Why Traders Lose Money Trading Markets

Interest-Rates / Learn to Trade Dec 01, 2013 - 05:00 PM GMTBy: Chris_Vermeulen

How to turn your trading into a simple automated trading strategy: you know the difference among a winning and losing trade – we have all experienced both and know the excitement and the frustration associated with it.

How to turn your trading into a simple automated trading strategy: you know the difference among a winning and losing trade – we have all experienced both and know the excitement and the frustration associated with it.

The brutal honest truth is a tough pill to swallow. The fact that most of the time it’s not the strategy that has failed; it’s you (the trader) which is why you need a simple trading strategy drawn out on paper with detailed rules for you to follow.

In today’s report I am going to talk about how you can stop losing money and become a successful trader. We all know that before you even enter a position, you must know where you place your stop-loss order. If you don’t know where you stops are to be placed then you are trading with a major disadvantage.

Your position entry is not complete without having a stop price figured out. It blows my mind why so few investors use stop-losses. If you are guilty of not using stops, you need this information. It might be the difference between retiring on time with a big nest egg or retiring later and still just churning your account.

If you plan and place stops you are planning to win, but prepare to take losses because you will get stopped out and you will have to get back up, brush yourself off and trade another day. So with that said we need to look at the psychology around taking losses because it’s not easy to manage, and is the main reason individuals do not use stops. Being proved you were wrong flat out SUCKS!

Successful traders understand they must know where they are going to be stopped out before they enter a position. They have to know ahead of time what a wrong trade looks like so they can exit it quickly. This is a rudimentary fundamental that EVERY trader knows the answer for.

Do You Have A Trading Strategy That You Can Trade Like a Robot?

Can You Answer The Following Questions?

1. How do you know when to sit tight or cut your losses?

2. Do you have rules to tell you when to sell a losing position?

3. Do you have rules of when to move your stop to breakeven?

If you cannot answer these questions properly, you are not alone. And what it means is that you need to establish some rules for yourself. All the trading rules in the world are meaningless if you do not use them. That is why I am telling about what’s really going on with you when you refuse to manage your risk in a proactive and professional way.

Most traders refuse to take a loss for two basic reasons:

1. They cannot admit they are wrong.

For most traders, this is just too painful to admit. It’s interpreted as failure or feeds a persistent, negative self-image which none of us enjoy feeling.

Humans by nature prefer to remain in denial instead of acknowledging their losses are causing them pain. This type of trader often has to lose it all before he begins to change (or gives up trading). I know this very well. I lost it all twice when learning to trade. It was not until the second time that I hit rock bottom (financially and emotionally) that I embraced trading rules and hired a mentor to help keep me inline with my trades.

2. The loss is too big relative to their overall portfolio size so they can’t afford take the loss.

Know this, there’s no such thing as just a paper loss. The investment (stocks, etf, options or futures contract) is worth what it’s quoted whether you realize it or not by closing the position.

Both of these examples are a form of self-delusion that millions of investors, both large and small, suffer from.

If what I am saying here is making you uncomfortable or bringing up feelings of anger or powerlessness, then that is a good sign. It means you have enough common sense and self-awareness to change what you are doing.

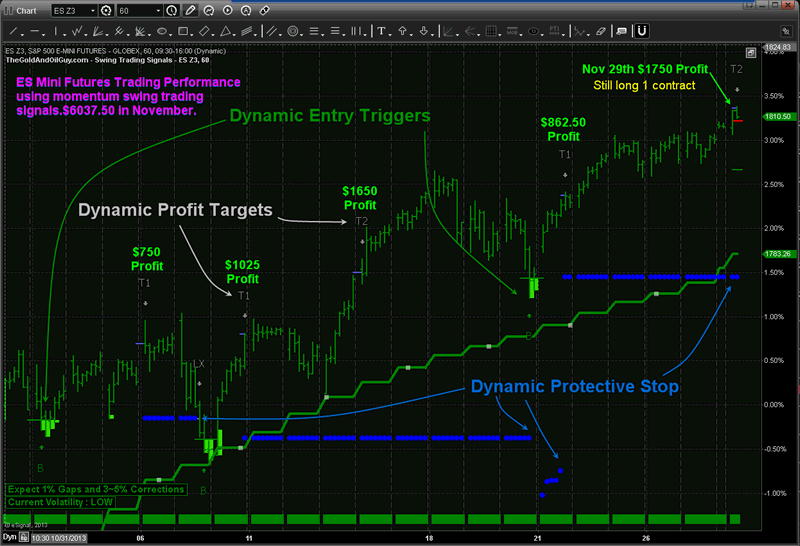

Example of How You Can Make Your Trading Strategy To Be More Automated:

A successful trader uses a different strategy from that of a losing trader (you) by looking at the pain from the loss in an impersonal way. They know the loss as a sign that something went wrong with their approach, or their execution, but NOT that something is wrong with them.

Winning traders separate who they are from what they do. They learn and know, that their trading losses lie in their approach to trading the market and not a reflection of whom they are as a person. The pain they feel is quickly transmuted into motivation, which fuels their desire and determination to become a better trader through refining their trading strategies to better navigate the financial market place.

Both are learned responses and within your control. The opportunity for growth from the pain of our losses are the same. It’s what we do with this emotional pain of a loss that matters, not the loss itself.

Stick with my proven Simple Automated Trading System Make winning a habit.

hris Vermeulen – Get 12 Months for the Price of Only 6 Months – Black Friday Special

By Chris Vermeulen

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.