Gold And Silver - For Strong Upside Movement Experts Continue To Be Wrong

Commodities / Gold and Silver 2014 Mar 22, 2014 - 03:14 PM GMTBy: Michael_Noonan

From our perspective, the charts reflect the reality of the unreal within the ruling Western elites that continue their financial stranglehold over every Western government, at a minimum, and through their central banks dictating how governments are to rule the governed, aka those enslaved into the system. [We will deal with how charts are the best read, later in the commentary.]

From our perspective, the charts reflect the reality of the unreal within the ruling Western elites that continue their financial stranglehold over every Western government, at a minimum, and through their central banks dictating how governments are to rule the governed, aka those enslaved into the system. [We will deal with how charts are the best read, later in the commentary.]

Actually, "the system" is an apt way of describing how the Rothschild formula has spread its dominating tentacles into every aspect of everyone's lives. Formula: Control all the money, control the government. Control the government, control the world. This diabolically simple plan has worked right from the outset. Rothschild was an incredibly astute businessman.

While becoming rich as a moneylender, he learned that it would be far more profitable to lend to governments than to people. Besides, governments had the power of taxation that guaranteed repayment of all loans. Further, he learned that there were even far greater profits to be had when countries were engaged in war. Nothing produced more riches for the Rothschild's growing dynasty than wars. It was through wars, and the previously unimaginable riches they brought, that Rothschild gained control of the Bank of England, as a starter.

Have you ever wondered why there are so many wars, why people cannot just "get along?" The Rothschilds see to it that dissent is fostered and civil unrest is encouraged, eventually leading to war. There is no country on earth that has been responsible for more wars and promoting them than the elite-controlled, puppet-run United States. The list, starting from the Korean war and Viet Nam, to present times is appalling but purposeful.

If it were not for Putin, Obomba would have promoted his [yet another] false flag chemical use against civilians as reason for bombing Syria. That door politically foreclosed on him, Netanyahu has picked up the mantel. Israel may not go too far, for it has some gas deals with Russia, and it would be bad economics to keep pushing against Syria.

"Give me control of a nation's money, and I care not who makes the laws," was not some idle boast on Rothschild's part. He literally began controlling governments. Once in control of governments, lending to controlling influences, through licensing, like the news media, the medical industry, communications, drug industry, education, the military, the web of money was all-controlling.

What makes the Rothschild formula so successful is that it became systematized. In every sphere of influence Rothschild "agents" were present and an integral part of how things functioned, always in furthering the financial ends of the family empire, and nothing was more controlling than the banking system. This was how the United States was gutted from within. First came the installation of the Federal Reserve in 1913, then the IRS in 1916, neither of which pass organic Constitutional muster, but the organic Constitution was replaced by a mirror federal constitution, written to favor the Rothschild interests.

This is the Rothschild's For Dummies abbreviated version of a very complex, very devious takeover of the world. In every instance, when the Rothschild's loaned governments cash or its equivalent, gold was demanded as payment in return. If there were not enough gold, silver was also acceptable. When both ran out, control of the financial arm of the government, [the money supply], came next. Once control of every part of finance was under control, then came control of everything else.

The love of money is the root of all evil, and evil reigns. All Western governments are criminal enterprises, and none more so than the United States, exporting its perverted form of "democracy," [debt at the barrel of a gun...not just a gun, invasions, tanks, drones, torture, every imaginable form of black-ops to create civil unrest...snipers in the Ukraine killing both sides, as a current example].

Guess what occurred at the first opportunity in Ukraine? All of its 33 tons of stored gold was transported [stolen] under cover of darkness at 2:30 a.m., local time, to be "stored" [stolen] in the rabbit hole at the New York Federal Reserve. This is how the Rothschild system works, from the French and English wars of a few hundred years ago, to just a few weeks ago. The first thing to go is a country's gold. It happened in Iraq, in Libya, even in Somalia.

Whenever a country is invited into the EU web, that country's onerous debt is compounded with even more, impossible to repay debt. What then follows are "austerity" programs, and now bail-ins, and for what? To save the insolvent banking system that created the disastrous financial, derivative-laced problems to begin with.

Who elected the people in control at the IMF? The BIS? The EU? No one. They represent no one. They are all agents in the service of the Rothschild elites, and their only mission is to gain absolute control over all of the money and over every citizen within the criminally corrupt web of Western governments.

Ukraine has nothing to do about "spreading democracy." It is all about control over energy sources, especially the flow of natural gas to Europe. The West has been at growing risk of losing its fiat "petro-dollar" control as the East, along with its resource riches and rising gold reserves, positions itself to take over. Who is leading the charge from the West? Once again, the Nobel Peace Prize recipient is pounding on the undertone drums of war, from half-way around the world, and with no skin in the game.

Consider, Barack and his [un]brilliant moves against Putin. In his latest "I'll huff, and I'll puff, and I'll blow your house down" with sanctions move: Visa and MasterCard have refused to process charges in Russian banks. That must be keeping Putin up at night. Meanwhile, China has announced that it plans to purchase even more natural gas from Russia. While Obama deals in petty debt threats of no consequence, Putin is making a huge economic deal with China, likely to be inked when Putin visits China in May.

When the deal between China and Russia is finalized, it will be another nail in the coffin of the fiat "petro-dollar," for the "dollar" will not be a part of the deal. It continues to be exit stage left for the waning US influence.

Hard to decide: no more debt-driven activity from the West versus offers of more lucrative international trade from the East? These Western sanctions from the dumber-than-dumb West must really have Russia concerned. Even more! The G-8 nations want to impose sanctions, as well. 7 of those 8 Western nations are essentially insolvent.

Based on how the charts continue to develop, there are no indications that gold or silver are about to "take off," or even keep a sustained trend to the upside. None of the oft- mentioned so-called fundamentals have impacted the direction of PMs, and none still do. It is all about what is going on in the West v East battle for investment survival.

Everything has been revolving around gold, and the West has played a losing hand. Its ace in the hole is what we referenced as "the system." The West has had its bluff called, over gold, and it has folded, much like the paper exchanges, COMEX and LBMA are. Paper-covers-rock may win in the Rock, Paper, Scissors game, but in real life, using debt paper to cover over the loss of golden rocks does not work.

If the East has gained control of the gold, and the West is essentially insolvent to its core, why aren't gold and silver finding a higher level that, at a minimum, would reflect a simple adjustment for inflation for the past few decades?

The Rothschild influence and control of the world's [all fiat] money, its total control over the governments of the West, except those within the BRICS sphere, is so pervasive that it has to have some degree of tie-in even with the independently driven countries like China, India, and now much less so with Russia, as Putin has tired of Obama's utter pettiness.

The war for resource control is what is influencing the price of gold and silver, and for as long as the West can influence events around the world, it will continue to be more than a thorn in the side of the East, and gold and silver will continue to seek a bottom.

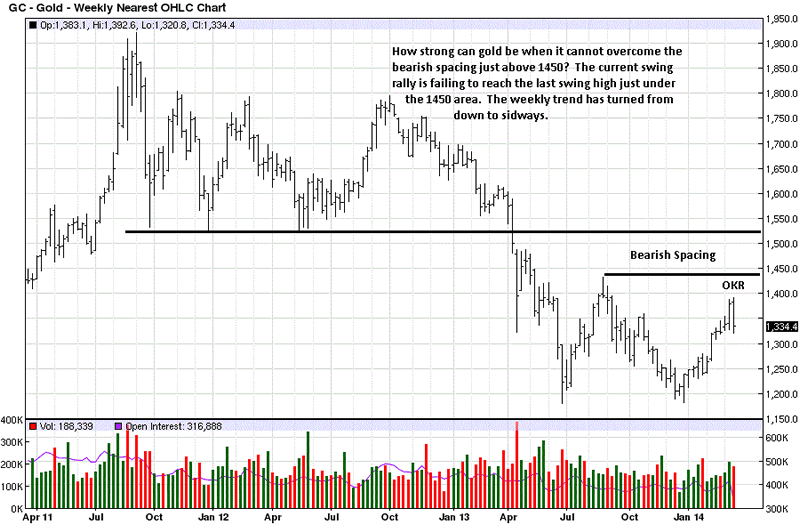

Amidst the sometimes "wildly" bullish attitudes toward gold, from a number of experts, so-called or self-professed, gold has not made any strong inroads on the weekly chart, a time frame more indicative of overall stronger buyers and sellers.

Bearish spacing remains intact, and the current price swing high has stopped under the last swing high. If it were pure fundamentals driving the price of gold, it would be at much higher levels. If it is not fundamentals driving the market, then the most likely reasoning has to be something along the lines we have discussed.

Whatever it is, however perverted the paper markets have become, even manipulated markets that are going to fail will begin to show signs of failure before the reality sets in. We see nothing in the charts that indicates an end to the grasp of the Rothschild ilk.

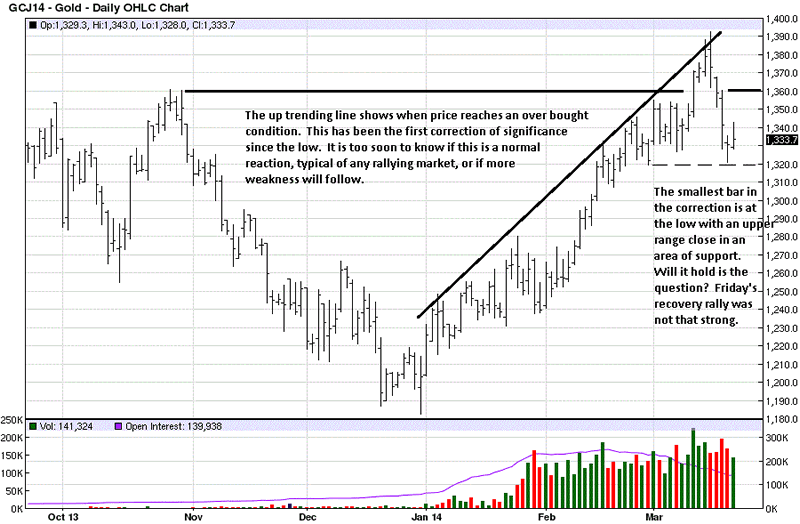

The daily trend is up. The current correction just erased the effort of the past 3 weeks. Of the 4 selling bars, the last was the smallest in range with an upper end close and at an area of support. The volume was relatively high, under the circumstances, and it indicates buyers were more in control than sellers. Fridays weak rally was still a higher high, low and close from the previous one.

If the trend is to remain intact, gold should renew it upward momentum. If not, then adjustments will be in order to suit the new information from the market.

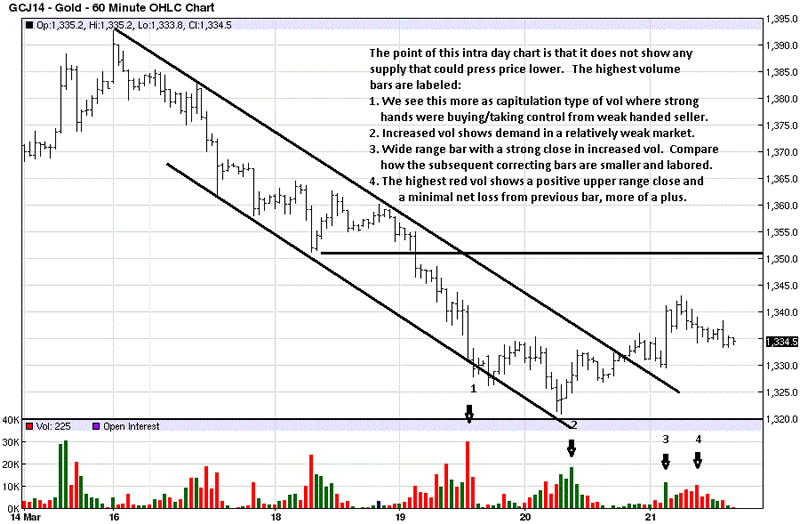

The chart comments say it all. We normally do not include intra day charts, but this does show a lack of strong selling volume as price moved sideways over the last 3 days.

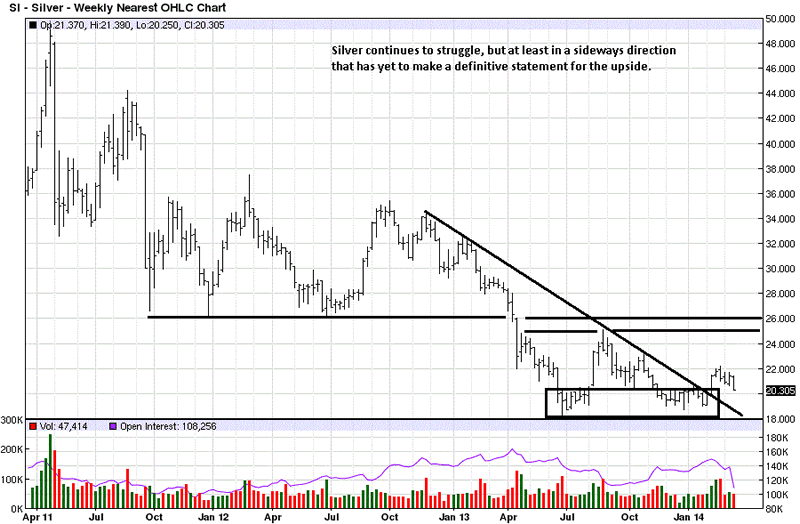

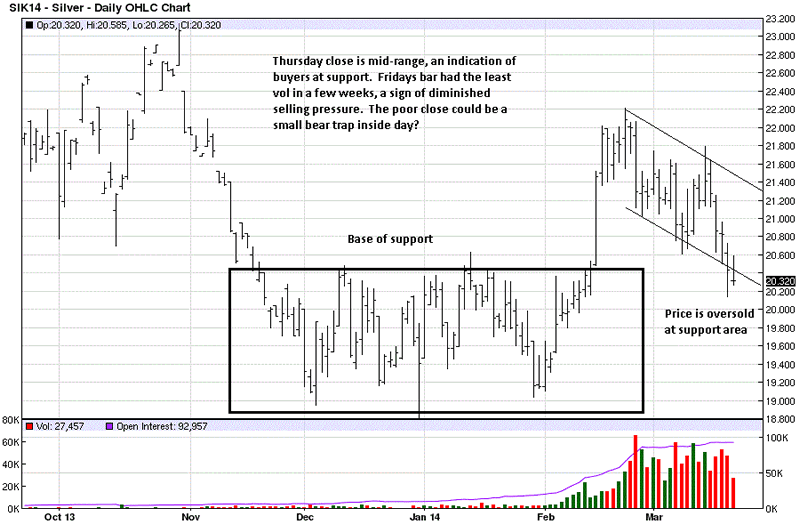

Many articles have been written about the explosive potential for silver, and at some point, it may happen, but for now, silver is languishing at the lows, and it gives no signs for a potentially strong move to the upside. All anyone has to do is look at this chart and draw one's own conclusion.

Where daily gold is in an up trend, daily silver is not. Looking at silver in the most positive light, from a chart read, it is at support, and it is in an oversold condition while at support. The combination may give rise to a rally, in the days ahead. However, if silver were to rally next week, it would still be viewed as a rally within a down trend.

$50, $100, $200 silver? It cannot clear its way above $22. How do the experts reconcile that with so much "rosy" enthusiasm? We like silver, but one has to be a realist and deal with what is. Accumulation of the physical is highly recommended, as is personally holding it, outside of any banking system.

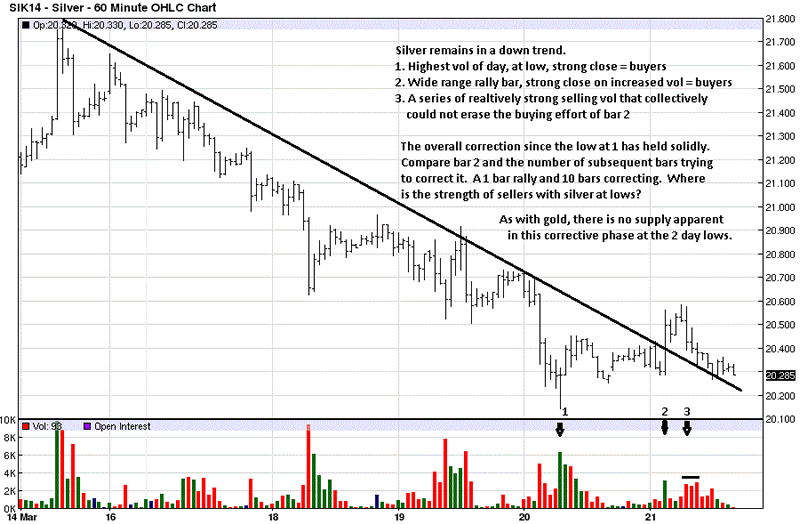

Even the intra day trend for silver remains down. There are several points to be made for positive behavior as this metal continues to bottom, but at some level, it should begin to "show its hand," if there is the underlying strength so many maintain.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.