Stock Market at a Minor Top?

Stock-Markets / Stock Markets 2014 Jun 23, 2014 - 01:07 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected, there will be another steep decline into late 2014. However, the Fed policy of keeping interest rates low has severely curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - May be tracing out an ending diagonal pattern.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

AT A MINOR (?) TOP

Market Overview

Most likely Friday marked the end of the move which started on 5/15 at 1862, but it is also possible that we are about to correct the entire phase from 1815. Either way, one should be prepared for a correction of at least minor status. It would probably take a technical miracle to keep this uptrend alive beyond Monday.

Why is this practically a certainty? To begin with, the daily indicators are in their worst technical condition since March/April and they could even be compared to last December's. At the same time, the hourly indicators are also in a poor technical condition. This comes at a time when the 1962 P&F projection (which has been mentioned previously a couple of times) has been reached.

The structure also looks complete for at least a minor top and perhaps even a little more. Only future price action will clarify the phase structure that is being completed.

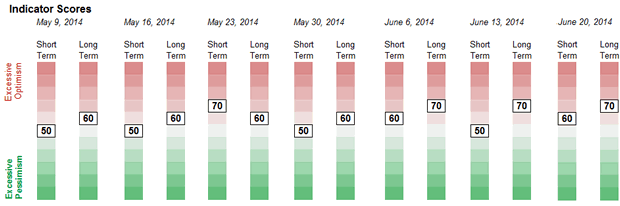

But the sentiment readings are what put the above in context. On Friday, the SentimenTrader closed at 70 for the third consecutive week. Late last December, before the January correction, it had the same reading. Also on Thursday, the P/C ratio closed at 57.9, a fraction lower than its 58.2 reading of last December 31st.

Whatever top we make here will definitely not be the top of the bull market and it would be premature to call this the high point for 2014. We will have to wait and see what kind of correction unfolds and what type of recovery follows.

Let's look at some charts.

Chart Analysis

The weekly technical picture is only barely negative, but a correction of a week or more would most likely turn the weekly oscillator down and increase the negativity of the weekly technical picture. We'll come back to it when this happens.

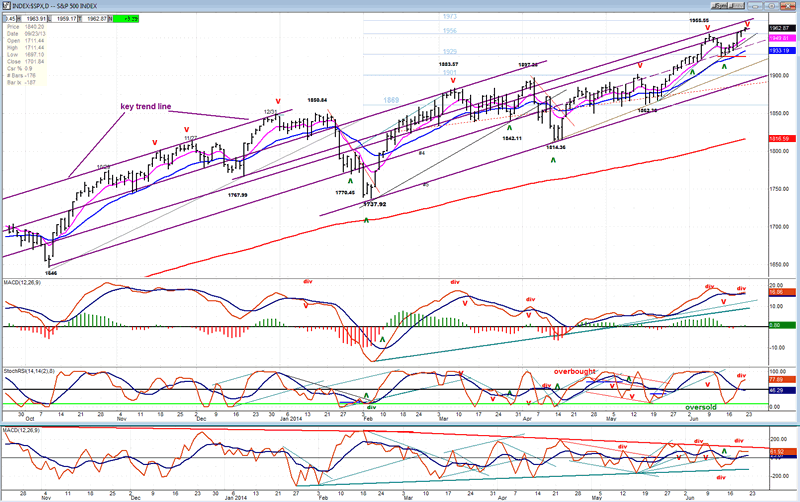

For now, let's go to the SPX daily chart (courtesy of QCharts.com). Some time ago I discussed the value of using parallel trend lines to mark support and resistance points in technical analysis. The purple lines that I have drawn can be considered to be defining the intermediate trend since the longest one starts in November 2012, at 1343. All lines are drawn from previous short-term lows except for the very outside line which connects four tops between September and December of last year and is the key trend line from which all others are drawn as parallels.

Prices are pulling away more and more from the original line and this illustrates the mild trend deceleration which is taking place in the index. The two recent tops were caused by the second and third parallels. The fourth briefly contained prices in the current phase from 1814, but prices were eventually able to rise above it. If we get the type of correction that I expect, these lines may not be tested again in the future. Most likely, the next move will be toward the lowest line which, if reached, should act as support.

Now that we have identified the top resistance, why do I think that prices will decline from that level? If you look at the indicators, you will immediately see the reason why. All three are showing negative divergence. However, the fact that there is still so much strength in the MACD makes anything more than a minor correction doubtful, unless we see severe, instead of mild, weakness developing.

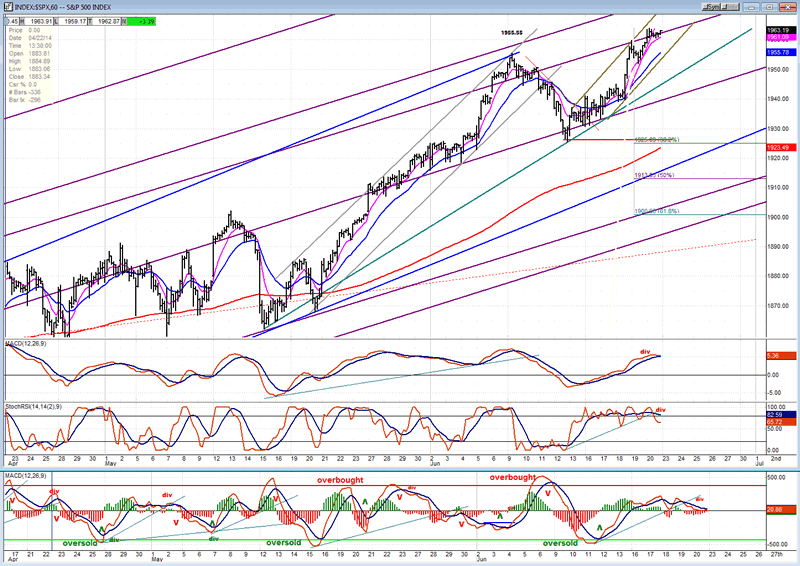

In the hourly chart we also see strong evidence that we are at a top. With weakness showing in the daily indicators, the condition of the hourly oscillators leaves little doubt that a correction is imminent.

The purple lines which appear here are the parallels discussed in the daily chart. I have also added some more conventionally drawn trend lines, such as the blue lines which make up the channel of the entire phase from 1814 and which has two points of contact on both bottom and top channel lines. There are also two grey lines which frame the steep price rise, and a smaller channel which should be defining the final up-phase. We can assume that the index will start reversing when it comes out of the bottom of that small channel, with the reversal being confirmed when the green trend line is broken. Support could come from the purple line, but the index should retrace to one of the levels indicated on the chart (.382 - .50 - .618). If we are correcting the entire phase from the 1814 low, we should retrace even lower.

Glancing at the oscillators, you can see that, like the daily ones, all three are showing negative divergence and have even started to roll over. This is why I believe that the odds strongly favor a reversal from the 1963 level.

Cycles

From last week: "After the 6-wk cycle, which is now in a downtrend and scheduled to make its low in a couple of weeks, the one which may influence the market the most is the 22-wk cycle which should bottom about two weeks later. The current cycle configuration definitely favors a continuation of the correction, perhaps even into the middle of July."

Helping to reverse the trend, the 4-wk, 6-wk, and 12-wk cycles are all due to bottom next week with the 10-wk and 22-wk due another two weeks afterward.

Breadth

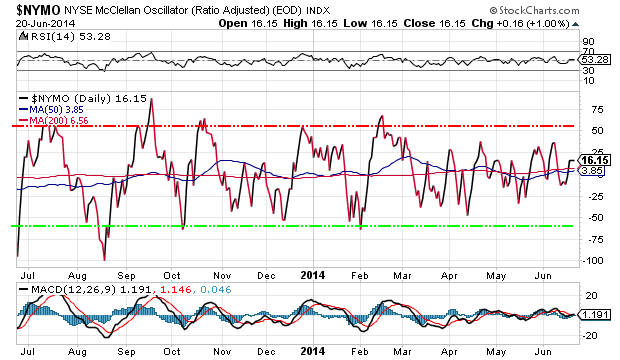

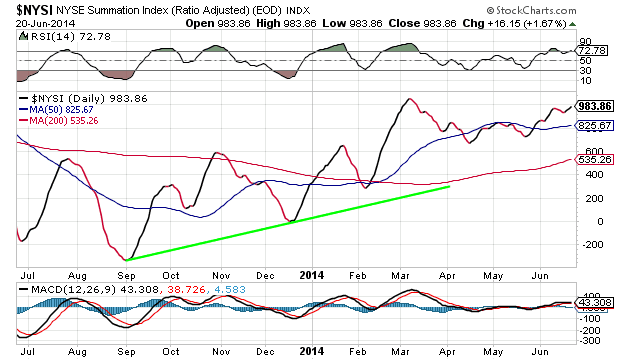

The McClellan Oscillator and the Summation Index appear below (courtesy of StockCharts.com).

At 16, the McClellan Oscillator is barely positive and it is well below its previous high, while SPX made a new high. This is the same negative divergence that we already observed in my daily chart (above).

Nevertheless, by being positive it has caused the NYSI to increase marginally -- not enough to nullify it negative divergence -- and kept the RSI at an overbought level.

Sentiment Indicators

"The SentimenTrader (courtesy of same) long term indicator remains at an elevated reading of 70 for the third consecutive week. Considering the technical condition of the market -- especially of the A/Ds -- the risk of a correction has increased.

VIX (CBOE volatility Index)

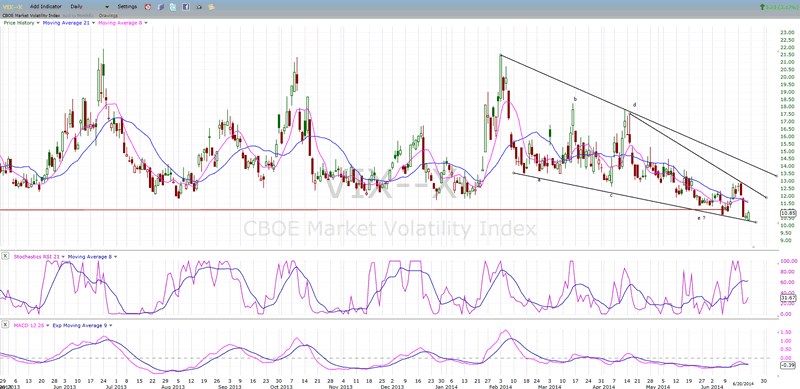

On Friday, VIX made a new 5-yr low. If the market has made a top of some kind, it should now turn up. The high degree of complacency could be dangerous for the market. Other than that, the chart pattern is a wedge formation which could also imply a negative outcome for market prices.

XLF (Financial ETF)

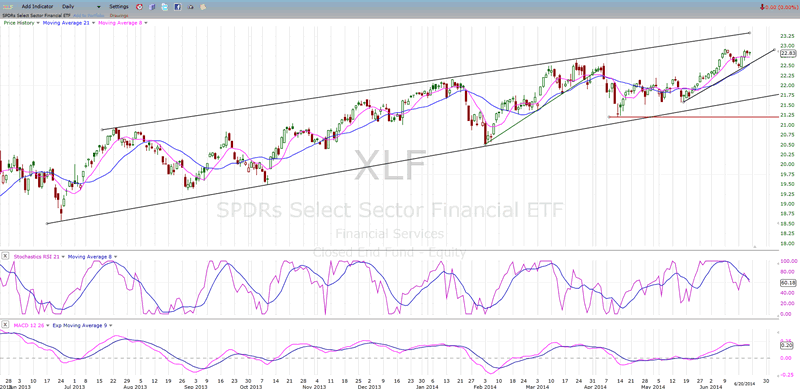

XLF's chart pattern is similar to SPX's but a little weaker. Its indicators also show that it is ready to turn down. However, the long-term trend line is still very much in place with the price still far above it.

TLT (20+yr Treasury Bond Fund)

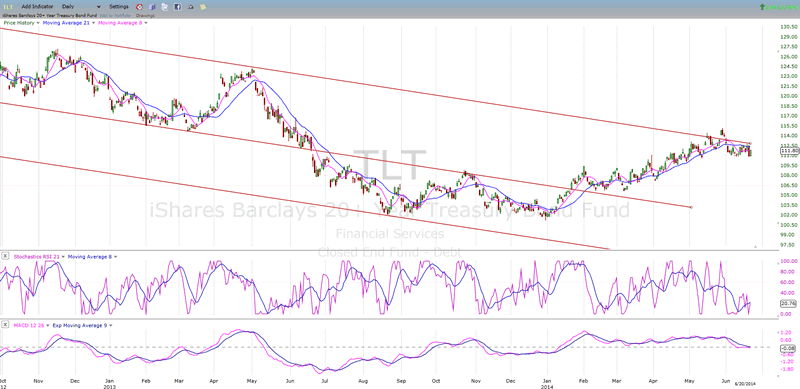

TLT is consolidating its advance just below the upper channel line. It's probably only a matter of time before it breaks through it and continues its uptrend. Its oscillators have corrected and may be ready to signal another short-term buy.

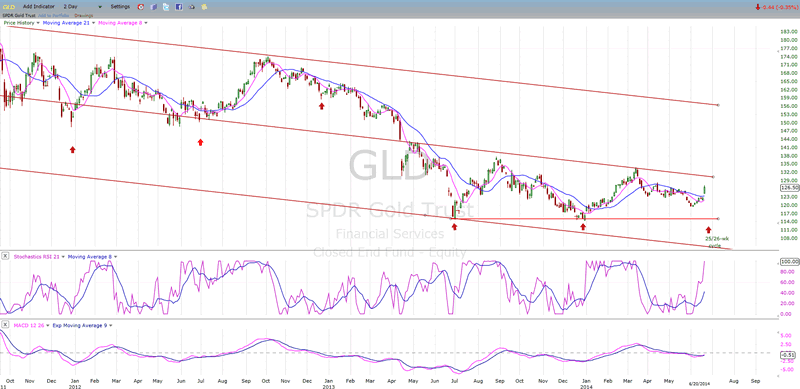

GLD (ETF for gold)

"GLD is in the process of establishing what could be a triple bottom - which may even turn out to be a valid inverse H&S pattern. If so, the right shoulder should be (just about?) complete since GLD is now in the vicinity of its 25-wk cycle low. With this cycle ready to turn up, it has an excellent chance of rising above its 200-DMA and breaking out of its downtrend. A move above 130-135 in the early part of the cycle's up-phase could lead to a substantial price increase, since the past year was used to build what could be an important base."

Thursday, GLD gapped open and closed well above its 200-DMA. It looks as if the cycle has already made its low and started up. GLD has established a base which could initially take it to the mid-140s.

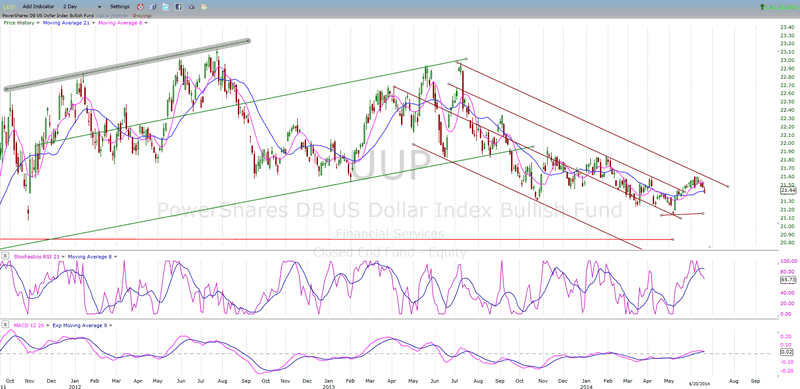

UUP (dollar ETF)

Now that GLD is apparently breaking out under the influence of its 25-wk cycle, I would expect UUP to do the opposite. That could very well mean a new low for the index.

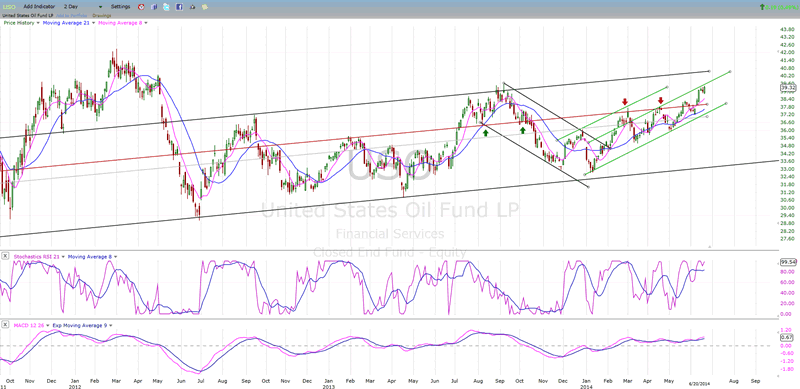

USO (US Oil Fund)

In spite of the strong Iraq-induced rise in oil, USO does not appear to be making a very aggressive move. It has established a bullish (green) channel, but it is having problem overcoming the mid-channel line resistance. Still, as long as oil is positively affected by the upheaval in that part of the world, I would expect it to continue a moderate uptrend. If things should start to settle down, it should quickly begin to retrace its upward path.

Summary

It took another week for the top formation to ripen and, if my indicators can be trusted, it now looks ready to pick! Besides negative divergences in all the daily and hourly oscillators, a P&F projection has been reached, and the sentiment indicators are also supportive. It certainly seems that everything is in place for a minor reversal. We can decide later if the correction wants to expand to something more.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.