It’s Inflation All the Way, Baby!

Economics / Inflation Oct 09, 2014 - 03:49 PM GMTBy: Gary_Tanashian

The title’s quote is one of many eminently quotable messages I had the pleasure of receiving over a few years of contact with a late, great and a very interesting man* named Jonathan Auerbach, who headed a unique specialty (emerging and frontier markets) brokerage in NYC called Auerbach Grayson.

The title’s quote is one of many eminently quotable messages I had the pleasure of receiving over a few years of contact with a late, great and a very interesting man* named Jonathan Auerbach, who headed a unique specialty (emerging and frontier markets) brokerage in NYC called Auerbach Grayson.

Jon was an honest and ethical man. He was also a gold bug (in that descriptor’s highest form) who innately understood the Kabuki Dance that has been ongoing by monetary authorities since the ‘Age of Inflation onDemand‘ (what guest poster Bruno de Landevoisin calls the Monetized New Millenium) started its most intense and bald faced phase in 2000.

Yesterday the minutes were released from the last (FOMC) meeting of official interest rate manipulators and surprise surprise, they are found to be hand wringing about the strong dollar. A strong dollar is going to take direct aim at US manufacturing among other exporting businesses, after all.

“Over the intermeeting period, the foreign exchange value of the dollar had appreciated, particularly against the euro, the yen, and the pound sterling. Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector.”

And the money line…

“At the same time, a couple of participants pointed out that the appreciation of the dollar might also tend to slow the gradual increase in inflation toward the FOMC’s 2 percent goal.”

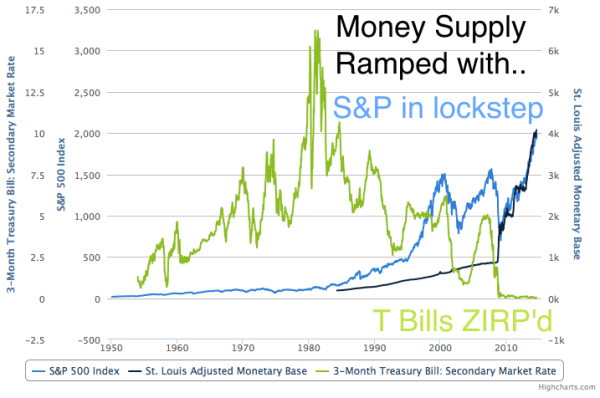

In an inflated construct (cue the chart for what seems like the 1000th time), there is no way out other than inflation “all the way”.

So while we twittle our charts and manage markets in the here and now as if we are conventional market participants, we (well I, anyway) are anything but that. What I do is have some fun along the way with graphical representations of the falseness that is the underpinning of the Age of Inflation onDemand; and the humor too. Every time the Fed rolls over on making real and sound policy and/or speaks out of both sides of its mouth the reaction is either comical or sad, depending on how you look at it. I choose both, it’s comical and sad…

“There is nothing wrong with your television set. Do not attempt to adjust the picture. We are controlling transmission. If we wish to make it louder, we will bring up the volume. If we wish to make it softer, we will tune it to a whisper. We will control the horizontal. We will control the vertical. We can roll the image, make it flutter. We can change the focus to a soft blur or sharpen it to crystal clarity. For the next hour, sit quietly and we will control all that you see and hear. We repeat: there is nothing wrong with your television set. You are about to participate in a great adventure…”

Nothing has changed since 2000, when Alan Greenspan began this most adventurous experiment in inflation. What we have had are boom and bust cycles. The current cycle has simply emboldened the worst kind of trend followers and touts in an ‘In Greenspan err, Bernanke, err… Yellen we trust!’ continuum of greed and ignorance. Today, the worst of us hold sway in promoting fantasies that newer and more gullible arrivals on the financial scene will pay for one day.

The FOMC minutes released yesterday prove that they are trying to inflate, they want inflation and that in this “monetized new millennium” it is asset appreciation above all else; especially above the saving that a chronically strong dollar would promote among the population. Saving after all, is necessary for real and sustainable economic cycles.

That is not what we have going here. What we have here is a one-way ticket to the Outer Limits or Wonderland or (pick a popular culture reference)…

* Among other things, Jon was pals with New York Dolls guitarist Johnny Thunders, attended a Mets game with Iggy Pop, was involved in the 1960’s NYC film and arts scene and even advised President Clinton on economic issues. “Did he take your advice?” asked I. “Ha ha ha… no” said Jon. Like I said… interesting. He was also NFTRH’s very first subscriber, a fact that to this day keeps me trying to live up to his standards.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.