Why Still Only A Cyclical Stocks Bull Market Within Long-Term Secular Bear

Stock-Markets / Stocks Bear Market Nov 16, 2013 - 02:30 PM GMTBy: Sy_Harding

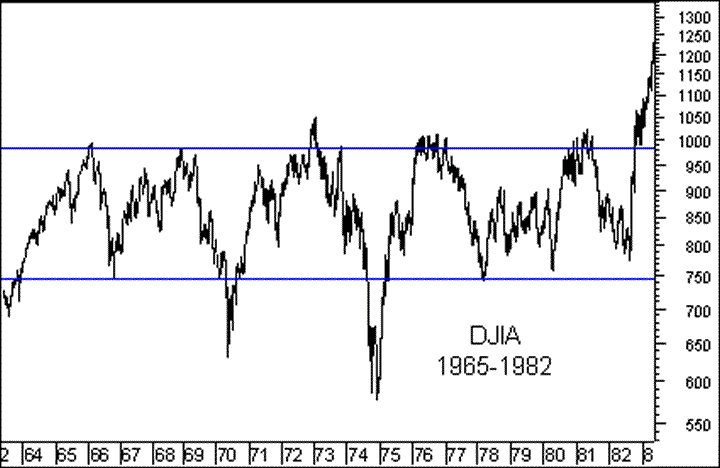

In 1999 Warren Buffett famously warned that “The next 17 years will be quite unlike the last 17 years. It might not look much better than the dismal 1965-1982 period.”

In 1999 Warren Buffett famously warned that “The next 17 years will be quite unlike the last 17 years. It might not look much better than the dismal 1965-1982 period.”

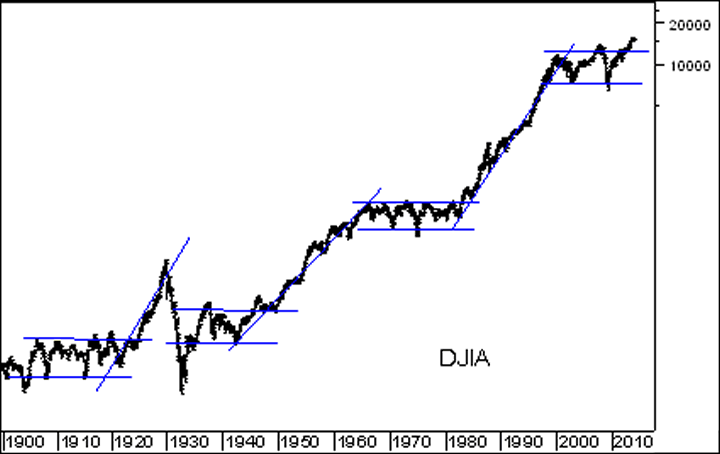

He was referring to the market’s history of cycling between long-term ‘secular’ bull and ‘secular’ bear markets, as it has done for at least 113 years.

In 1999, the last 17 years Buffett was referring to encompassed the powerful 1982-1999 secular bull market. During that period, cyclical bear markets still took place, like the 1987 crash, the 1990 bear market, and the 1998 mini-crash. But when they ended, the long-term bull market resumed to ever higher new highs.

However, during the previous period of 1965-1982 that he referred to, cyclical bear markets also periodically took place. But when they ended, the next bull market only returned the market to the vicinity of its previous highs, and then collapsed again.

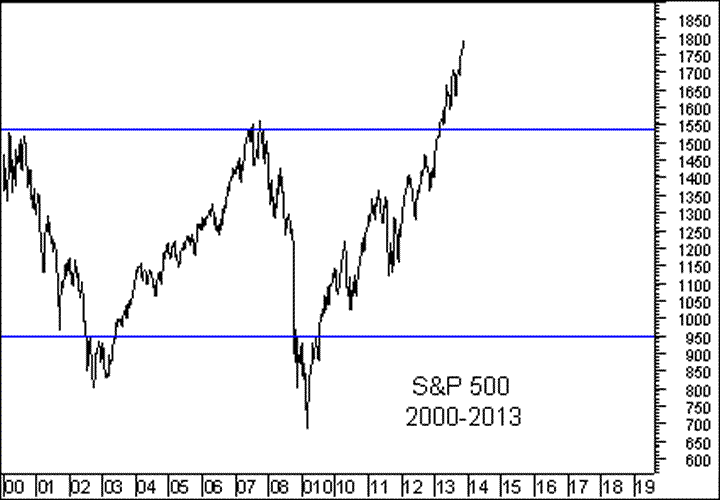

So far, Buffett has been right that the 17 years beginning in 2000 would be more like the period of 1965-82 than the 17 years of 1982-2000.

Here are a few of many reasons to believe he will continue to be right, that the cycle will not end until the 17 problem years he envisioned are up in 2017:

By most measurements, like Tobin’s Q, Nobel Laureate Robert Shiller’s CAPE ratio, and Warren Buffett’s favorite valuation method (the ratio of total market capitalization to annual GDP), the market has reached substantially overbought and overvalued levels again.

Then there is investor sentiment. Retail investors have fallen back in love with the stock market to a significant degree. According to the Investment Company Institute, as is typical in the cycles, public investors, devastated by the 2007-2009 bear market, pulled money out of the market through the first three years of the new bull market that began in 2009. But they have been pouring money back into equity funds at an increasing pace since mid-2012, reaching a near record $92 billion in the first half of this year, (even as data shows institutional investors have been cutting back their exposure).

The last time retail investors became as enthusiastic and confident was in 2007, when they moved $85 billion into equity mutual funds in the first seven months of the year. So by that measure anyway, greed has replaced fear to an even greater extent than near the serious market top in October, 2007.

It also should not be ignored that we are in the first two years of the Four-Year Presidential Cycle. Its long history is that the first two years tend to be negative, and if there is not a correction in the first year the odds increase that a serious correction, even a bear market, will take place in the second year, which next year will be.

There is also the statistic that there have been 25 bear markets in the last 110 years, or one on average of every 4.4 years. This bull market was 4.4 years old in August.

There are numerous potential catalysts in place to roll it over the top, not the least of which is that by next spring at the latest, the Federal Reserve is highly likely to be tapering back the stimulus and easy money policies that have been the main driving force of the bull market.

The combination of conditions is such that, while I am a firm believer in the remarkable consistency of the market’s annual seasonality, I am not completely confident that seasonal strength will last all the way into the spring or early summer this time as it usually does.

If Buffet was right that the secular bear would last 17 years, and others are right in worrying that the high valuation levels, overbought technical conditions, investor euphoria, and so on indicate the next cyclical bear market is right around the corner, then we need to be aware that neither seasonality nor a friendly Fed are always enough to prevent the market from topping out.

The S&P 500 topped out into the serious 2000-2002 bear market on March 23, 2000. And it topped out into the 2007-2009 bear market on October 9, 2007. Although in both cases it recovered some before the end of the favorable season, those dates, within the favorable seasons, were the market tops.

Investors probably need to temper the current level of greed and euphoria with awareness of how closely conditions are working out as Buffett envisioned, and the high odds of at least one more cyclical bear market within the secular bear before enthusiasm buy and hold investing can be trusted again.

In the interest of full disclosure I and my subscribers are 100% invested in the DJIA via the etf DIA in our Seasonal Timing Strategy portfolio, but only 40% invested at the moment, and 60% in cash, in our non-seasonal Market Timing Strategy portfolio (70% invested overall).

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.