Annuities - Afraid Your Money Will Vanish before You Do?

Personal_Finance / Pensions & Retirement Oct 23, 2014 - 04:30 PM GMTBy: Casey_Research

By Andrey Dashkov

By Andrey Dashkov

Unlike Jack Nicholson’s character in A Few Good Men, we trust that you can handle the truth. No matter your age, securing a comfortable retirement is a huge concern. Folks want the whole truth about their financial outlook, but straight answers are hard to come by.

Both sides of the mainstream media habitually present opinion-tainted partial facts. Case in point: the unemployment numbers announced earlier this month. One side is cheering because unemployment dropped to a six-year low, while the other side is calling it pure fraud.

I found author and libertarian-about-town Wayne Root’s remarks in a recent article for The Blaze particularly telling:

The middle class isn’t getting richer, it’s getting poorer…

The only people being hired are your grandparents. 230,000 of the new jobs went to those in the 55-to-69-year-old age group. In the prime working age group of 24 to 54 years old, 10,000 jobs were lost…

It means grandma and grandpa are desperate and willing to take grandson’s low wage job to survive until Social Security kicks in. The US workforce is now the oldest in history. And if grandpa has to work (out of desperation) until the day he dies, there will never be any decent jobs for the grandkids.

Here’s the part Root gets wrong: Baby boomers are not working until Social Security kicks in. They’re working well past that point, because they feel they must. Smart boomers know they can’t afford to wait until robust interest rates return; they’re taking action to protect themselves now, lest their circumstances become truly dire.

You’re 65—Now What?

The Employee Benefit Research Institute surveys workers each year concerning their retirement confidence. Despite an uptrend, the latest report shows that 82% of workers feel less than “very confident” about having enough money to retire comfortably.

With that statistic in mind, we looked at three different 40-year retirement scenarios. Note that the numbers and charts in this overview are meant to illustrate several scenarios, not provide individual guidance. Every person’s situation differs in terms of taxes, time horizons, and other parameters, and we encourage you to work with a financial planner to manage your savings.

The data exclude other sources of retirement income you may have, such as Social Security or a pension. All of the amounts, including annuity incomes, are pre-tax.

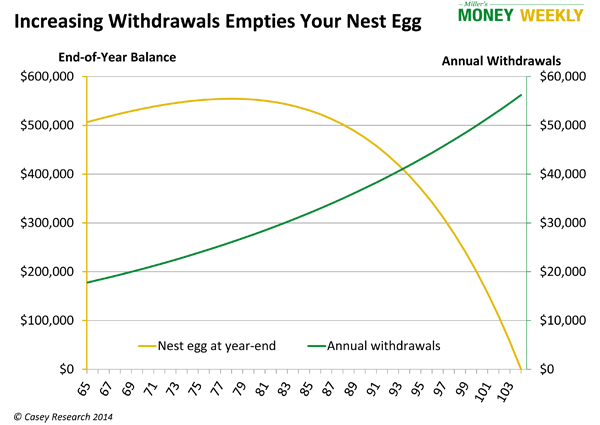

- Scenario 1. At age 65, you decide to retire with $500,000 in personal savings. You anticipate your expenses will rise approximately 3% annually. Thus, with each subsequent year, you will need to withdraw 3% more than the previous year. You estimate that your savings will grow by 5% annually. You are planning for a 40-year retirement, meaning your savings must last until age 105.

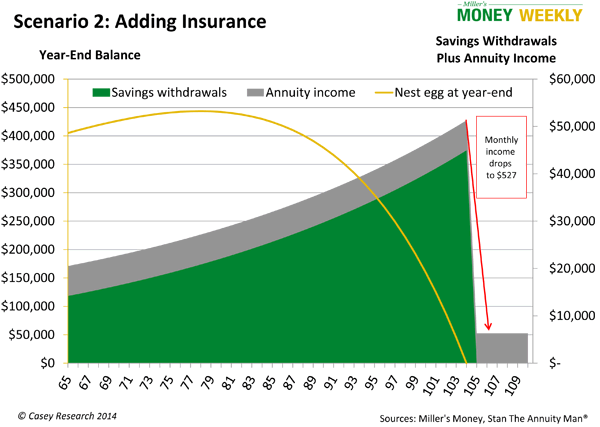

How much money can you withdraw each year, using those assumptions? - Scenario 2. At age 65 you have the same $500,000 in personal savings that you did in Scenario 1; however, you take $100,000 from your account and buy an annuity. Our go-to source for annuity information, Stan The Annuity Man, says that currently, this annuity would pay $527 for the rest of your life. You use the remaining $400,000 as principal for the next 40 years in the same fashion as in the first case: assuming the same 5% rate of return and an annual 3% withdrawal increase.

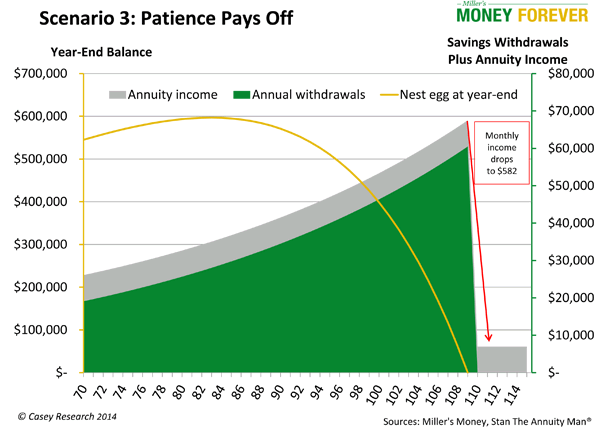

- Scenario 3. Instead of retiring at age 65, you work for five extra years and buy a 100,000 annuity at age 70. We will assume you did not add to your savings during that time (though it did earn interest). Many boomers use extra working years to eliminate any lingering debt, so they can retire 100% debt-free. (However, note that we encourage a different approach: using extra working years to save as much as possible, including maximizing catch-up contributions to your 401(k) or IRA.)

If your nest egg grew at a 5% compound rate, it will total $638,141 when you are age 70. So, excluding the $100,000 spent on an annuity, you have $538,141 to draw from. As with Scenarios 1 and 2, we’ll assume the withdrawals last for 40 years here, stretching the retirement period until age 110. Buying the annuity at age 70 instead of age 65 raises your monthly annuity payout to $582 per month.

Now, let’s take a closer look at each of these cases.

Scenario 1: He Who Takes It All Is Not the Winner

For your nest egg to last 40 years, in year one, you can withdraw $17,747, or $1,479 per month, from your $500,000 nest egg. Each year you take out 3% more to keep up with rising expenses.

Follow the yellow line representing your nest egg in the chart above. As you can see, after 40 years your $500,000 is gone.

What happens if you stay within your monthly allowance and live past age 105? Here’s hoping you have generous grandchildren. If not, you might be at the mercy of a Social Security system that may or may not be around in its current form.

There’s good reason the Bureau of Labor Statistics projects that workforce participation for people age 75 and over will rise to 10.5% by 2022, up from 7.6% in 2012. For the 65-74 age group, it projects that the rate will jump to 31.9%, up from 26.8% in 2012 and 20.4% in 2002. Better health and a sustained desire to work may be one reason more seniors are working longer, but another is fear.

61% of older Americans fear outliving their money more than they fear death. This is a fear we hope no one encounters as they near the end of the line. Other than the late George Burns, I doubt many centenarians are holding down a job.

Running out of money and having Social Security as your final safety net is a legitimate concern. Every politician, regardless of party, acknowledges the US government cannot make good on all of its promises. No one knows what the future will bring.

With that in mind, let’s move on to Scenario 2.

Scenario 2: Spreading Out Risk

Insurance companies have a range of annuities that will pay you for the rest of your life, which our team covered in detail in Annuities De-Mystified. In essence, holding an annuity as part of your overall retirement plan is one way to reduce the risk of running out of money. Since going back to work at 105 is both unappealing and impractical, let’s look at how Scenario 2—the same $500,000 nest egg with $100,000 used to purchase an annuity at age 65—plays out.

Your annuity will provide monthly payouts of $527. Using the same 40-year time frame, your monthly income from the remaining $400,000 will be approximately $1,183 per month in first year, or a total of $1,710.

You start out with a bit more money; however, the annuity payment will remain constant, with no adjustment for inflation. At the end of 40 years, your nest egg will be gone, but you will still receive the annuity payments.

There is no way to know how long you will live. Today, a man who reaches age 65 can expect, on average, to live to age 84.3; a woman, 86.6. One in ten 65-year-olds, however, can expect to live past age 95. Medical advancements are pushing those numbers up, making life after age 105 seem not too far fetched. An annuity is just one way to hedge against running out of money too soon.

One big disadvantage of an annuity is that it doesn’t offer real inflation protection. Even annuities with inflation riders usually yield marginal results.

If you receive Social Security, you can hope the annual inflation adjustments make up some of the difference, but it’s unlikely to be enough to maintain your current lifestyle. That brings us to Scenario 3.

Scenario 3: Delayed Gratification

Congratulations! You made it to age 70. The $500,000 in savings you had at age 65 has grown to $638,141 (at an annual rate of 5%). You buy an annuity for $100,000 that will pay you $582 every month until death and draw down the remaining $538,141 over the next 40 years—again assuming 5% growth rate and 3% annual withdrawal increase.

The lump sum of $538,141 will provide approximately $1,592 per month during the first year. Add the annuity payouts and your total monthly income comes to $2,174, before taxes.

In the first year, your total income, including withdrawals and annuity income, will be $26,085 compared to $17,747 in Scenario 1 and $20,516 in Scenario 2.

And although your savings will still run out after 40 years, you will be 110. By working an additional 5 years and deferring the start date you get an additional five years before you have to rely on the annuity only.

The Takeaways

This is all a reminder that the best way to enjoy retirement is to build a portfolio that can generate enough capital gains and dividend income to satisfy your spending needs, while leaving the principal intact as long as possible. If you want to end up in the 18% of people who are very confident about having enough money to retire, you may want to keep working after age 65, if possible, and invest part of your savings in an annuity to ensure you have at least some income if you outlive the rest of your nest egg.

To determine if an annuity is right for your retirement portfolio, read your free copy of our special report, Annuities De-Mystified. It includes tips for uncovering hidden fees and a frank look at the risks associated with annuities. Plus, it’s the only such report we know of written by financial educators who do not sell annuities. Access your free copy of Annuities De-Mystified here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.