Bitcoin Price Medium-term Trend Being Tested

Commodities / Bitcoin Jul 22, 2014 - 03:28 PM GMTBy: Mike_McAra

Briefly: we still support long speculative positions in the market, stop-loss at $550.

Briefly: we still support long speculative positions in the market, stop-loss at $550.

We read an interesting piece on Business Insider which brought up the ideas of Fred Wilson, founder of Union Square Ventures and a Bitcoin investor. Wilson earlier spoke for the NYC Foundation for Computer Science Education and expressed his views on Bitcoin:

(…) I got a lot of emails from people, particularly in the last few days, who said, I don't have any Bitcoin, I would have to buy the Bitcoin, it's going to take me three days for the Bitcoin to show up in my account. So I'm not going to be able to get the Bitcoin in time to make it to the event [Mike McAra: the event could only be paid for with Bitcoin]. If you had Bitcoin in your account it was simple, you just gave 1/20th of a Bitcoin and you come. So, not enough people have it.

(…)

One of the real issues with Bitcoin right now is that it's not that secure, and the reason it's not that secure is, it's easy to hack into people's computers, if they have a wallet on their own computer, it's easy to get in there and steal the Bitcoin. Bitcoin theft is a big issue. Bitcoin fraud is a big issue. And what will have to happen is we will need to see companies like Coinbase and others merge that can invest heavily in security. And that's both technological security, and also process security — to make you comfortable to keep your Bitcoin there. And I think that that's probably going to be first big commercial opportunity in Bitcoin, is to create secure systems. Because without that, I don't think we'll ever get enough confidence and trust in the system for people to really start using it.

We tend to agree with these points. Bitcoin is still not widely used, not matter from which angle you approach this problem. It also has gone through turbulent events stemming from lack of transparency and security. We have numerously expressed the view that the main driver for Bitcoin’s growth will be the number of people accepting the currency. Wilson correctly states that it will be impossible for the currency to really take off unless security solutions are worked out.

That’s not to say that Bitcoin is dangerous by itself. It merely experiences its own childhood diseases one of which are problems with security compared with traditional payment methods. The fact that such impediments exist is a challenge but also an enormous opportunity. If Bitcoin’s shortcomings are overcome in the future, the currency might spread across the world as a competitive payment system.

For now, let’s focus on the charts.

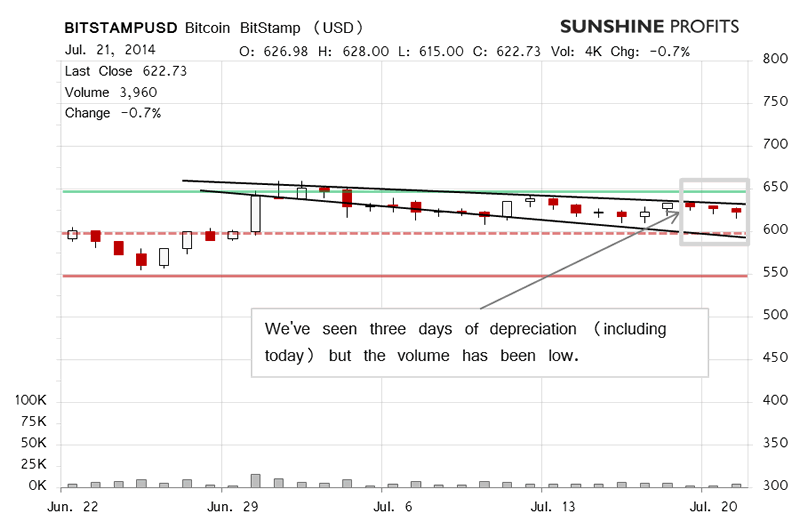

On BitStamp, we saw yet another day of depreciation yesterday but the depreciation was fairly insignificant and the volume was low. By itself, this was definitely not a bearish sign.

Today, we’ve seen some more depreciation (this is written before 11:00 a.m. EDT) but, again, the move down has taken place on low volume and the outlook remains unchanged from yesterday. This means that our recent comments are still up to date:

The recent price moves haven’t changed the short-term outlook and it remains more bullish than not in our opinion. The particularly encouraging fact now is that all the declines so far have taken place on relatively low volume. This is particularly true for the last three days (…).

The thing we have in mind the most is your performance and the above factors suggest that currently it might be best not to change one’s positions. It seems to us that adding to the longs is still not a good idea since the situation is too unclear to put more capital at risk that the usual speculative position.

One thing that might be worrying you is that we’ve now seen quite a lengthy period of declines. The move has taken place between two possible trend lines (black declining lines on the chart). We feel obliged to provide you with our take on the current situation. From and investor’s perspective, the recent declines have been weak, both in terms of price and volume. We haven’t really seen 50% of the preceding rally being wiped out and as such it is still possible that we’ll see some more depreciation but our analysis of price moves in light of the volume levels brings us to the conclusion that the recent moves are not representative of the general direction in which the market is headed. Consequently, having your returns in mind, we are of the opinion that closing long speculative position is not a good idea at this time.

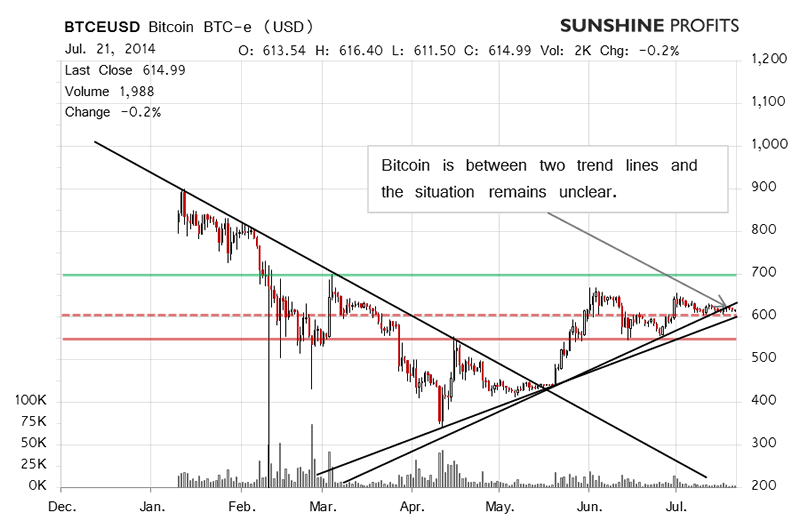

On BTC-e, we’re seeing Bitcoin between two possible medium-term trend lines – below one but above the other. Because of that, our yesterday’s comments are still valid:

The long-term BTC-e chart is slightly less optimistic. We see that the exchange rate has gone down below one of the possible medium-term trend lines but is still above another. This suggests that the prospect for Bitcoin might have deteriorated. What we ask ourselves is: “Have they deteriorated significantly?” The answer to this question is: “No, they haven’t.”

Bitcoin is still above the other trend line and this makes a possible breakdown very much dependent on perspective. But there is also the indication coming from volume, which has been low so far, that the current moves are not very significant as far as the direction of the market is concerned. Taking this into account, we think that Bitcoin might as well temporarily go below $600 but this could be followed by a more decisive move up.

The current situation might have become slightly more risky but we still are of the opinion that the current environment favors a more significant move up.

The medium-term chart suggests that the situation is becoming increasingly tense, in spite of the fact that the volume hasn’t been particularly pronounced recently. Once again, thinking about your returns and potential positions, it seems to us that keeping long speculative positions might be a good idea.

Summing up, in our opinion long speculative positions might become profitable in the future.

Trading position (short-term, our opinion): long, stop-loss at $550.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.