Non-Farm Payrolls Friday – Who Needs to Work When the Market Makes 30%?

Stock-Markets / Financial Markets 2014 Jun 06, 2014 - 03:21 PM GMTBy: PhilStockWorld

Is there any point to working?

Is there any point to working?

For Americans, it's just the time we waste while waiting to consume. As more and more of our jobs are taken over by machines – why are we still hung up on working?

There is the small problem of distributing the wealth but, once our bosses let go of the idea of needing us to show up just to get paycheck – I think we can get our economy back on track.

What we need in America is for our vast consuming class to go pro – to demand to be paid to shop. Retailers already pay for ads to get our attention so why not cut out the middle men and just get paid to go shopping? Imagine how full the malls would be if people stopped working by choice, rather than by circumstance.

The last Superman movie, "Man of Steel" had $160M worth of promotions tied to it. The movie only grossed $291M and, at $10 a ticket, that means about 30M people saw the film. Rather than paying Warner Brothers to make another retelling of the Superman story, why don't the advertisers just GIVE $5 to everyone who sees the movie? More people would see the movie, so the studio would be happy – and that $160M would be spent in the economy, giving everyone a boost.

The top 100 movies last year grossed $11Bn last year so, if we figure they could pay out 50% of the box office, that's $5.5Bn = enough money to give $25,000 to 220,000 professional shoppers. If we apply this logic to other industries as well, we could put millions of pro shoppers to work right away and THEN there would be a demand for more jobs.

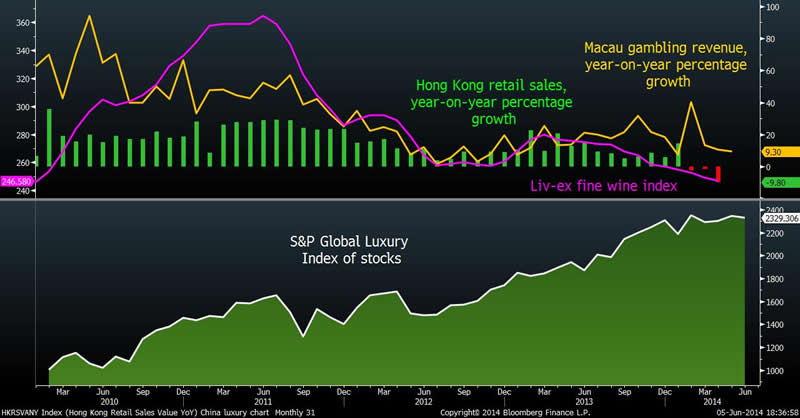

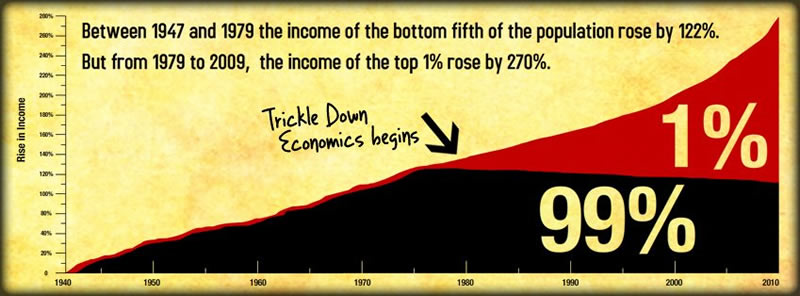

We certainly need to do SOMETHING because, as you can see from the chart above, China's spending patterns are falling off dramatically. Surprisingly, the money their Central Bank is pumping into the bank accounts of the top 1% isn't trickling down to the bottom 99% and even the top 1% are starting to cut corners because – SHOCKINGLY – when they don't hire and pay workers, the workers stop buying their goods and services.

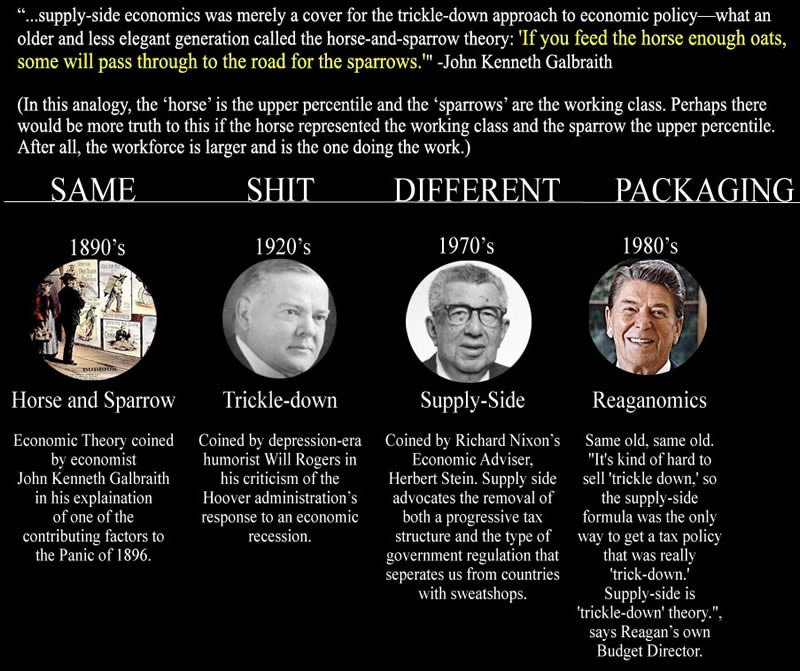

Who could have seen this coming? We thought, when you double the income of the top 1%, that they would be so thankful that they would run out give out raises to their employees and spend all that bonus money to boost the economy. That's what Uncle Ronnie told us would happen!

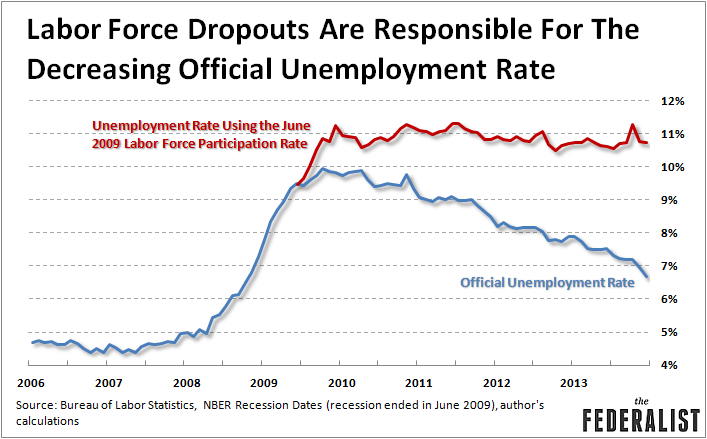

As I pointed out on the last Non-Farm Payroll Report (May 2nd), what few jobs we've been creating are TERRIBLE jobs, mostly food service and retail – ie. minimum wage jobs with little chance for advancement. Rather than accept these crappy jobs, many Americans are downsizing their lifestyles and opting out of the labor force and THAT, kids, is why we have a declining "official" unemployment rate:

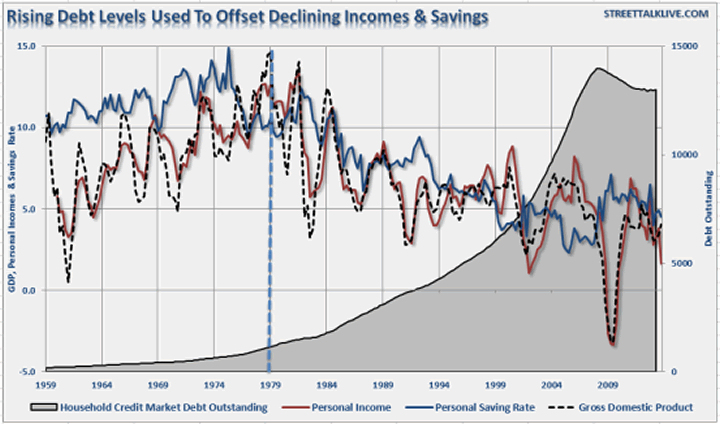

You can fake all the charts you want but the reality is there's simply less money in the hands of consumers than there used to be and the only thing driving our economy at the moment is low interest rates on homes and autos that are allowing people to stretch what little they have to the max.

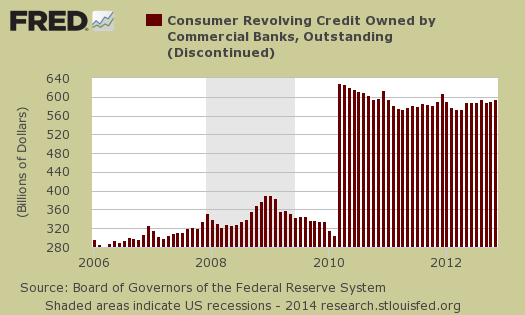

Lower interest rates have allowed consumers to double down on credit and consumer spending is 70% of our economy so it's been fun while it lasted but, as we saw from Draghi's "emergency measures" yesterday in the ECB, the wheels are already coming off that bus in Europe and quartely earnings reports are giving us the indication that US consumers may be tapped out as well.

This isn't complicated, folks – the top 1% are using their TV stations and Newspapers and Magazines to make you think that it is – but it's not. People are making less money and their savings are being destroyed which forces them to borrow more and more money from the banks (who make more and more profits – especially as they don't pass on the ultra-low rates they are getting when they borrow) until the people are what we call "wage slaves" - essentially working their whole lives just to try to pay off their debt:

This CAN'T go on forever. When it will end is the question. If rates reverse and trend higher, it can end very quickly – that's what our Central Banksters are so worried about. They need those consumers to keep making those payments to the banks they owe money too or the top 1% may actually suffer – and there's just no way we can allow that to happen!

6-5-2014 3-20-33 PM Draghi TepperSo, for now, the Fed, the ECB, the BOJ, the PBOC will do whatever it takes to prop up the economy and keep the money flowing to the top 1%. For their part, the top 1% will convince you not to tax their massive earnings so they can sock it away ahead of the invevitable collapse, when they'll need that cash to foreclose on everyone's home. So – long on lawyers, I suppose…

Meanwhile, the markets are having another free money party, courtest of Draghi and the ECB (and blessed by David Tepper, who says it's all fixed now), but a closer reading of Draghi's action yesterday shows little of substance – just a lot more empty promises of actions it's not entirely clear that he would be authorized to take. As noted by Dave Fry:

Later in the day Appaloosa Hedge Fund founder, David Tepper, threw gas on bulls' fire by appearing on CNBC to promote previous market “dangers” had passed given the ECB’s actions. This allowed bulls to jump in markets with both feet since many investors had been feeling left out of the rally. A little history indicates that Tepper had become the designated hit man for the CNBC faithful who hung on his every word.

Two years ago, he famously argued that investors had little to worry about since “bad news was good” meaning the Fed had their backs. Recently he had expressed fears markets had become dangerous. But with the ECB’s actions, dangers had passed and the way forward was clearly higher (Oh, to be able to talk your book on TV and reliably watch your existing holdings rise in value.)

LOL – There's a good reason we chose to sit out this week. We pressed our shorts into the weekend and we'll see what sticks early next week and, if we're wrong – then we'll be happy to open our Buy List and join in the frenzy. Until then – it's fun to sit back and watch the madness of the crowds.

Have a good weekend,

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.