Forget About Trying To Get Rich With Gold… You’re Going To Need It To Survive!

Commodities / Gold and Silver 2013 Dec 06, 2013 - 06:58 AM GMTBy: Submissions

Mike McGill writes: With the precious metals market in the doldrums and at the bottom of a thirty month correction, there has definitely been some hand wringing and a whole bunch of moping from investors who purchased gold and silver at or near the 2011 highs. This is natural and to be expected. Nobody wants to lose money. People purchase investments ostensibly to make money – hopefully, a lot of it.

Mike McGill writes: With the precious metals market in the doldrums and at the bottom of a thirty month correction, there has definitely been some hand wringing and a whole bunch of moping from investors who purchased gold and silver at or near the 2011 highs. This is natural and to be expected. Nobody wants to lose money. People purchase investments ostensibly to make money – hopefully, a lot of it.

Here at the trading desk of Liberty Gold and Silver, we hear our share of complaints as well. However, the complaints originate predominantly from a small minority of our customers. A synopsis of the fundamental attitudes of this minority goes something like this: “We bought our gold and silver not for fundamental reasons, such as safety and security, but solely to make a so-called quick “paper” profit in the same way that stock day traders and house flippers do. Precious metals are simply another trading vehicle, no different than any other that is strictly used for financial gain; and we got into this because we noticed the markets were surging just like the recent Bitcoin phenomenon and we wanted to get in on the exciting fast action.”

The basic problem with this thinking, as we see it, stems from a complete lack of understanding of the history of failed empires, paper money, and world reserve currencies. A solid study of the above can lead to one and only one conclusion. In the collapse of any financial or social system, precious metals have not only proved invaluable, but ABSOLUTELY MANDATORY for citizens caught up in the unbelievable chaos and suffering that arises from such a collapse. This is an historical fact.

There is a very old proverb relating to the necessity for precious metals whose origin has long been forgotten. It is this; “Silver will feed you, gold will save your life.” Allow me to share a very pointed story told to me a few decades back by a dear now departed friend. His name was Nicholas Bierman. Nick was a great teacher and mentor to me and assisted me in one of the darkest and loneliest periods of my life. Nick was a German Jew. His father owned a successful printing company whose business began to suffer decline following Germany’s defeat in World War I. The nation was devastated and profoundly in debt. Its government, the Weimar Republic, decided it would follow the path that all deeply indebted governments do when they cannot pay their financial obligations. It began to crank up the printing presses and attempt to inflate (print its way) out of the deep hole in which it found itself.

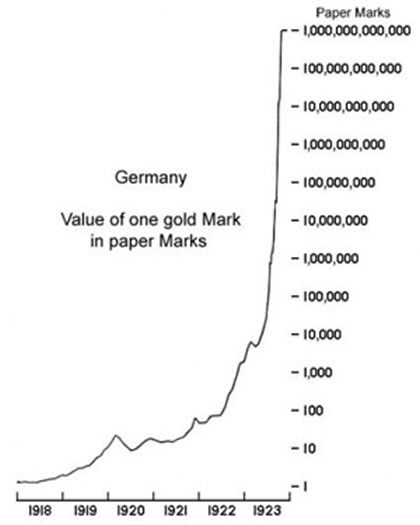

Nick’s father being the prudent type decided that he would begin converting all his excess company profits into gold coins as a safety measure. At the end of the First World War, an ounce of gold for about forty German marks. By 1925, the German mark had been destroyed by raging hyperinflation and it took over one trillion marks to buy that same ounce of gold. A loaf of bread went for billions of marks. Social chaos reigned. Well to do citizens found themselves begging in the streets almost overnight. All distribution channels for food and necessities collapsed as credit dried up and banks failed one after another. There were riots in the streets. Countless people starved or were killed. In this environment, the fascist Brown Shirts, led by Adolph Hitler began their ascension to power.

However, Nick’s father was able to provide for food and other necessities by bartering a small portion of his gold. Their family survived the great post World War I depression and profited afterwards. Nick’s father never forgot this lesson and tenaciously held onto the remainder of his gold even when the German economy fully recovered by the mid-1930s. He instructed his son about the absolute necessity of keeping gold as the ultimate insurance policy. It is a good thing he did for the family was soon to need it again. As the Nazi persecution of Jews escalated, Nick’s father was forced out of his business and had many of his financial assets seized but he still had his gold. Nick, his father, and sister decided that they had to escape if they were to survive. Nick was a teenager at the time.

The family packed up everything they could carry with them and loaded it into their old Mercedes and made a desperate back road pilgrimage to a German port city on the Baltic Sea. They had to drive around many identification checkpoints along the way to avoid Nazi guards looking for escaping Jews. Finally arriving at their destination, Nick’s father hid his children in a dilapidated rental house while he spent a week finally locating a Norwegian fishing captain whom he could bribe to take his family out of the country.

The only thing that finally swayed the Norwegian was a very large payment in German gold coins. Once in Norway, Nick’s family surreptitiously crossed into Sweden. Once there, Nick’s father used all his remaining gold to secure passports, visas, and transportation to the United States. His dad had a contact in St. Louis who helped them relocate there. When they finally settled in St. Louis, they had less than $100 left of their savings, but they were ALIVE!

Nick grew up, got married, raised a family and, incidentally, became a millionaire, but he never lost his gratitude or lost track of the lessons he had learned. I am very grateful that he shared them with me. If he hadn’t, our company, Liberty Gold and Silver, would not exist.

Now as I look back over my life and watch the criminal mismanagement of our fine country along with the unbridled greed and corruption within the banking and political environment that has stolen our nation’s wealth, reduced over fifty million Americans to food stamps, eviscerated trillions in pension benefits for retirees, and eroded the US dollar’s purchasing power by over 98% in the last century, I realize it is now more necessary than ever for all our citizens to quit worrying about how to get rich fast and to concern themselves with saving whatever is left of their financial assets.

Last month, a computer glitch temporarily shut down food stamp cards in several southern states. What resulted was mass rioting and looting of various Walmarts and other grocery stores. When we simply consider the insanity that prevailed at the recent Black Friday shopping melees all across the country, where people were beating and shooting each other in an insane attempt to SPEND their hard earned money on Chinese junk, it should force us to ponder how bad it will be when this financial system completely blows up. And let me assure you, blow it will.

Since the turn of the century, the United States has lost 58,000 manufacturing companies and has seen all forms of debt, government, corporate, and personal rise to $300 trillion, three times our gross domestic product. Ladies and gentlemen, we cannot borrow our way to prosperity. There is going to be a heavy price to pay for this foolishness. A great calamity is approaching day by day, make no mistake about it. It is time for all of us to reconsider our priorities. We strongly recommend that investment in gold and silver be part of them.

Mike McGill

Chief Operations Officer

To learn more about the rewards of precious metals investing, including how to fund your existing IRA with gold or silver, call Liberty Gold and Silver seven days a week at 888.751.3330. To learn about the most generous referral program in the precious metals industry, please visit the Liberty Gold and Silver Referral Program. We're happy to spend as much time as you need to discuss the details with you.

© Copyright 2013 Liberty Gold and Silver, All rights Reserved. Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.