Gold and Silver Big Moves In and Out of Comex Bullion Warehouses

Stock-Markets / Stock Markets 2013 Oct 20, 2013 - 02:47 PM GMTBy: Jesse

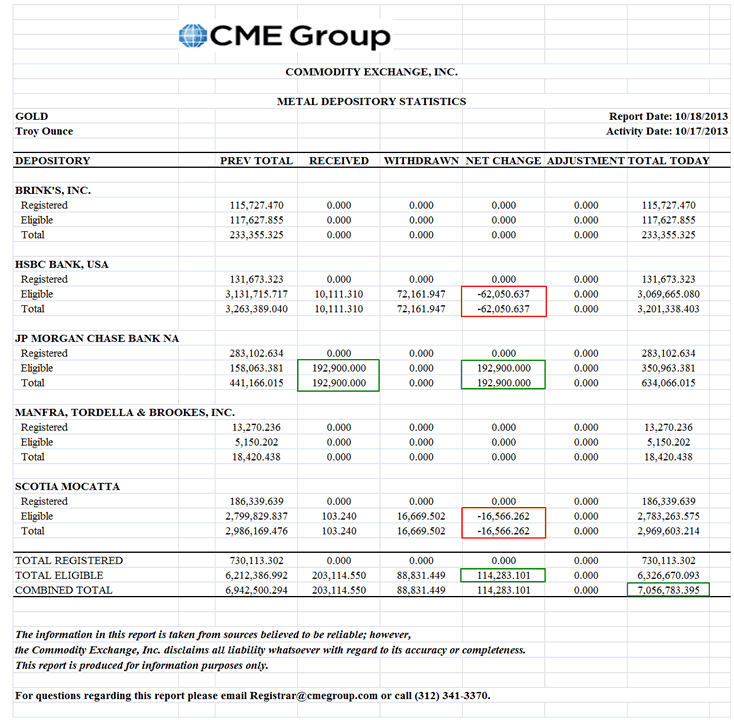

Yesterday saw two big withdrawals of gold bullion from the Comex warehouses.

Yesterday saw two big withdrawals of gold bullion from the Comex warehouses.

62,050 ounces came out of HSBC and 16,556 ounces left Scotia Mocatta, both out of eligible storage.

But never fear, JPM came to the rescue with a whopping deposit of 192,900 ounce of gold bullion into eligible storage. I wonder where that came from. Wink wink, nod nod.

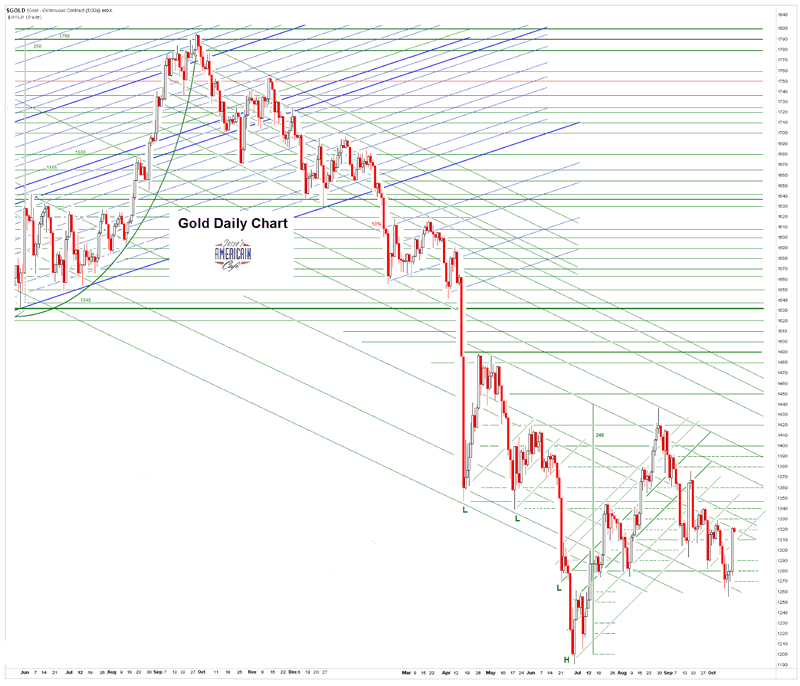

I just want to be able to watch the next leg up in the gold market, if and when it comes. It could be impressive, and put some serious pressure on bullion supply.

Michael Kosares has a new piece out titled China’s London-Zurich-Hong Kong gold conduit — a major financial coup d'état.

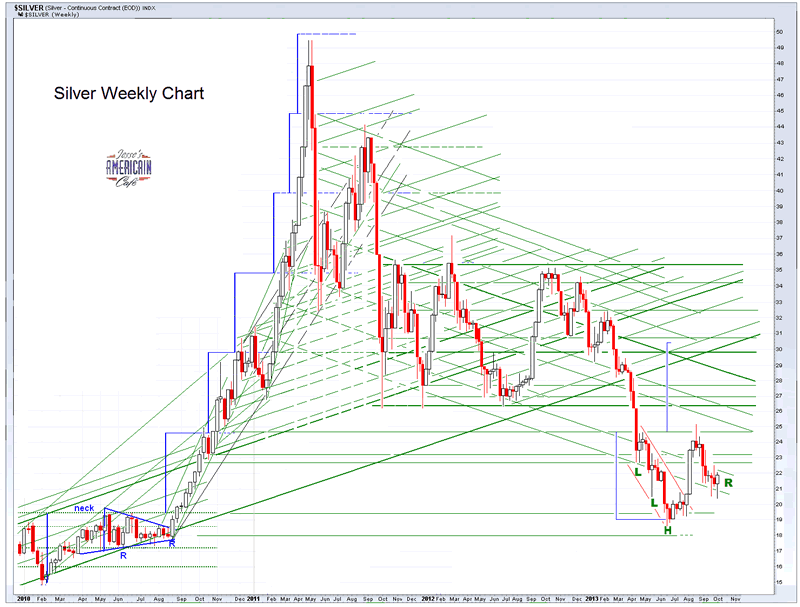

Gold and silver were both capped today, chopping sideways after the big pop from yesterday.

As a reminder the government will be releasing the September Non-Farm Payrolls Report on Tuesday. Antics are customary.

Try to keep a clear head as others tend to lose theirs, overwhelmed by the phantoms of their imagination. I get tired of reading about the imminent collapse of nearly everything as we know it. I cannot help but note how many 'legends' are seeing imminent dangers growing more terrifying nearly every day.

I suspect that this excess of nervous energy is the result of not having enough to do. Spending too much time listening to financial opinions and to the uber-wealthy whining about nothing in particular can be nerve wracking. But that is financial television.

Having a sick dog helps one to maintain a well-grounded perspective. Young children are an effective sink for excess energy as well. Grandchildren work, but it is a bit of a cheat because at the end of the day you get to send them home, at least most of the time.

It appears our shitzu has contracted Lyme disease, which is quite common in this area amongst the canine class. She is so naturally lazy that it was hard to tell at first. I have been serving as her caregiver, as well as for she-who-must-be-obeyed, and loved beyond all others. Tomorrow she gets her comeuppance in a trip to the vet, which will confirm her illness and a shot of antibiotics in the rump. The shitzu that is, not my dearly beloved. She is in for her own set of treatments again on Monday.

Have a pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.