Gold and Silver Subdued as Panic Over

Commodities / Gold and Silver 2014 Oct 24, 2014 - 05:47 PM GMTBy: Alasdair_Macleod

For gold and silver it has been a week of two halves: first prices rallied to a peak on Tuesday, then declined to show net losses for the week on Wednesday for silver and Thursday for gold. Broadly these precious metals reflected first weakness then strength in the US dollar. And equities reversed the nervousness of the previous week after a FOMC member suggested QE would be extended, with the S&P 500 closing up 7% on Thursday from its October 15 low.

For gold and silver it has been a week of two halves: first prices rallied to a peak on Tuesday, then declined to show net losses for the week on Wednesday for silver and Thursday for gold. Broadly these precious metals reflected first weakness then strength in the US dollar. And equities reversed the nervousness of the previous week after a FOMC member suggested QE would be extended, with the S&P 500 closing up 7% on Thursday from its October 15 low.

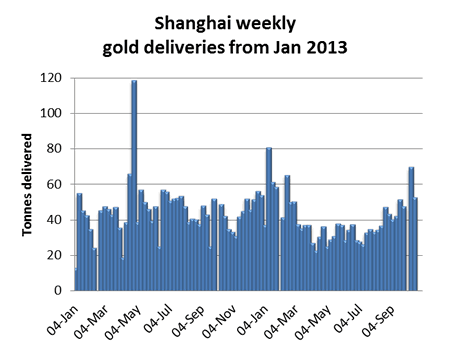

So it has been panic over for the moment in the markets and back to business as usual for precious metals. However there are signs of good underlying demand for physical gold, with the Shanghai Gold Exchange delivering 68.37 tonnes into public hands over the holiday period (two weeks with only five trading days), and a further 51.5 tonnes last week. The chart below shows gold withdrawn from the SGE this year, totalling 1,547 tonnes so far, on course for a 1,900 tonne total this year, only 300 tonnes short from the 2013 total.

There has been a significant pick-up in deliveries in recent months. Indian demand for gold has recovered as well, with the Diwali festival coming up, coupled with attractive prices. Jewellers reported demand being up about a third on last year.

An opinion poll of voters in next month's referendum on the Swiss National Bank's gold policy shows 45% to 39% in favour of requiring the SNB to repatriate its gold held abroad, maintain 20% gold on its balance sheet, and sales of gold prohibited. So far, the gold market is ignoring this startling development, but if the SNB is forced by law to comply with these measures one can imagine chaos ensuing as the SNB attempts to comply while the Russian and Asian central banks are also buying; not to mention the likely political pressure on other European central banks to do the same thing. You never know: the SNB might just be the victim of a protest vote.

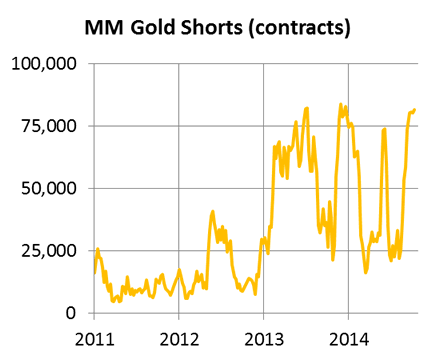

Russia continues to add to her reserves, taking them to nearly 1,150 tonnes making her the fifth largest official holder. Ignoring all this positive news of physical gold passing from weak into strong hands, the Managed Money category on Comex still has near-record short positions as shown below.

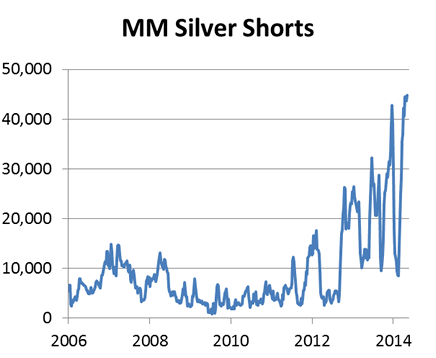

And silver shorts are even more dramatic, clearly in record territory:

The fact that public speculators are so short is strong evidence that the outlook is for higher prices on a massive bear squeeze, and not the fall in prices universally expected by the talking-heads in capital markets.

Next week

Monday. Eurozone: M3 Money Supply. UK: CBI Distributive Trades. US: Pending Home Sales. Japan: Retail Sales.

Tuesday. US: Durable Goods Orders, Durables Ex-Transport, S&P Case-Shiller Home Prices, Consumer Confidence, Federal FOMC meeting starts. Japan: Industrial Production,

Wednesday. UK: BoE Mortgage Approvals, Net Consumer Credit, Secured Lending, M4 Money Supply. US: FOMC Fed Funds Rate.

Thursday. Eurozone: Business Climate Index, Consumer Sentiment, Economic Sentiment, Industrial Sentiment. US: Core PCE Price Index, GDP, GDP Deflator, Initial Claims, Personal Income, Personal Spending. Japan: CPI Core, Real Household Spending, Unemployment.

Friday. Japan: Housing Starts, Construction Orders, BoJ Overnight Rate. Eurozone: Flash HICP, Unemployment. US: Core PCE Price Index, Employment Cost Index, Chicago PMI,

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.