Federal Reserve to Markets: You're Too Easy!

Stock-Markets / Stock Markets 2014 Oct 27, 2014 - 10:15 AM GMTBy: John_Rubino

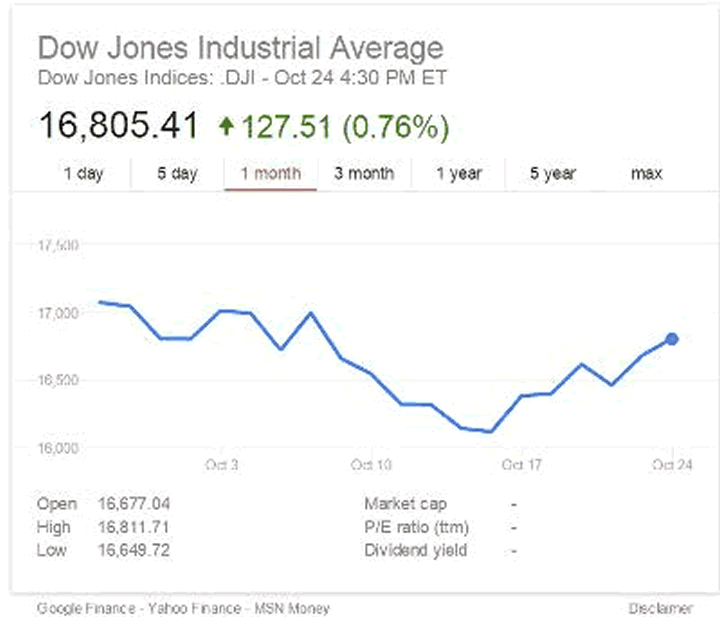

As the end of the latest quantitative easing program approached, everyone was wondering if history would repeat in the form of a stock market correction that terrified the government into another round of debt monetization. And right on cue, volatility surged in late September, sending US stocks down by about 6% by mid-October.

As the end of the latest quantitative easing program approached, everyone was wondering if history would repeat in the form of a stock market correction that terrified the government into another round of debt monetization. And right on cue, volatility surged in late September, sending US stocks down by about 6% by mid-October.

And even that tepid bit of excitement was enough to send the Fed's spinners into action:

James Bullard: Fed Should Consider Delaying The End Of QE

James Bullard, President of the St. Louis Federal Reserve Bank, told Bloomberg Television's economics editor Michael McKee today that the Fed should consider delaying the end of QE.

Bullard said, "I also think that inflation expectations are dropping in the U.S. And that is something that a central bank cannot abide. We have to make sure that inflation and inflation expectations remain near our target. And for that reason I think a reasonable response of the Fed in this situation would be to invoke the clause on the taper that said that the taper was data dependent. And we could go on pause on the taper at this juncture and wait until we see how the data shakes out into December. So...continue with QE at a very low level as we have it right now. And then assess our options going forward."

That was literally all it took. No concrete action, no pulling out the bazooka, just some regional Fed chair whom 99.9% of Americans have never heard of speculating that maybe the end of tapering should be delayed by few months. And the markets went volatile on the upside, recouping most of the previous couple of weeks' losses in a few days.

Somewhere out there a bunch of Fed suits are sitting around a conference table laughing about how easy it is to manipulate today's "investors". After a decade of artificially-low interest rates, massive debt monetization, trillion-dollar bank bailouts and who knows what other kinds of secret interventions in what used to be free markets, the leveraged speculating community no longer cares about fundamentals. Instead it's all about the flow of newly-created currency from the world's central banks. When the spigot is on, buy. When it's off, sell. This has turned out to be one of the easiest periods in financial history to run money on the "don't fight the Fed" system.

So now what? Another burst of asset price inflation that takes small cap equities and junk bonds to the moon? Maybe. The new money has to flow somewhere, and with Europe joining the debt monetization party there might soon be a lot of money indeed sloshing around a global financial system with relatively few attractive choices.

But there's a reason that unlimited money creation has never been an easy path to affluence: It only works for a short while and is inevitably followed by a period of chaos as all the malinvestment generated when money was too easy causes various kinds of crises.

In any event, the question that should be on everyone's mind isn't whether the Fed will keep QE going, but why, after five years of epic debt monetization and record low interest rates, inflation expectations are, as Ballard notes, plunging. The Keynesian answer is that $30 trillion (or whatever the true number turns out to be) wasn't enough. $50 trillion, they assert, would have returned the world to steady, sustainable growth.

For lack of another politically-marketable policy option, the "more is better" crowd will get what they want in 2015, when something will happen somewhere to scare the world's central banks into a coordinated attempt to inflate away their past mistakes.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.