Has the U.S. Housing Market Hit the Wall?

Housing-Market / US Housing Mar 05, 2014 - 10:29 AM GMT The housing market began 2013 with a great deal of momentum, but recent data on this sector has moderated considerably. It would be easy to blame this trend on the weather, but there may be more to the housing story. The contribution of this sector to economic growth going forward may not be as robust.

The housing market began 2013 with a great deal of momentum, but recent data on this sector has moderated considerably. It would be easy to blame this trend on the weather, but there may be more to the housing story. The contribution of this sector to economic growth going forward may not be as robust.

Construction and sales fell to a very low base level during the depth of the recession, and therefore were able to show outsized gains as the recovery began. Residential investment was one of the biggest contributors to gross domestic product growth in 2011 and 2012.

Progress was attributable to a favorable confluence of factors. Supply conditions are much clearer than they were immediately after the crisis, as the industry has done a steady job of working down the backlog of foreclosed homes. The presence of these units made it difficult for certain markets to reach new price equilibria. Sales of foreclosed homes made up 11% of existing home sales in January, down from 14% a year ago and 22% in 2012.

On the demand side, household balance sheets are in much better condition, and wealth gains have been used as down payments by some purchasers. Low mortgage rates and heavy underwriting from the FHA (which insures mortgages with low down payments) helped add to the momentum. Investors played a role, too, by scooping up vast tracts of single family homes and turning them out for rental.

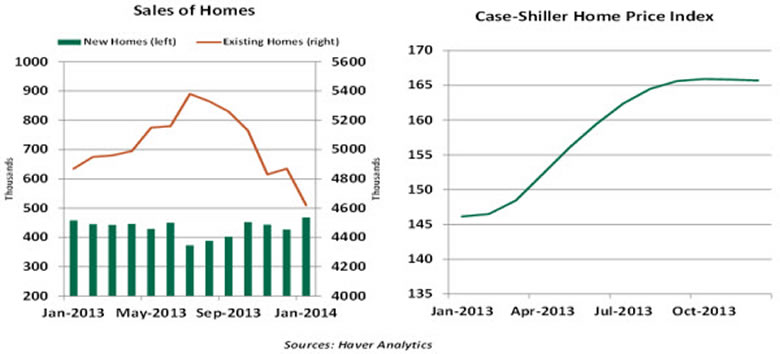

These trends were expected to continue for some time, but the charts below clearly show that things levelled off in mid-2013, long before the weather in much of the country turned ugly.

Sales of existing homes have slipped in five of the past six months, and sales of new homes are at the same level they reached six months ago. The Pending Home Sales Index, a leading indicator of home purchases, dropped in three of the four months ending in January.

Coincident with the slowing in sales has been sluggishness in the pace of permit issuance for new construction. The National Association of Home Builders notes that supply constraints for labor, materials and lots hindered home building activity in late 2013. But the main drivers behind the lost energy in the housing sector involve credit conditions.

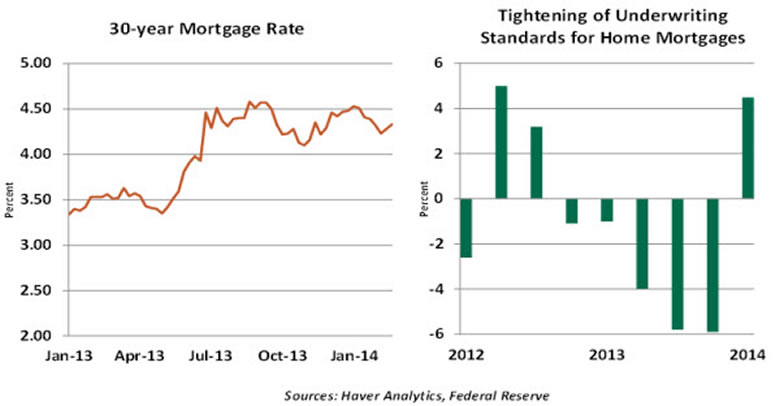

The first of these is mortgage rates. The recent 30-year fixed rate mortgage at 4.3% is down slightly from the peak in January 2014, but it is still nearly 110 basis points higher than the low posted in May 2013. With the Federal Reserve tapering its asset purchases, it seems unlikely that borrowing rates will retreat much further.

The second is the tightening of mortgage underwriting standards, evident in the January 2014 Senior Loan Officer Survey. This came as a bit of a surprise, given that underwriting standards for almost all other types of credit have eased considerably over the past two years.

The reversion may reflect the impact of new regulations pertaining to “qualifying mortgages” issued by the Consumer Financial Protection Bureau, effective as of January 10, 2014. Lenders must now consider eight factors to establish the borrower’s ability to repay the loan. Failure to do so can leave the lender liable for loss even if the loan is later sold.

The biggest hurdle to cross is the 43% debt-to-income ratio of the borrower, with debt inclusive of student loans, car loans, credit card debt and all other loans. Given employment conditions, it takes a much longer time for first-time buyers to reach a point of qualification.

These rules are certainly well-intentioned and aim to reduce the agony of foreclosure endured by millions over the last several years. But there is little doubt that they will be a significant limitation to some prospective purchasers.

While an improvement in employment conditions and steady mortgage rates should help housing activity, it appears that the reversion from homeownership to rental is not yet complete. So it is not surprising that sales and construction of single family units are diminishing.

Of course, strong employment and strong markets could change this dynamic, which is what the industry is hoping for. But housing finance has still not reached its “new normal.” And until it does, neither will home sales and home construction.

Carl R. Tannenbaum

Chief Economist

http://www.northerntrust.com

Carl Tannenbaum is the Chief Economist for Northern Trust. Prior to joining Northern Trust, Carl led a team at the Federal Reserve Bank of Chicago whose charter was to analyze financial risk, its implication for the broad economy and policy choices to address it. He served as the head of the entire Federal Reserve System's risk group in Washington for a year that ended in March, working closely with Federal Reserve System Governors and senior officials.

Copyright © 2014 Carl R. Tannenbaum

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.