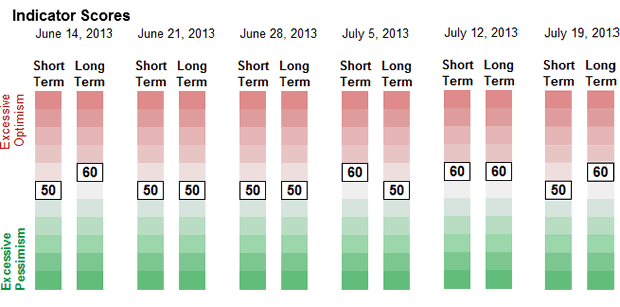

The SentimenTrader (courtesy of same) long-term index is showing a reading of 60 for the second consecutive week, but it is not a high enough reading to suggest that an important top is at hand.

VIX

VIX continues to decline as the market moves higher. Last week, it broke the prevailing uptrend line and closed at a new short-term low. Since indices have already made all-time highs, one should note that VIX is still above its long-term lows. This long-term positive divergence is noteworthy, but it is only when short-term divergence begins to be apparent that we can start looking for something more than a brief correction.

The current pattern is not suggestive of an imminent important top.

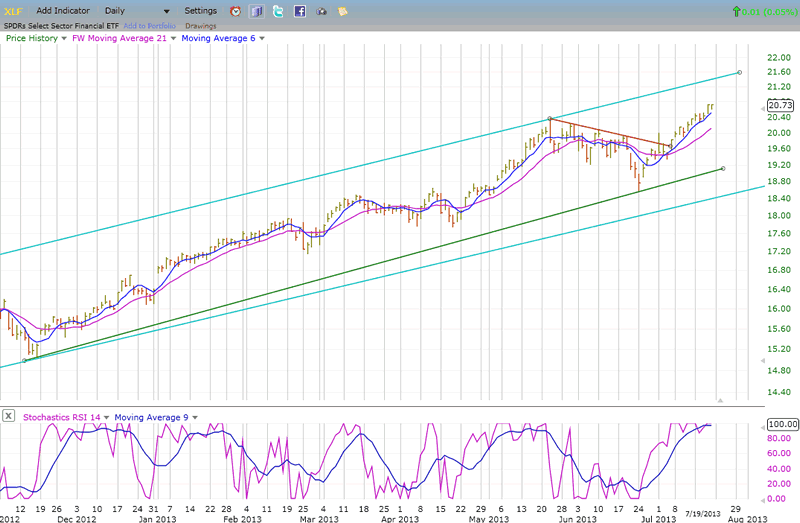

XLF (Financial SPDR)

One way to analyze XLF is to look at where it is in relationship to its 2007 top. The steady uptrend since its bull market low has brought it within a point of retracing 50% of its decline from May 2007. Instead of focusing on its relative strength to SPX, we might instead see what it does when it gets near 22.00, which is still a little over a point away. If we are looking for relative weakness, we'll find that it clearly exists over the long-term. I'll leave it to the fundamentalists to interpret what this means for the U.S. economy.

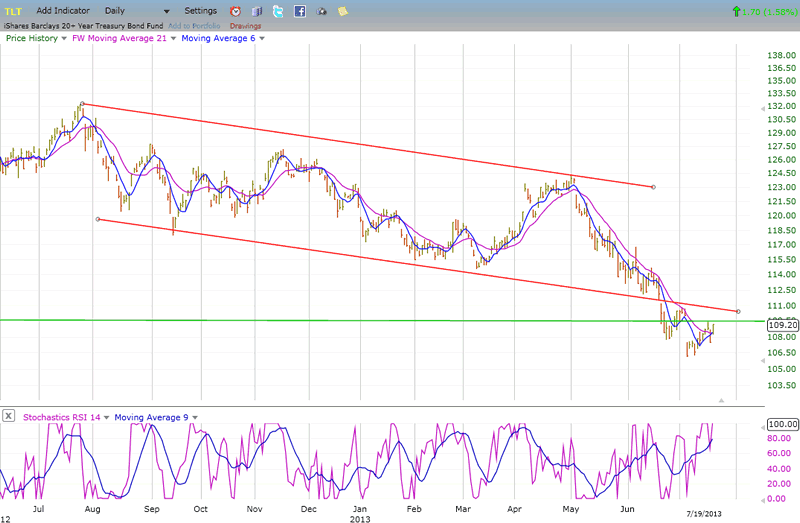

BONDS

It is too soon to tell if TLT has made an important low. Over the past two weeks it has had a 3-point reversal which is more likely to be a deeply oversold rebound than anything else. There is no sign that TLT has begun a significant reversal.

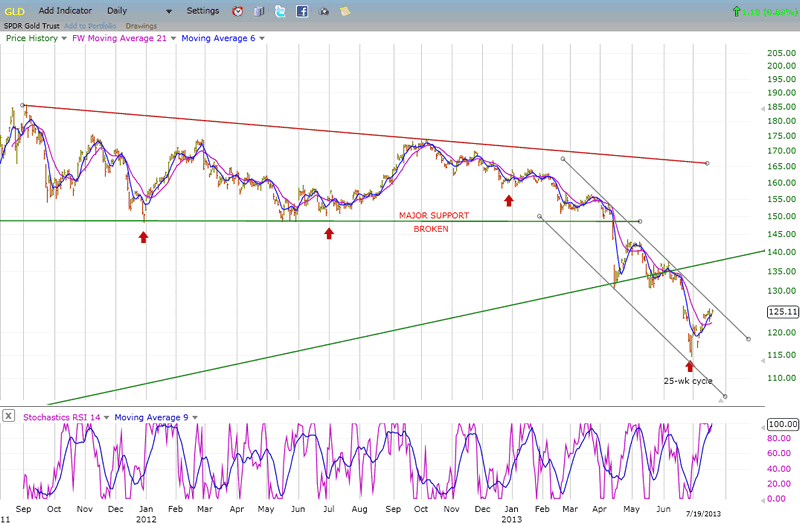

GLD (ETF for gold)

GLD has experienced a strong rebound than TLT but it, too, is unlikely to be starting a significant rally, especially since it still has an unfilled projection target to 110.

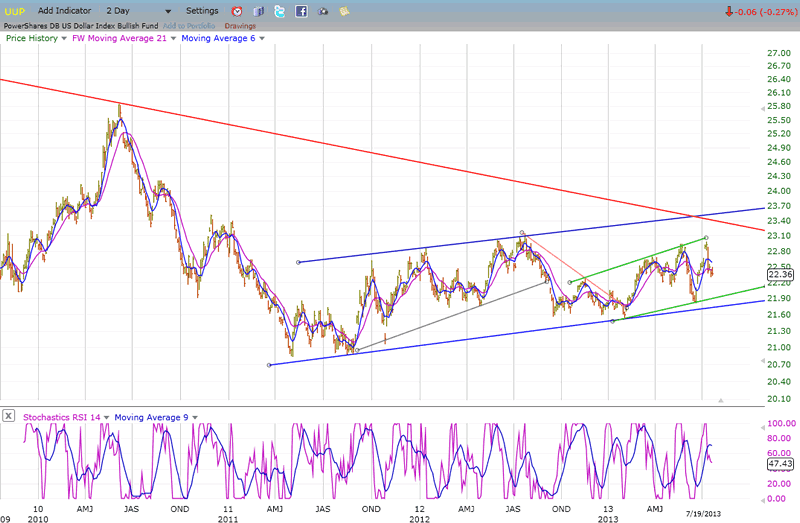

UUP (dollar ETF)

UUP continues to trade within a long-term base. According to its P&F chart, over short to intermediate term, it has the potential to reach about 23.50. This would put it at the top of its long-term channel and against significant resistance. From a trading point of view, the index would become interesting only if it broke (and stayed) above its long-term trend line. If the base pattern that it has created represents long-term accumulation, it would then be ready for a significant uptrend.

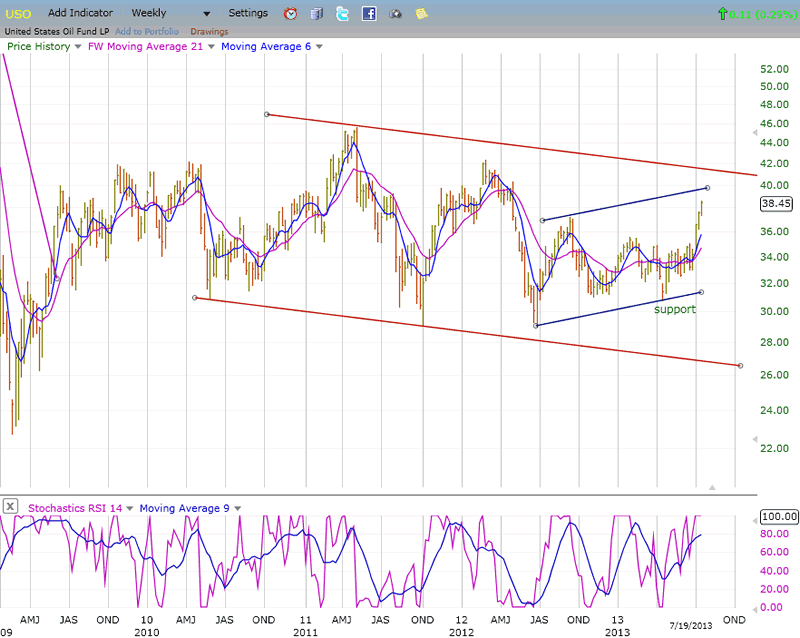

USO (United States Oil Fund)

Last week, I mentioned that USO could be starting an uptrend and could rise at least another 4 points. This has already been accomplished with a move to 38.50. The upside momentum that was displayed should enable it to rise to 41/42 - for a start. The P&F base that was recently created gives it a potential move to about 48 before it runs out of steam.

Summary

In the last letter, I predicted that SPX was ready for a pause before moving up to its 1692 projection. The pause was only a 2-day affair and the index has now reached its target. However, the recent P&F pattern gives it the potential to move a few points higher. This could be accomplished as soon as Monday and mark the top of minor wave 3. Technical indicators are more than ready to signal a short-term reversal.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.