Will the Stock Market S&P 500 Impact Gold Stocks?

Commodities / Gold and Silver Stocks 2013 Aug 21, 2013 - 04:49 PM GMTBy: Jordan_Roy_Byrne

With recoveries come questions. Will this last? Is this just setting up a bigger decline? The current recovery in the gold stocks has been both strong and broad based. It has occurred at a time when the stock market seems vulnerable. The stock market is up substantially since 2009. Yet, the most recent gains have resulted almost entirely from margin expansion rather than profit growth. Meanwhile, nominal GDP growth is the lowest ever (ex recessions). Gold stocks are up 16.8% in the last 13 days while the S&P 500 has declined by 3.4%. Should gold stock investors and speculators worry about the effect of a deeper decline or cyclical bear market on the mining sector? History says no.

With recoveries come questions. Will this last? Is this just setting up a bigger decline? The current recovery in the gold stocks has been both strong and broad based. It has occurred at a time when the stock market seems vulnerable. The stock market is up substantially since 2009. Yet, the most recent gains have resulted almost entirely from margin expansion rather than profit growth. Meanwhile, nominal GDP growth is the lowest ever (ex recessions). Gold stocks are up 16.8% in the last 13 days while the S&P 500 has declined by 3.4%. Should gold stock investors and speculators worry about the effect of a deeper decline or cyclical bear market on the mining sector? History says no.

The relationship between the gold stocks and the stock market is difficult to pinpoint as its quite scattered. At times the two markets can trend together and in either direction. Sometimes when the stock market is falling, gold stocks can rise. The reverse can also happen as has been the case for the past two years.

The determinant is the current correlation between the two markets. If the two markets are trending together then they will continue to trend together following a major trend change. Examples of this include the late 1920s to the mid 1930s and the mid 2000s to 2010. Yet if the two markets are negatively correlated (with the S&P 500 rising) then they will remain negatively correlated after the trend change. The following are important examples of that.

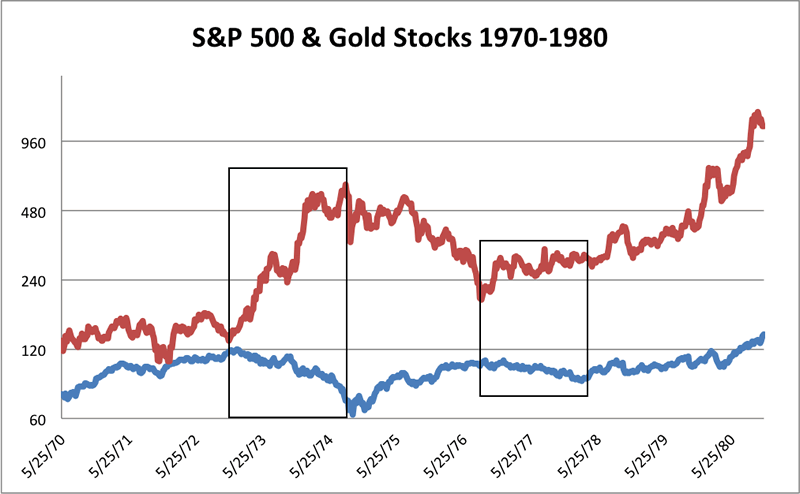

The gold stocks (red) and the S&P 500 were negatively correlated from 1972 to 1978. The gold stocks absolutely exploded to the upside from 1972-1974 while the S&P was in a bad bear market. As the bear market ended, gold stocks fell into a consolidation and a decline which closely resembles the most recent bear market. When the S&P 500 fell into a mild cyclical bear market, gold stocks emerged from their bottom.

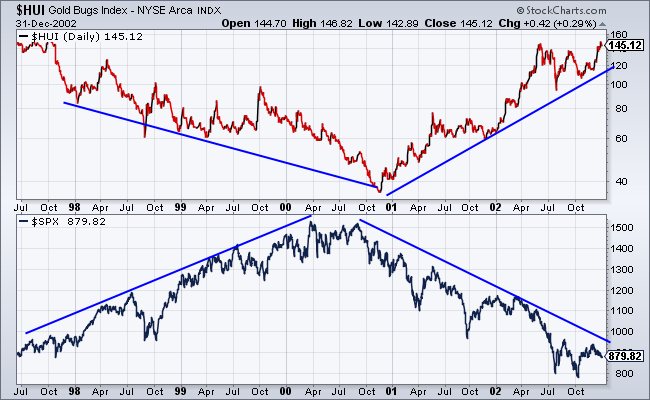

Many market observers forget the period of the late 1990s. The gold stocks were in a nasty bear market as the Nasdaq went parabolic. The S&P 500 continued to rise into 2000. Similar to 1973-1975, the gold stocks exploded higher despite a severe bear market in general equities.

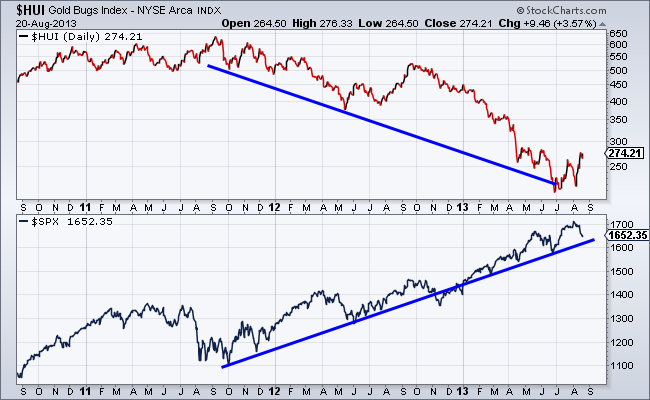

Finally, over the past two years the gold stocks declined nearly 70% while the S&P 500 advanced nearly 50%.

The stock market falls because of rising inflation or because of tighter credit or recessionary conditions. Rising inflation is usually a boon for metals prices but negative for general equities as it cuts into margins and hurts corporate profits. Currently corporate profit margins are at all-time highs while revenue growth is lacking. With the S&P trading at over 18x trailing earnings, the market is not cheap and therefore is vulnerable to rising rates and rising inflation. Moreover, common sense tells us that if gold stocks correct while the stock market gains, its quite unrealistic to expect gold stocks to continue to decline if the stock market declines. At present, if the economy nears recession and the stock market falls (for whatever reason), policy makers will act and it should benefit precious metals.

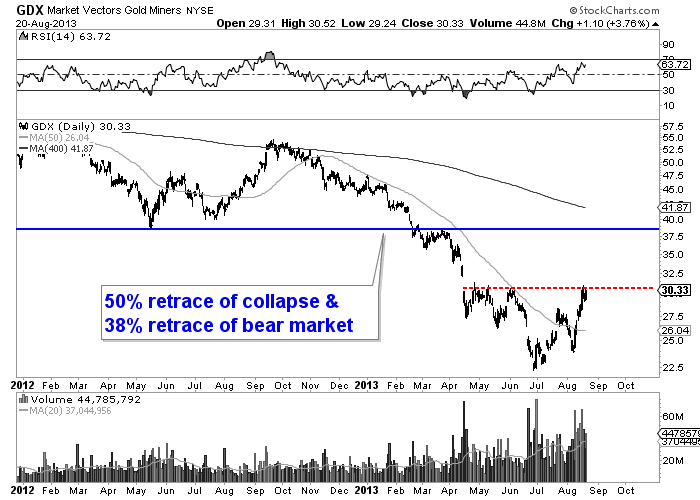

Technically, the gold stocks continue to follow a typical post-bottom rebound path and look very strong. The daily RSI of GDX is at a 10-month high as GDX consolidates around $30. We’d love to see GDX consolidate for a few weeks but it may break above $31 within days. There is an open gap at $34 while $38-$39 remains a strong target.

In summation, if you are a gold stock investor there is no need to worry about the stock market. History shows that some of the best gains in gold stocks (1972-1974 and 2000-2002) occurred during a bear market in stocks. Also, history shows that given the current negative correlation between the two markets, we should expect gold stocks to perform well if the stock market is in the very early stages of a bear market. Perhaps at somepoint the gold stocks will consolidate for several months when they are overbought or when the stock market is most vulnerable. That point is nowhere close. Stay bullish and look for continued gains in the coming weeks.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.