Silver Price Rally Could Mean Another 1,000% Bull Run

Commodities / Gold and Silver 2014 Jan 31, 2014 - 10:53 AM GMTBy: Money_Morning

Peter Krauth writes: Let's face it, 2013 was rough on silver.

Peter Krauth writes: Let's face it, 2013 was rough on silver.

The precious metal started out the year at $31, and ended at $19.50, continuing an overall slump dating back roughly to mid-2011.

That, however, obscures a massive run, like gold, that silver embarked on in 2001 when it was near $4, eventually topping out around $49 in April 2011. At its peak it generated a return of 1,091%.

Heading into 2014, I've pinpointed a number of key drivers - some often missed - that say silver may be poised for another spectacular run...

Two Bullish Signs - That Others Miss

The gold market is much bigger than the silver market.

For that reason, silver traders closely watch gold price action. Since the 2001 bull market began, 92% of silver's price behavior has correlated to gold's.

That's why gold's recent strong price action since the start of 2014 is a positive sign that silver's poised to rise too.

A few weeks back, I told you about 1,600 Reasons To Buy Gold Now. In effect, all the reasons I presented on gold apply to silver as well.

But in addition, there are a few more drivers specific to silver that all point to higher prices.

Like gold, silver's often hated. That in itself is often a great contrarian indicator.

The way to gauge this is to observe what the speculative traders are doing. Particularly when their bets are at or near a sentiment extreme, doing the opposite can be lucrative indeed. That's been the case a number of times since 2001.

Back in early December, silver-futures short positions of all speculators (in the Commitment of Traders COT reports from the US Commodity Futures Trading Commission) hit a bull-to-date high at 54,000 contracts.

This kind of extreme often signals a strong performance in the silver price over the next 1 to 3 months.

Since bottoming at $19 in early December, the silver price has already gained 7%. And I think that's just the opening act.

The most recent COT reports show speculators have already pared back their short bets considerably, so this reversing trend is playing out in textbook fashion. The extreme pessimism is already subsiding.

We saw this happen in each of the past three years, and conditions look ripe for a repeat.

Another useful way to gauge whether silver is cheap or expensive on a relative basis is to use the Gold/Silver ratio.

By dividing the gold price by the silver price, you can tell how many silver ounces one gold ounce will buy.

In the past decade, the range for this ratio has mainly been between 45 and 60.

Currently, one gold ounce is good for 63 silver ounces. That's high by historical standards, and it's high by bull-to-date standards.

Simple reversion to the mean tells us to expect silver to climb relative to gold. If silver were to just return to the middle of that range, then a Gold/Silver ratio of say 53, with gold at $1,250/ounce, would yield a silver price around $23.60, or 18% higher from here.

But silver is so overdue for a corrective bounce, it could easily reach for the bottom of the range. If the Gold/Silver ratio went to 45, we'd be looking at $27.75 silver based on $1,250 gold.

That's a whopping 39% higher from here, and all with gold staying put!

Coin Collectors to ETF Managers "Predict" This Rally

Thanks to weak silver prices last year, silver coins went like hot cakes.

The U.S. Mint got top spot, selling 42.4 million one-ounce American Eagle silver coins. By mid-November, the Mint had set a new sales record.

The Royal Canadian Mint was second, setting its own record with 26.4 million ounces sold.

And Australia's Perth Mint came in third, selling 8.6 million silver ounces, up 33% over 2012.

And all of this happened as silver declined 37%. Rather than scaring off investors, lower silver prices encouraged them to load up in what many consider the last opportunity to buy silver cheap.

Such intense physical accumulation of silver is another clearly bullish sign. Uniquely, ETF managers are lining up with coin collectors in increasing their holdings.

The two flagship physically backed precious metals ETFs are iShares Silver Trust (ETF) (NYSE ARCA: SLV) and SPDR Gold Trust (ETF) (NYSE ARCA: GLD).

And their physical holdings bifurcated during 2013, saying a lot about investors' mindset.

GLD investors sold right out of the gate as 2013 started. From record-high inventories, GLD saw its level of gold bars rapidly decline more than 40% by year's end.

When the gold price panic hit in April, GLD lost 15% of its holdings within just a month and a half.

SLV was another story entirely, as investors decided to hold onto their shares despite silver's plummeting price.

In fact, during both the early and late parts of 2013, SLV's silver holdings were actually up from their average 2012 levels.

Lower silver prices clearly didn't scare investors away from the major silver ETF.

Right now, silver's looking ready to pop.

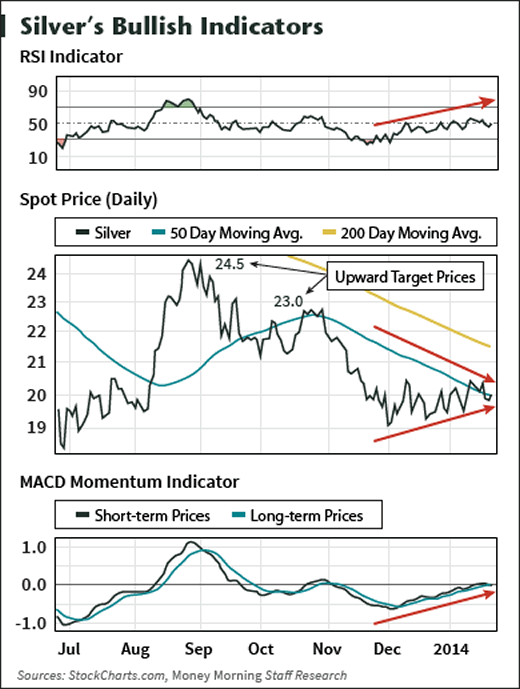

Have a look at this chart.

Here are the main takeaways:

- The RSI indicator has been trending up and only becomes overbought when it reaches 70.

- Silver has strong support at the $19.75 level and will likely break out of its wedge pattern (represented by the converging arrows in the middle graph) soon, I expect to the upside.

- The MACD momentum indicator shows a healthy positive divergence, pointing to a rally.

- Target prices: Initial level is $23, if that's taken out, silver could rally to $25.

This Company Stands Out

Based on all the factors I've detailed above, I think silver will close the year higher than it started, and a 50% gain to the $30 range is not out of the question.

To take advantage, consider Silver Wheaton Corp. (NYSE: SLW). The company invented the streaming business and is the largest precious metals streaming/royalty company by market cap at $7.9 billion. With more than 1.6 billion ounces to their name, SLW has more silver reserves than any other silver company in the world.

Their suite of assets is very well-diversified geographically, with mostly geopolitically low-risk projects. Most of their ounces have a total cash cost around $4 (extremely cheap), and production is expected to grow about 45% between 2012 and 2017. What's more, as a streaming/royalty company, SLW bears none of the exploration, permitting, and development risks that miners do.

Of course, Silver Wheaton is likely to amplify any moves that silver makes, both up and down.

As I've outlined above, bullish price action in both gold and silver, the out-of-whack gold/silver ratio, extreme pessimism of speculators, record coin sales, and sticky ETF holdings are all converging toward a higher silver price.

And great returns for you...

Source : http://moneymorning.com/2014/01/31/silvers-rally-mean-another-1000-run/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a finan

cial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.