Gold And Silver Still No End In Sight

Commodities / Gold and Silver 2014 Oct 11, 2014 - 12:05 PM GMTBy: Michael_Noonan

Miscellaneous, with a central not-so-apparent binder. Do they relate to gold and silver?

In a way, yes.

Miscellaneous, with a central not-so-apparent binder. Do they relate to gold and silver?

In a way, yes.

At the end of September, Yahoo ran a picture of Putin along side of Stalin. No too much in the way of suggestive association at play here by the media intent on pleasing the elites and federal government. The caption was what the two have in common, both from Russia certainly being one. What we know for sure is that neither ever won a Nobel Peace Prize, and neither has been responsible for inciting wars all across the globe and bombing other countries into submission, so Obomba is one-up on them in that regard, but his photo did not appear in the line up.

Question? How many countries have Russian troops on their soil? The US has maybe over 150. How many drone strikes has Russia conducted against other sovereign nations? No one has unleashed more killer drone strikes than Barack Hussein Obomba. No one. How many Islamic extremist groups has Russia trained and armed? The CIA has created, armed and trained al-Quida, and now ISIS with the intent is to create chaos in the Middle East as an indirect deflection for bringing down Assad in Syria and attempting to disrupt the flow of Russian oil and natural gas to Europe, trying to save the fast-sinking US fiat petrodollar.

~

Few Americans have ever heard of Udo Ulfkotte, a former editor of Frankfurter Allgemeine Zeitung [one of Germany's largest newspapers]. The CIA had been pimping him out to write pro-American articles for German and international consumption. He had an “aha” moment of conscientiousness when he could see how the US has been pushing so hard for war, and he had had his fill of lying for the US government. There is an article and clip from RT News, but do not be put off by the news source. No US media would ever give it coverage. It is interesting, especially for Americans who do not get any or much news outside of elite-controlled mainstream news.

Lest anyone think the story lacks credibility, we did an article a few weeks ago of a US journalist who refused to cooperate and, in fact, wrote an expose on the CIA employing journalists in this country, [Do You Trust The Government, Or The Media?]. The movie, Dark Alliance, is due out soon.

~

Who put the TSA in charge of groping Americans, including the handicapped, the elderly, and children from toddlers to teens? In every other aspect of American society, children are a special class and are to be protected. The federal government does not see it that way. Obama is responsible for that. There has never been a single incident in U S airports to justify the personal abuse and onslaught against rights. Other airports around the world where terrorists are more likely to strike do not have the same kinds of unnecessary security as does the US, but it serves a purpose here. Psychological control and conditioning to keep citizens subservient to the increasingly militarized government.

Ferguson, Missouri is an example of the direction this country has taken, and as night follows day, expect to see the militarization of all police, more control given to the TSA, more clamping down by Homeland Security [it is NOT your Homeland being secured… the homeland is the corporate federal government that is to be protected at all costs].

~

The US wars in Iraq and Afghanistan cost $6,000 billion, and counting, as compared to the $738 billion spent on the Vietnam War. There are certain factions in the Western world that are the sole financial beneficiaries of creating war[s].

The United States has been in a perpetual “state of war” since WWII. During times of war, constitutional rights are suspended, a fact of which few American are aware.

~

Here is something to which many Americans can relate. To learn how corrupt the United States government has become, just follow the money. According to the most recent Federal Reserve Flow of Funds report, US households currently have an all-time high $82 trillion in overall wealth. However, that wealth is not evenly spread around. If it were spread out evenly, every US household would now have $712k. As of the end of 2013, the median household only had $56k in wealth. From 2007 – 2013, overall wealth increased 26%, while the median household lost a shocking 43% of their wealth. If median wealth continues to decline at this rate, over 50% of US households will be bankrupt within the next decade. Next time, listen closely to Obama as he tells you how well the economy is doing. Then compare his empty words to the facts of reality.

~

The US knows two things and two things only, exporting debt and war. The rest of the world has reached the end of their tolerance level as the US continues to lose respect and support from what were once considered staunch allies. Everyone knows what has happened to Greece, Cyprus, Ireland, and a host of other countries on the brink on insolvency. All of these countries were financially weak and politically vulnerable to the unelected officials from the EU who are dictating to these once sovereign nations. Those financially weak were stuffed with more impossible to repay burdensome debt. Other counties, particularly of the Muslim persuasion, have been facing war endless bombing, and the devastation of their countries, either in the service of US control of the drug trade and the wealth it brings, or in the service of applying pressure to Russia.

~

Take Germany, for instance, the de facto 53rd state of the United States. Germany has had to make some choices recently: agree to side with the US and support sanctions against Russia over Ukraine, or not. By allying with the US, Deutschland is faced with unlimited amounts of debt and increasing risk of war. By Germany not sanctioning Russia and maintaining its economic ties, instead, it had potential unlimited economic growth. Frau Merkel chose to side with the US and the unelected parasites from the EU and go along with the sanctions pushed so hard only by Obama and no other country.

In so choosing, Merkel has put at risk over 300,000 German jobs. There has been a 25% decline in new car sales, 8.8% less capital goods were produced, factory orders were down by 5.7%, and industrial production declined by 4%, recently. There are around 4,000 German companies that do business with Russia, and there are also many financial ties between Germany and China. Germany chose to suffer economic decline over economic growth in order to support sanctions against Russia that are not working, and in fact are working against those countries participating in the sanctions.

It is hard to believe Germany will continue along the path of decline along with the US descent into Third World Status. If not Merkel, sooner now, rather than later, the German people will say, Enough! When that happens, it will be the US/UK standing [sinking] alone as the rest of the Western world, maybe except Poland, decides sovereign-death- by-US-debt is not the way to go.

~

Ebola. Americans have to be body searched at airports, cannot bring bottles of water on board, and a host of other absurd but harmless rules, but hey if you have the Ebola virus, bring the patients to America on board flights. No problem, says the federal government. “We have everything under control.” Why risk and allow people exposed to this deadly virus into the country? From that non-Ebola infected state, Connecticut, its citizens are now now subject to martial law where people can be detained for no apparent Ebola reason than “just in case,” and detained for any length of time, without recourse to rights or any trial. How New World Order of Connecticut to take pre-emptive measures and shred the Constitution and all Rights for its residents. Coming soon to a state near you! Us motto: Never let a good disaster go without taking advantage of the people.

~

What is the binding factor in these events? All have the fingerprints of the elites going about whatever way necessary in order to destroy social order and bring about total New World Order control over a Single World State. Taken individually, there would seem to be no apparent tie, but all Western world events are tied to elite domination.

The fact that the New World Order continues to move forward, unimpeded by any nation, to date, tells you how suppressed control over the price of gold and silver is so readily accomplished, irrespective of China and Russia’s massive accumulation of both metals.

The end of the story is inevitable, at least for the US as a failed nation that wrecked its own economy and those of many other countries, all in the service of perpetuating a fiat currency Ponzi scheme devised and implemented by the Rothschilds. No nation has ever escaped from or triumphed over a fiat paper economy. What so many are now discovering, and is the point of this article, is that it will take much longer than most ever expected before gold and silver will emerge as winners over a failed system. All of these seemingly unrelated events are examples of the hidden but absolute control exerted by government forces carrying out the orders of the money controllers.

Have gold and silver seen a bottom yet, and is there a turnaround soon in the cards? No, and no. The realization that the Shanghai Gold Exchange has not had the impact of “truth in gold pricing” many expected, should come as no surprise. It is still business as usual as gold and silver languish around recent lows. There is no date one can mark on the calendar that points to an end of the Rothschild dominance over Western fiat currencies and their suppression of the anti-dote to all fiats, gold and silver.

We reported Switzerland is due to hold a referendum on expanding the % of gold as a backing to its once stable currency. The Swiss central bank came out opposed to any such notion as it would restrict the central bank’s ability to issue more fiat, and it would make Swiss bankers more fiscally responsible, an impossibility for them. If ever there were an example of getting out from under the Rothschild fiat thumb, this would be such an opportunity. It will likely go the way the Scottish referendum did: A fixed “No” vote.

All one can do is to keep holding and keep buying as much as one can, suitable to their financial circumstances, and wait. There really is no alternative, and complaining about it will not bring the day of fiat reckoning any closer.

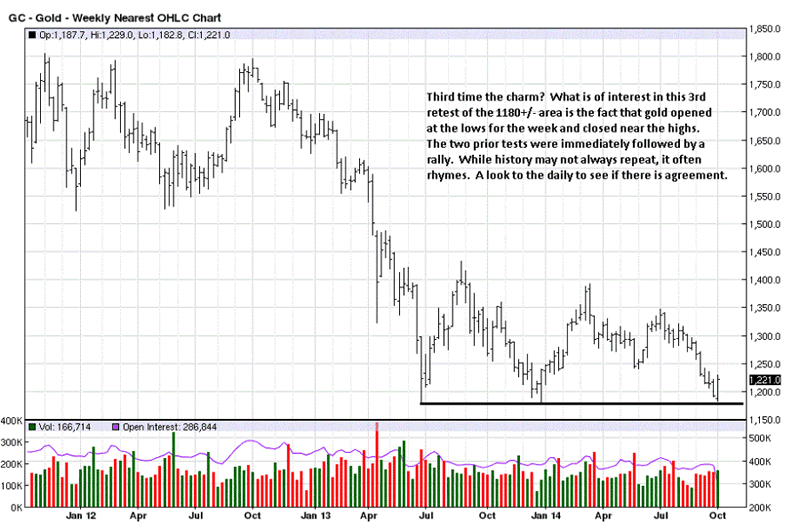

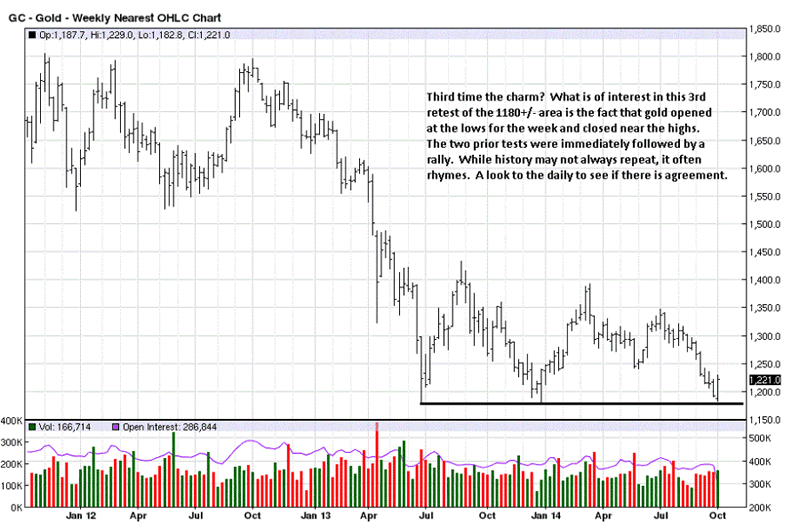

Weekly gold has hit important support for the third time since the 2011 highs. There was an immediate rally following the previous two tests, and it would seem one will follow this one. There is a more positive sign on last week’s retest, for it is the only retest where price opened near the low for the week and closed relatively strongly.

Many want to be the first to call a bottom, and almost all of those “many” have already called for a bottom, some more than once, but we will not likely be among them. We prefer to follow developing market activity, and let it determine when a bottom is final. The realization of a bottom can take days, often weeks to confirm. Those who have called bottoms in the past few years never had the patience to wait for confirmation, which never came, obviously.

Agreement between time frames is important, so after last week’s key reversal low, a look at the daily chart is in order to se if that time frame supports the weekly activity.

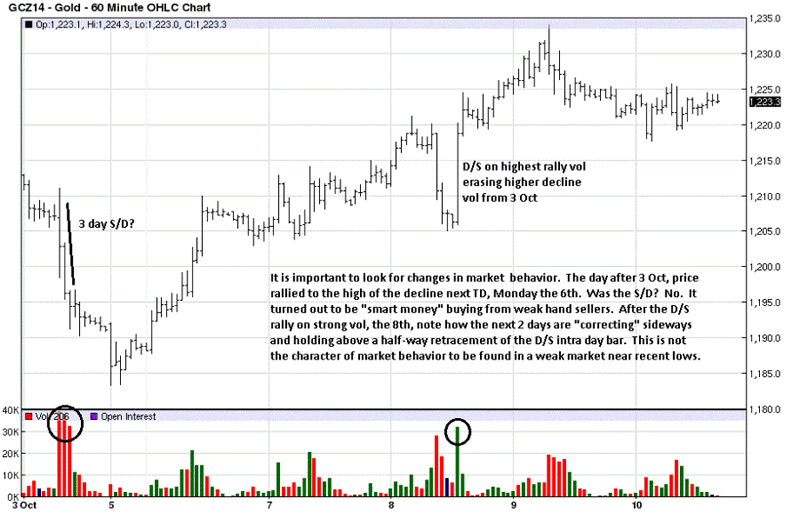

The chart comments are apt. Wednesday’s high volume red bar, [indicating a close lower than the previous day] is noteworthy because increased effort to sell did not lead to more selling. If that were the case, then the apparent selling is more likely smart money buying from weak longs and short-term profit-takers who bought lower.

It seemed the activity from last week looked mixed but could be stronger than it seemed, so a look at an intra day chart could add to the read.

Three things stand out, in order, and their order demonstrates the necessity of waiting for confirmation of one form of activity followed by another. We start with the S/D from the previous Friday, 3 October. [S/D = Supply over Demand, denoted by an EDM {Ease of Downward Movement}, a wide range bar on increased volume that closes low-end.] By Friday’s poor close, it “looked” like there was more downside to follow, and that would be a logical assessment.

By the end of trade on Monday, the previous Friday’s losses were retraced. There was no confirmation that Friday’s sell-off would lead to lower prices. A few days later, on the 8th, there was another strong volume move lower, intra day, but it stopped at the developing support area of 1205, and a fast reversal developed on even stronger volume, a D/S bar that totally erased the sell-off from the 3rd.

What can be said now of the activity from the 3rd, which was not apparent at the time, is that the S/D was really strong hands buying everything offered from weak longs, sell stops, new shorts, etc. This is an important piece of information because we now know that area, 1210 – 1195 will be defended as support rom those who were buyers.

Adding the D/S market activity from the 8th strengthens that new read of market activity, and the 1205 area should be watched closely as future support. It also explains the artificially set closing price at the low of the bar, when in reality, price closed near the high. This would be a minor example of persistent price manipulation by the banks in charge of setting prices for gold.

The seeming weak upside rally attempt and less than strong close looked like buyers had lost the ability to move price higher, but with last Friday’s activity added, both days stayed above a 50% range retracement of the D/S high volume bar of the 8th. This indicates a sign of strength, at least for the short-term, in an otherwise down market environment.

It is not that these price points are necessarily inviolate over the next several TDs [Trading Days], but they are important point to watch for HOW price reacts to them in the future. For example, if a correction were to hold at the 1205 area, it would then confirm what was observed back them. If price declines easily through the 1205 area support, it then erases the potential significance of support there.

The conclusion is that gold has responded positively over the last several TDs. Now we need to see some successful retesting and holding at these observed levels.

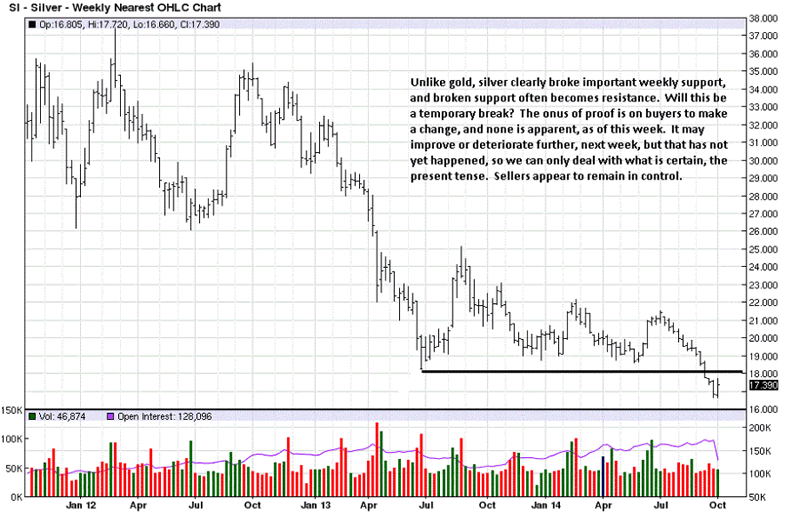

Silver is a different read, lacking the positive elements discussed in the gold charts. We need to see buyers be able to create strong volume and strong close bars to the upside. Just as one swallow does not a summer make, one reversal bar does not a trend change make.

Not much can be said of silver until there is evidence of buyers taking a stand and overcoming the effort of sellers. In fact, silver remains in an oversold condition, so one cannot be very bullish about a market in a down trend and oversold within such a trend. It does not speak of any strength.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.