What's With the Japanese Yen?

Currencies / Japanese Yen Sep 09, 2014 - 02:59 PM GMT The Yen has morphed into a different pattern than I had originally portrayed. Not that there weren’t clues already there, but the first Triangle formation threw me off, thinking that the decline in the Yen was complete on January 10, 2014. Usually Triangles occur in fourth waves. However, they also occur in B waves.

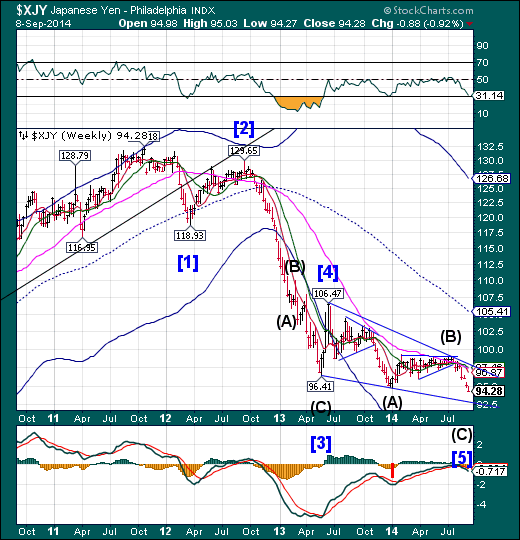

The Yen has morphed into a different pattern than I had originally portrayed. Not that there weren’t clues already there, but the first Triangle formation threw me off, thinking that the decline in the Yen was complete on January 10, 2014. Usually Triangles occur in fourth waves. However, they also occur in B waves.

This explains the reason for two triangles in close proximity. The rule of alternation says that you cannot repeat the same Wave Structure twice in a row. However, the rule may not apply here, since the first Triangle was a Minor B Wave within an Intermediate Wave (A). The second Triangle Was an Intermediate Wave (B). Thus, the rule is bypassed, since we are dealing with two different degrees of waves.

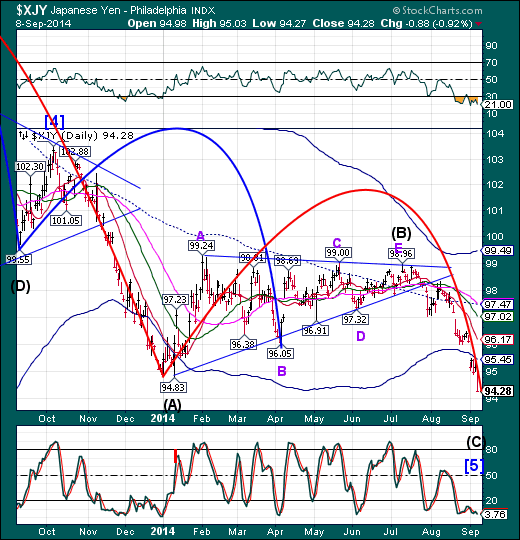

You can see on the weekly chart that the target for this Intermediate Wave (C) of a Primary Wave [5] is at or near 92.50, not accounting for a throw-under. There may be a bounce back to the Daily Cycle Bottom at 95.45 before a final thrust to its target.

The next Cycle Pivot day is Thursday, September 11 (any significance here?). This matches up with the average Master Cycle low date, as well.

The Wave [5] decline may be the direct result of money printing by the Bank of Japan to offset the declining economic conditions , most recently exacerbated by the sales tax hike at the end of the first quarter.

This, in turn, has boosted the Yen carry trade. You can see that borrowing Yen and buying SPY (according to the Bank of Japan) has paid off…so far. But the Ending Diagonal is in throw-over and appears to be in its final throes.

The reversal of the Yen will have far-flung consequences. I have been saying for quite some time that when the reversal takes place, there will be a huge sucking sound coming out of equities.

Could it be that another 9-11 attack is in the works? I don’t know. It could be any number of things.

Meanwhile, here in the U.S. the SPX performance is being muted by a rising Dollar. Of the two Orthodox Broadening Tops, the smaller one is in agreement with the Ending Diagonal formation, which has a target of 1560.33.

We are awaiting a breakdown of the SPX below 1990.00 to kick off the Panic Cycle.

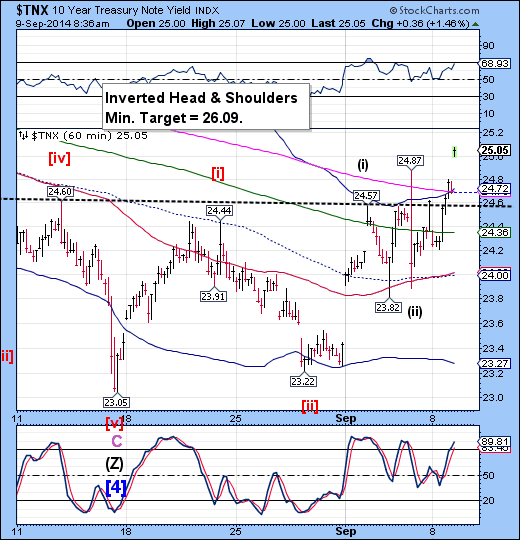

TNX finally broke above both the Head & Shoulders neckline and the prior Micro Wave b (false) breakout. Rates should continue to the Daily mid-Cycle resistance, currently at 26.37.

Things are beginning to heat up.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.