Sheffield Best Estate Agents, Buyer and Seller Rating

Housing-Market / Sheffield Mar 23, 2014 - 03:18 PM GMTBy: N_Walayat

(Last Update 2nd May 2014)  Sheffield has a very active housing market with over 2,500 properties on the market at any one time and with nearby Rotherham another 1,000 that generates more than £2 million in commissions annually shared out between more than 20 local estate agents.

Sheffield has a very active housing market with over 2,500 properties on the market at any one time and with nearby Rotherham another 1,000 that generates more than £2 million in commissions annually shared out between more than 20 local estate agents.

Home Sellers

Home sellers bewildered at the amount of choice can be easily bedazzled by estate agent tips and tricks in an attempt to hook sellers into sole selling contracts on the basis of lower fees, higher valuations and promises of promotional packages as they compete to lock you in. Therefore the decision making process of home sellers can be skewed in the wrong direction as they can become influenced by marketing hype over substance or go with lowest priced service as both can end up proving to be costly time wasting mistakes.

Home sellers bewildered at the amount of choice can be easily bedazzled by estate agent tips and tricks in an attempt to hook sellers into sole selling contracts on the basis of lower fees, higher valuations and promises of promotional packages as they compete to lock you in. Therefore the decision making process of home sellers can be skewed in the wrong direction as they can become influenced by marketing hype over substance or go with lowest priced service as both can end up proving to be costly time wasting mistakes.

Worst still are those home owners who think they can sell their own homes using a myriad of cheap online DIY services, which usually turns out to be a disastrous decision because as if a home owner who has never sold a property themselves before will ever have more experience than even the worst of estate agents.

Home Buyers

House hunters are at the other end of the spectrum who have to deal with many estate agents. What house hunters are looking for from estate agents is an efficient, helpful, polite and above all honest service. However estate agents repeatedly get a bad press because many if not most tend to fail on virtually all of these points. Whilst it is true that the estate agents work in the interests of house sellers, however leaving a bitter taste in the mouths of house hunters is not going to help sell your home!

Then there is the outright dubious activities that estate agents can engage in that literally warrants an formal investigation. For instance in a real life personal example, I placed an ALL CASH offer down on a property which was according to the estate agent not accepted by the vendor only to later discover that the property had sold for a near 7% LOWER price than my offer. I am sure this was not an isolated incident and goes a long way to explain why people tend to hold estate agents in such low esteem, as clearly the lack of regulation and large sums involved can prove very tempting to the huge determinant of both sellers and buyers.

So the best source to the answer question who are the best estate agents in Sheffield (and surrounding areas such as Rotherham) is to ask those who have already been through the whole process, the buyers and sellers who have made it through to the other end and share their experience by voting on the quality of service received.

Voting is very easy, all you need to do is pick the estate agent(s) that you have experience of and then click to rate them from 1(poor) to 10 (great). - Max 1 vote per month per estate agent.

Voting Results : 16th March 2014 to 2nd May 2014 - Check back for regular updates.

| Estate Agent | Average Rating (1-10) | Total Votes | Vote Now - Rate Estate Agent 1-10(best) on Quality of Service Received | |||||||||

| Merry Weathers | 7 | 17 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Fenton Board | 6.8 | 12 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Haybrook | 6.7 | 36 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Fairways EA Sheffield | 6.4 | 7 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Blundells | 6.3 | 61 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Property Shop - Sheffield | 6.3 | 8 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Bairstow Eves | 6.2 | 9 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Winkworth | 5.8 | 11 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Saxton Mee | 5.1 | 24 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Reeds Rain | 5 | 20 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Hunters | 4.8 | 7 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Your Move | 3.9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| William H Brown | 3.8 | 18 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| ELR - Eadon Lockwood & Riddle | 3.6 | 19 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Archers | Pending | 4 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Baldersons | Pending | 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Barton EA | Pending | 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Crapper Haigh | Pending | 1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| JMC EA | Pending | 5 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Pinks Homes | Pending | 3 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Spencers EA | Pending | 4 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Staves EA | Pending | 6 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

This poll started on 16th March 2014 - http://www.marketoracle.co.uk/Article44837.html

Note: the votes as are recorded by individual IP/ router and only count once per month per estate agent, additionally a maximum of 2 votes per hour for the same estate agent is counted thus preventing fraudulent votes. The minimum number of votes to achieve a rating is 7, the higher the total number of votes the more reliable will be the rating.

Sheffield Best and Worst Areas to Live

As excerpted from the New UK Housing Market Ebook:

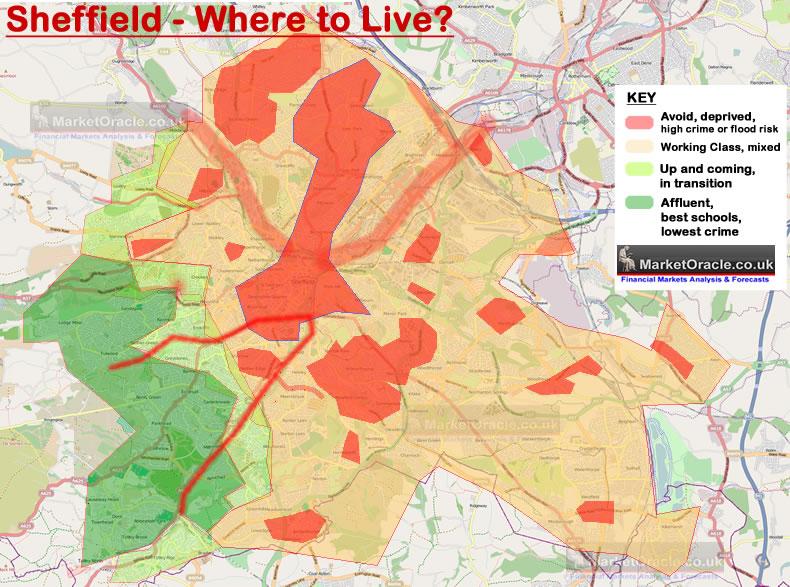

The below map details which areas of Sheffield should be avoided and which areas should be favoured in terms of the best places to live. Obviously the amount of financing available will play an important factor in determining the choice of area's, but at a minimum the RED areas should be avoided as people moving to Sheffield, purchasing a property for their own residency in a Red area will soon come to regret their decision.

The large expanse of orange area's are as a consequence of the size of Sheffield's public sector and the private sector that directly relies on it, that continues to see deep cuts in local government spending, this also means that there is a continuing large supply of properties in these areas of Sheffield which acts to depress average house prices that masks booms taking places in pockets of the city and thus offers many opportunities towards the middle end of the property market.

Meanwhile prospective home buyers can expect a huge jump in financing requirements to purchase a property in the affluent areas of the city (Dark Green) which are situated in the the South West of the city as these areas will have experienced little in terms of the impact of the economic depression with the consequences and in terms of expected house prices is that just like many areas of London, these areas are already trading near their pre-crash levels as these are the areas that will be those that are in greatest NATIONAL demand, just as many parts of London are in great INTERNATIONAL demand (as high as 50% of properties in many areas of London are bought by foreign investors).

Click here for a Large version of the Where to Live Map

In summary, prospective home buyers should take notice of the fragmented nature of the city which can make a huge differences both in terms of the quality of life, school catchment etc. However, the best areas of the city can be found to be concentrated in the South West of the city as the affluent residents continue to price most local house hunters out of these areas, just as is the case for many areas of the UK. Furthermore, the most affluent area's of the city tend to have a buffer zone of up and coming areas that acts to further the gap in house prices between relatively short distances.

What this means is that whilst the pseudo-economists (journalists) that populate the mainstream media focus on average house price trends, instead the reality is of a highly fragmented and buffered market that results in areas of Sheffield that rival anything that can be seen in the South East of England in terms of house prices, which I am sure will come as a shock to many house hunters who tend to look at the academic statistics, the averages that will FAIL to give a true picture of Sheffield's housing market for instance a 4 bedroom detached house in S11 typically starts at £400k, whereas 2 or 3 miles distance a similar sized 4 bed would typically cost less than £200k.

UK House Prices Mega-trend Forecast 2014-2018 Ebook

The UK housing market ebook is due be completed by the end of this month (March 2014) that contains extensive analysis and detailed trend forecasts. The ebook also includes extensive guides on how to buy or sell properties, value increasing home improvements, how to maintain and save money on running costs and more - ALL for FREE.

Ensure you are subscribed to my always free newsletter for my latest analysis and to be able to download the ebook for FREE on release.

However, given the time critical nature of the content excerpted analysis including the detailed trend forecasts were posted online in 2 parts on the 30th of December 2013:

- 30 Dec 2013 - UK House Prices Forecast 2014 to 2018, The Debt Fuelled Election Boom

- 30 Dec 2013 - UK House Prices Forecast 2014 to 2018, Inflation, Trend Trajectory and General Election 2015

Source and Comments: http://www.marketoracle.co.uk/Article44925.html

Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, stocks, housing market and interest rates. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.