Turning Point in Junior Gold Mining Stocks?

Commodities / Gold and Silver Stocks 2014 Feb 01, 2014 - 12:14 PM GMTBy: Doug_Horning

It's not exactly news that gold mining stocks have been in a slump for more than two years. Many investors who owned them have thrown in the towel by now, or are holding simply because a paper loss isn't a realized loss until you sell.

It's not exactly news that gold mining stocks have been in a slump for more than two years. Many investors who owned them have thrown in the towel by now, or are holding simply because a paper loss isn't a realized loss until you sell.

For contrarian speculators like Doug Casey and Rick Rule, though, it's the best of all scenarios. "Buy when blood is in the streets," investor Nathan Rothschild allegedly said. And buy they do, with both hands—because, they assert, there are definitive signs that things may be turning around.

So what's the deal with junior mining stocks, and who should invest in them? I'll give you several good reasons not to touch them with a 10-foot pole… and one why you maybe should.

First, you need to understand that junior gold miners are not buy-and-forget stocks. They are the most volatile securities in the world—"burning matches," as Doug calls them. To speculate in those stocks requires nerves of steel.

Let's take a look at the performance of the juniors since 2011. The ETF that tracks a basket of such stocks—Market Vectors Junior Gold Miners (GDXJ)—took a savage beating. In early April of 2011, a share would have cost you $170. Today, you can pick one up for about $36… that's a decline of nearly 80%.

There are something like 3,000 small mining companies in the world today, and the vast majority of them are worthless, sitting on a few hundred acres of moose pasture and a pipe dream.

It's a very tough business. Small-cap exploration companies (the "juniors") are working year round looking for viable deposits. The question is not just if the gold is there, but if it can be extracted economically—and the probability is low. Even the ones that manage to find the goods and build a mine aren't in the clear yet: before they can pour the first bar, there are regulatory hurdles, rising costs of labor and machinery, and often vehement opposition from natives to deal with.

As the performance of junior mining stocks is closely correlated to that of gold, when the physical metal goes into a tailspin, gold mining shares follow suit. Only they tend to drop off faster and more deeply than physical gold.

Then why invest in them at all?

Because, as Casey Chief Metals & Mining Strategist Louis James likes to say, the downside is limited—all you can lose is 100% of your investment. The upside, on the other hand, is infinite.

In the rebound periods after downturns such as the one we're in, literal fortunes can be made; gains of 400-1,000% (and sometimes more) are not a rarity. It's a speculator's dream.

When speculating in junior miners, timing is crucial. Bear runs in the gold sector can last a long time—some of them will go on until the last faint-hearted investor has been flushed away and there's no one left to sell.

At that point they come roaring back. It happened in the late '70s, it happened several times in the '80s when gold itself pretty much went to sleep, and again in 2002 after a four-year retreat.

The most recent rally of 2009-'10 was breathtaking: Louis' International Speculator stocks, which had gotten hammered with the rest of the market, handed subscribers average gains of 401.8%—a level of return Joe the Investor never gets to see in his lifetime.

So where are we now in the cycle?

The present downturn, as noted, kicked off in the spring of 2011, and despite several mini-rallies, the overall trend has been down. Recently, though, the natural resource experts here at Casey Research and elsewhere have seen clear signs of an imminent turnaround.

For one thing, the price of gold itself has stabilized. After hitting its peak of $1,921.50 in September of 2011, it fell back below $1,190 twice last December. Since then, it hasn't tested those lows again and is trading about 6.5% higher today.

The demand for physical gold, especially from China, has been insatiable. The Austrian mint had to hire more employees and add a third eight-hour shift to the day in an attempt to keep up in its production of Philharmonic coins. "The market is very busy," a mint spokesperson said. "We can't meet the demand, even if we work overtime." Sales jumped 36% in 2013, compared to the year before.

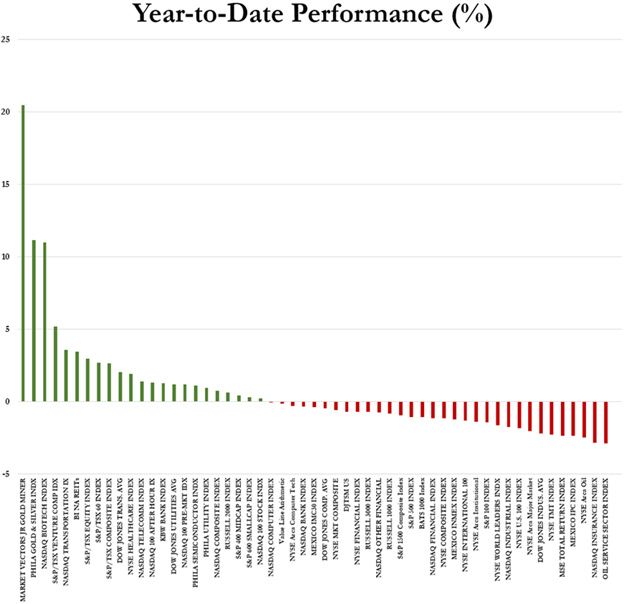

Finally, the junior mining stocks have perked up again. In fact, for the first month of 2014, they turned in the best performance of any asset, as you can see here:

(Source: Zero Hedge)

The writing's on the wall, say the pros, that the downturn won't last much longer—and when the junior miners start taking off again, there's no telling how high they could go.

To present the evidence and to discuss how to play the turning tides in the precious metals market, Casey Research is hosting a timely online video event titled Upturn Millionaires next Wednesday, February 5, at 2:00 p.m. Eastern.

© 2014 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.