U.S. Dollar and Gold Elliott Wave Projection

Commodities / Gold and Silver 2014 Sep 16, 2014 - 06:01 PM GMTBy: Trader_MC

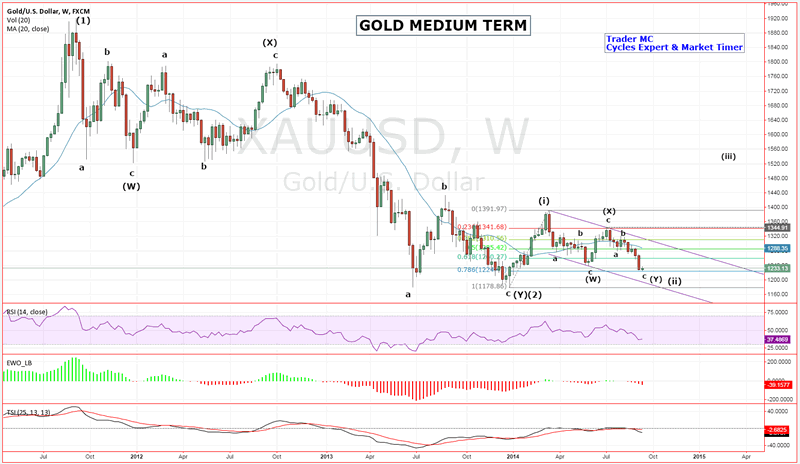

Gold is now at a key juncture and it should reveal its price action structure in the coming weeks. The first chart is my main Elliott Wave count and shows a Double Three Corrective Pattern (W)-(X)-(Y) in process from the top in 2011. You can see that Gold is currently in a corrective channel and should end soon a Wave (ii) which is also composed of a Double Three Corrective Pattern. If that scenario plays out Gold should enter a Wave (iii) that should send it to around $1550 which would be the minimum target.

Gold is now at a key juncture and it should reveal its price action structure in the coming weeks. The first chart is my main Elliott Wave count and shows a Double Three Corrective Pattern (W)-(X)-(Y) in process from the top in 2011. You can see that Gold is currently in a corrective channel and should end soon a Wave (ii) which is also composed of a Double Three Corrective Pattern. If that scenario plays out Gold should enter a Wave (iii) that should send it to around $1550 which would be the minimum target.

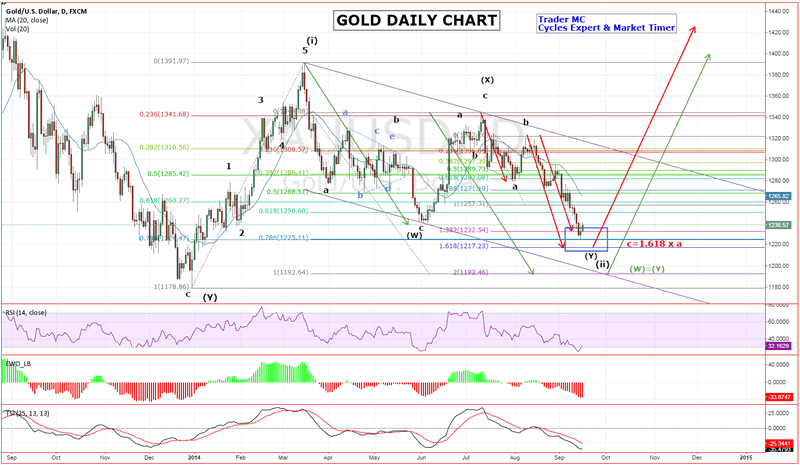

The next chart is a closer view of Gold that shows the projection of the corrective Wave (Y) within the Wave (ii). In case Wave (X) equals Wave (Y) Gold could reach $1192. Wave (Y) is also composed of three corrective subwaves a-b-c and if wave c has a Fibonacci connection with wave a (c = 1.618 x a) then Gold could reach $1217 which would be the extreme of Wave (ii).

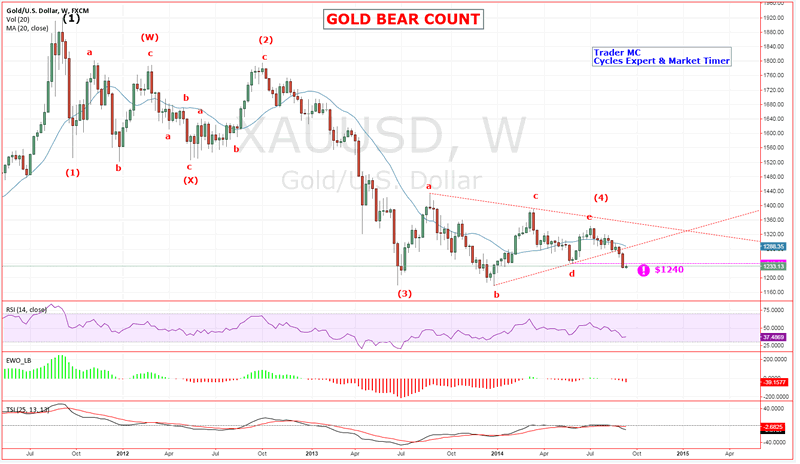

The Elliott Wave Principle prepares us psychologically for the highest probable outcome but also alerts quickly when something is wrong in case we need to change our strategy. $1178 is a key level for my main count to play out but if this level is broken I will switch to the following bear count which shows an impulsive downmove in progress since 2011 top. An impulsive downmove is composed of 5 waves and Gold could currently be in the final Wave 5 as it broke down of a corrective Triangle Pattern which is characteristic of a Wave (4) (price action just broke down below point d at $1240).

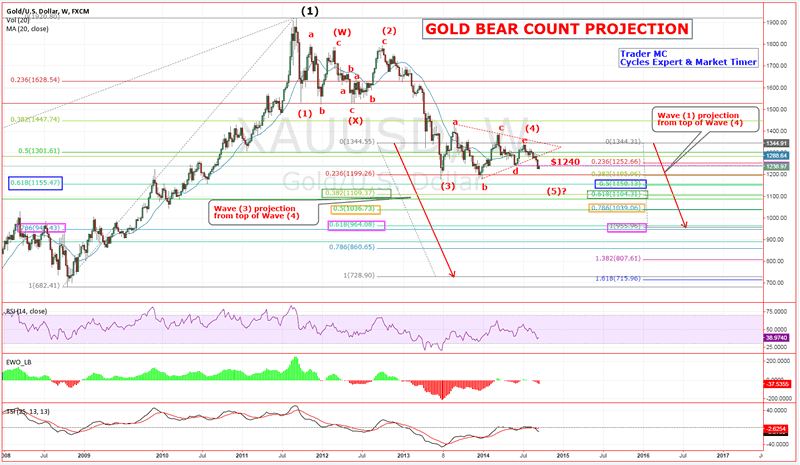

If $1178 is broken we should see an acceleration move to the downside for Wave 5. On the following chart you can see different targets for Wave (5) using a Fibonacci projection of Wave (1) and Wave (3) from the top of Wave (4) as Wave (5) has usually a Fibonacci relationship with these waves. If this scenario plays out, the first possible target would be $1150-$1155 as it corresponds to 0.618 Fibonacci level from the low in 2008 to the top in 2011 and it also matches with 0.50 Fibonacci level of Wave (1). The second possible target would be around $1104-$1109 as it matches with the Fibonacci numbers 0.382 of Wave (3) and 0.618 of Wave (1). Lastly you can see that the next Fibonacci convergence zone targets are $1036-$1039 (0.50 of Wave (3) and 0.786 of Wave (1)) and $947-$964 (0.618 of Wave (3) and Wave (5) equals Wave (1)).

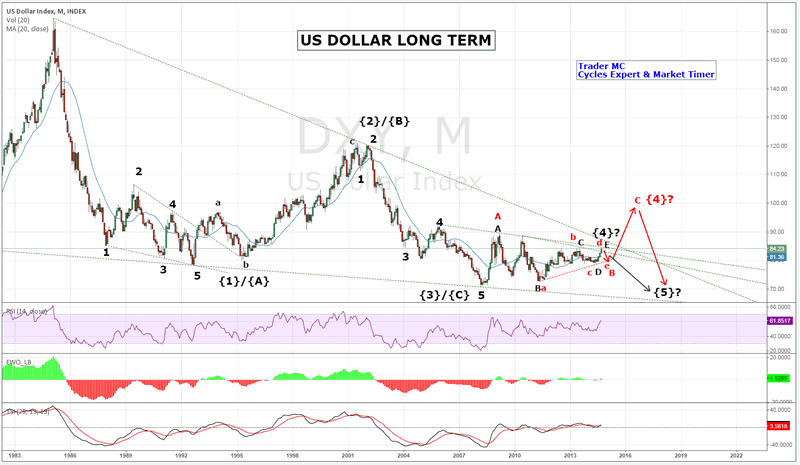

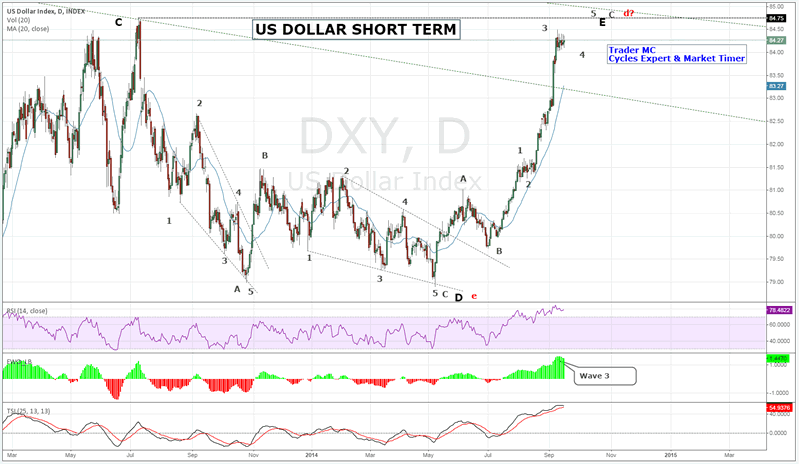

It is also important to keep an eye on the Dollar structure as the Dollar Index has usually an inverse relationship with Gold (except in the 80′s when central planners did not create trillions of free dollars). The following chart is the US Dollar big picture. You can see that the Dollar is in a 30 years Wedge Pattern and has been forming a Triangle Pattern these last 5 years. This Triangle Pattern should be completed soon and a breakout either to the upside or to the downside should be very telling for the Gold Market structure.

The current Wave (E) or d of the Triangle Pattern is composed of 3 corrective waves A-B-C and the Dollar Index should make soon a final Wave 5 up before reversing to the downside. The Dollar is also approaching key levels for its market structure.

Gold price is currently between $1192 and $1240 which are key levels. Patterns change with the psychology of the market and it is important to adjust in real time. The Gold market structure should reveal itself very soon, we just have to be patient and let the market come to us.

Trader MC

Company: Cycle Trader MC OU

Web site: http://tradermc.com

Email: contact@tradermc.com

My analysis covers different assets – Market Indexes, such as US, Europe, Emerging Markets, China, Russia etc., Commodities, Currencies (Forex Trading), Bonds and Rates. In addition to the Markets Updates for MC Members, I also post real-time Trading Alerts for MC Leveraged Members for a more aggressive strategy in all the sectors. Besides the market analysis, this site also contains Cycles Count Updates for all Market Assets, including the Forex Market.

© 2014 Copyright Trader MC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.