U.S. Non-Farm Payrolls Report - Small Business Creation Boomed In October

Economics / Employment Nov 09, 2013 - 03:24 PM GMTBy: Jesse

Did new small business jobs creation boom in October during the government shutdown/default crisis?

Did new small business jobs creation boom in October during the government shutdown/default crisis?

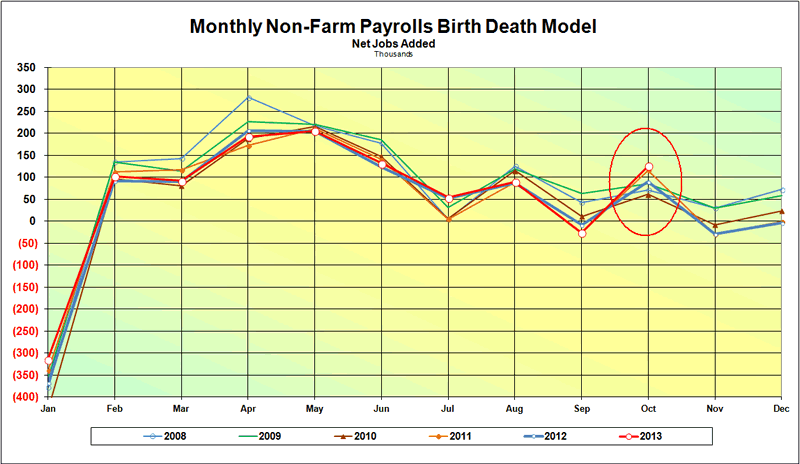

Well, you might think so by looking at the Bureau of Labor Statistics 'Birth-Death' model report contained in today's October Non-Farm Payrolls Report.

According to the Birth Death Adjustment there were 126,000 jobs added in October. And what an October it was apparently. These are the most new jobs added for any October going back to 2003, which is as far back as my own spreadsheet goes.

A more usual number might be around 103,000 or less. So, someone thinks it was a strong October jobs market.

You can look at the historical Birth-Death Model numbers from 2000-2012 here. And there is a list of Frequently Asked Questions here.

As I have cautioned in the past, the Birth Death number is added to the Non-Seasonally adjusted number, and then seasonally adjusted. So it is not a 'pure addition.'

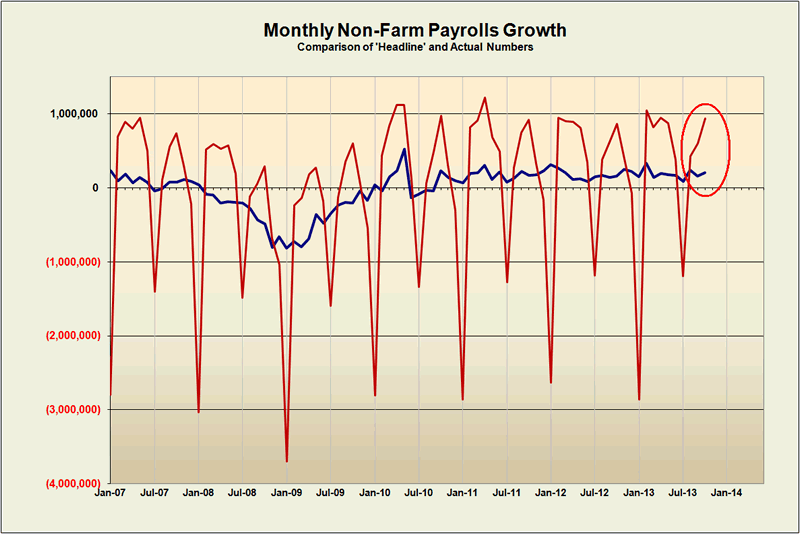

The Non-Farm Payrolls report contains very large numbers, on the order of 137+ million jobs which are estimated and deseasonalized, and then further revised for the next two months. So reacting strongly to a particular monthly jobs report is a bit of a Wall Street and political game.

What is more important is the trend in the number of jobs, and the quality of the jobs, both in hours worked and hourly compensation.

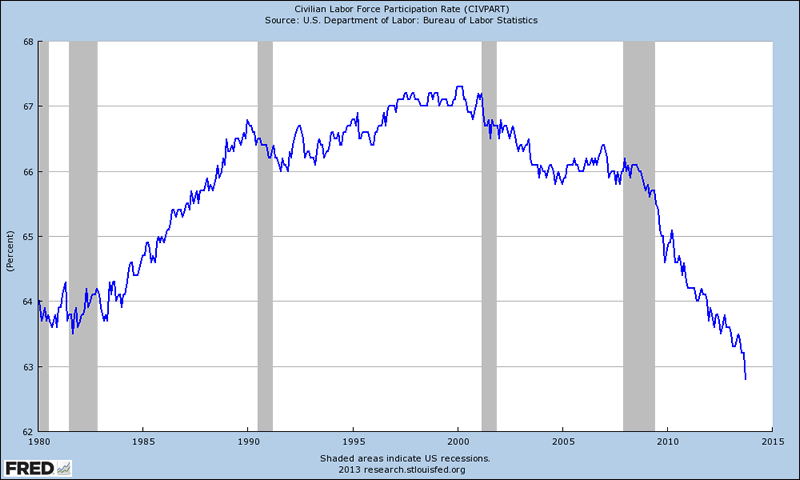

Another statistics worth noting is the Labor Force Participation Rate. There is a fairly good commentary on that data from this Payrolls report here. There was a similar issue with the Households Report since it dealt with the layoffs from the government shutdown differently than the headline NFP report.

As an aside, when I hear some financier talking about 'the new normal,' as they were on financial television today, it makes me want to gag. They are attempting to justify the results of their fraud and financial repression as a necessity, just business as usual. There is nothing 'normal' about this current economic environment. We are in a financialized society where big money dominates public policy for its own ends.

Getting back to the Non-Farm Payrolls number, the big hoohah question is always, 'Is the government lying?' I think it is fair to say that they are certainly putting their best foot forward, in this and quite a number of things.

I am a little more concerned about the lies that take the US into wars of aggression to be frank. But economic deception can have very bad long term effects when coupled with bad economic policy decisions such as those we are seeing today, that are propagating and even increasing an inherently unstable economy.

All things considered, and not just the numbers in this report, the recovery is weak, and real median wages do not support any sustainable recovery. Inequity is increasing, and policy supports and subsidizes this growing inequality in both political and economic power.

Keep an eye on the real median wage, and you will have some indication on how the American public is faring. Although the calculation of inflation is fraught with the fog of politics. John Williams of Shadowstats has done some excellent work in this area.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

And that is the bottom line.

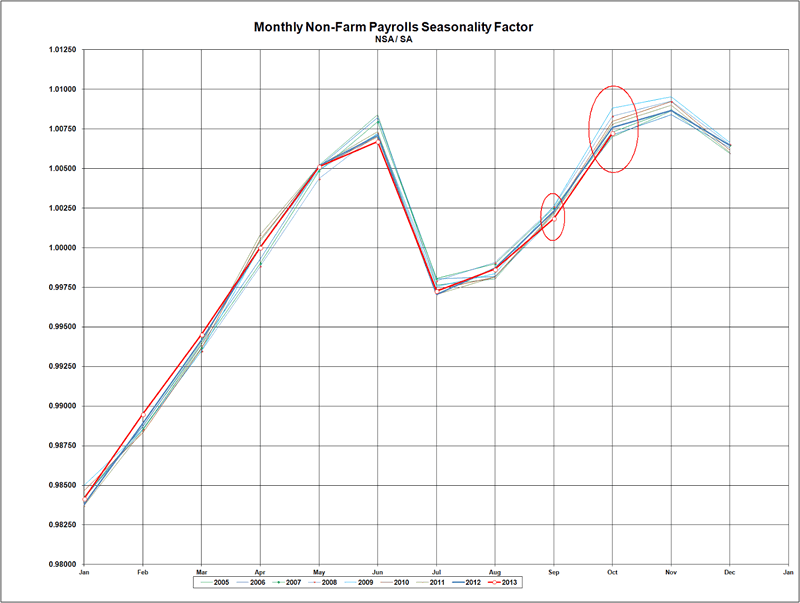

In this case the smaller the seasonality factor the bigger the jobs increase because the raw number is being divided by and reduced in September and October to arrive at the seasonal adjustment. But there are so many estimates involved that the answer really lies in the trends and even more importantly the quality of the jobs.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.