Are Investors Too Bullish on Stocks?

Stock-Markets / Stock Markets 2013 Nov 10, 2013 - 11:54 AM GMTBy: Clif_Droke

Just how far has the bullish sentiment of independent investors recovered since the 2009 bottom? Pretty far indeed.

Just how far has the bullish sentiment of independent investors recovered since the 2009 bottom? Pretty far indeed.

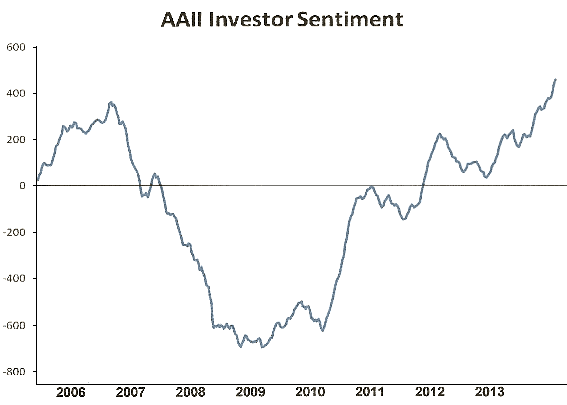

Below is a chart showing the cumulative AAII investor sentiment going back to 2006. As you can see, the typical small investor had a mostly bearish outlook on stocks from late 2007 through the end of 2009. The small traders then turned slowly bullish on equities in 2010 and have been increasingly more enthusiastic about stocks ever since. As of last week, this indicator made a new multi-year high which shows you just how much investor sentiment has rebounded. This has caused many to wonder if investors have become too bullish on stocks.

Yet for all this, the public at large is still missing from this remarkable rebound. It's mostly high-net-worth investors that are the driving force behind this bull market. The general public has exposure mainly in the form of 401Ks, but gone are the days of day trading and direct investment. The average retail investor (i.e. the general public) never quite regained the same appetite for equities he had in the years prior to the credit crash. Yet high-net-worth investors are as bullish as they have been in years. So is the typical Wall Street pro. But is this enough to put a top on the market (from a contrarian standpoint)?

Consider that in the years since the 2009 bottom there have been at least three notable corrections: the "flash crash" in May 2010, the 2011 mini-bear market, and the April-June 2012 correction while the master weekly Kress cycle was bottoming. Each of these setbacks occurred on low public participation. It's clear that the stock market has largely become a rich man's playground since the credit crash and Wall Street is basically just playing against itself, not the public at large. So the answer to that question is yes, stocks can "correct" substantially even without widespread public participation.

The next question that comes to mind is, "But doesn't history show that major bull markets don't end until the public has maximum exposure to stocks?" This is a true observation, so there is some question as to whether the recovery that began in 2009 will continue, albeit with fits and starts, after the 60-year cycle bottoms in 2014 and until the public finally embraces the bull. Quite simply, this is a matter of speculation and unfortunately technical analysis, with its short-term focus, offers no conclusive answers. But the odds are still in favor of 2014 witnessing another broad market correction - the first in over a year.

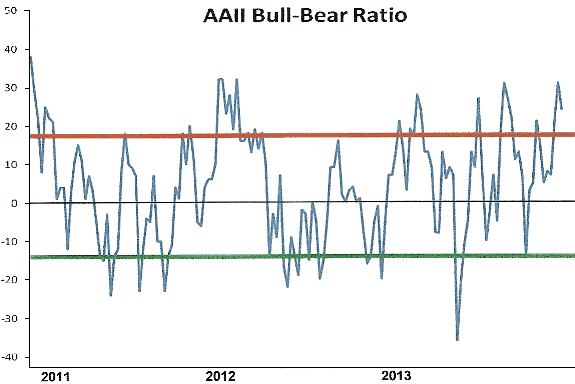

So while the general public remains ambivalent toward equities, the current participants - which include large speculators and institutional investors - are as bullish on stocks as they've been all year. The CNNMoney Fear & Greed Index is currently at 71, its highest reading since the September peak. The AAII bull-bear ratio is currently at a level which in the past has suggested too much optimism and has heralded market pullbacks (see chart below).

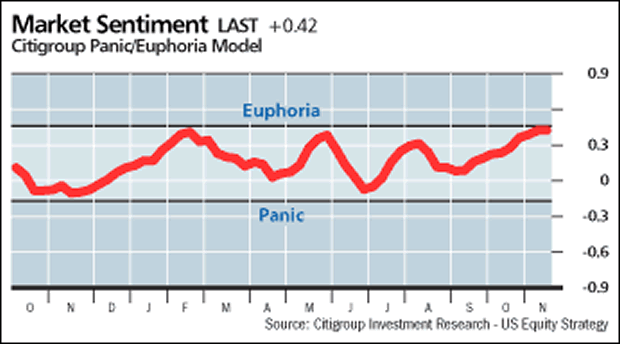

Consider also the current state of investor sentiment as reflected in Citigroup's Panic/Euphoria Model. The indicator is currently reflecting a state of "euphoria," as defined by Citigroup's admittedly loose methodology. The indicator is not without merit however: it correctly predicted the previous pullbacks of February, May-June and August.

It must be emphasized that none of the above mentioned sentiment indicators can pinpoint a market top with any precision. Rather, they should be viewed as "heads up" indicators to prepare us for a potential market juncture in the near future.

Stock Market Cycles

Take a journey with me as we uncover the yearly Kress cycles - the keys to unlocking long-term stock price movement and economic performance. The book The Stock Market Cycles covers each one of the yearly cycles in the Kress Cycle series, starting with the 2-year cycle and ending with the 120-year Grand Super Cycle.

The book also covers the K Wave and the effects of long-term inflation/deflation that these cycles exert over stock prices and the economy. Each chapter contains illustrations that show exactly how the yearly cycles influenced stock market performance and explains where the peaks and troughs of each cycle are located and how the cycles can predict future market and economic performance. Also described in this original book is how the Kress Cycles influence popular culture and political trends, as well as why wars are started and when they can be expected based on the Kress Cycle time line.

Order today and receive an autographed copy along with a copy of the booklet, "The Best Long-Term Moving Averages." Your order also includes a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.