Gold And Silver - Charts Show Power Of Elite's Central Bankers

Commodities / Gold and Silver 2014 Nov 08, 2014 - 06:20 PM GMTBy: Michael_Noonan

When considering Precious Metals fundamentals do not apply, and that is key to understanding how to relate your holdings of physical and/or interest in gold and silver. Nothing else matters. There are many sites that give minute details of the depletion of gold and silver stocks on the COMEX and LBMA; many that report on the demand for and scarcity of both metals; just last week, the news flash heard around the PM community on how silver American Eagles were sold out...shades of 2013-type news that dominated for several weeks. [Yawn].

When considering Precious Metals fundamentals do not apply, and that is key to understanding how to relate your holdings of physical and/or interest in gold and silver. Nothing else matters. There are many sites that give minute details of the depletion of gold and silver stocks on the COMEX and LBMA; many that report on the demand for and scarcity of both metals; just last week, the news flash heard around the PM community on how silver American Eagles were sold out...shades of 2013-type news that dominated for several weeks. [Yawn].

Consider this: everything you have heard, including information of which you have not heard but others have is already priced into the market! Compile every sort of bullish news available, and almost all of it is true, yet gold and silver hit recent 4 year lows. How are all those news events working out, and not just for fundamentalists? So far, none of this information has mattered, at least with respect to current price levels. Ultimately, all of these known factors will have an impact on price. For now, all anyone can conclude is that legitimate demand is not a market-driver.

Precious metals are being driven by one thing only: survival of the elite's world-wide fiat system, aka paper debt foisted on the public and called "money." Debt is the opposite of money, but the Rothschild fiat system has successfully been sold to the American public since the financial coup d'état by the Federal Reserve Act, when one of the world's most important and prophetic sentences ever uttered, by Mayer Amschel Rothschild, went into effect:

"Give me control of a nation's money and I care not who makes its laws"

Specie-backed United States Notes were destroyed and replaced by circulating Federal Reserve Notes, which are not Federal, for the fiat is issued by a privately owned banking cartel; there are no reserves, for as fiat they are backed only by people's imagination, which for the American public apparently has no limits; and they are not Notes, for there is no stipulation for payment of anything, to anyone, at any time. The fact that almost all people do not grasp the importance of the content of this paragraph goes far to explain why most fail to understand the power of the moneychangers to maintain total control over those living in the Western world.

The Euro Dollar is as phony as the fiat Federal Reserve Note, yet Europeans are as willing as Americans to subvert their common sense for fiat nonsense that ruins their economic lives, yet sill gives life to the unelected bureaucrats unreasonably in charge. So much for Europeans thinking Americans are not the brightest of people.

The most important piece of news for PMs last week was not the "Sold Out" sign by the US Mint, rather it was the selling of about $1.5 billion in gold at the market. There are only two practical answers as to the "who" [or what] was selling, and both are from the same family of central bankers: either the New York Federal Reserve, acting though "other" agents to disguise direct involvement, or the BIS, [Bank of International Settlements], the central bankers bank.

No other entity has that kind of financial wherewithal or carelessness to execute in a market with no other intent than to do harm. It should also be your biggest clue why gold and silver reached recent lows. No one can fight the fiat financial might of the central bankers. Russia and China can, and are doing so in a different way. Plus, both are willing to accept the opportunity to accumulate more PMs at current levels. In fact, it is not out of question that lower prices are a required accommodation to China in return for China not trashing the toxic Treasury bond market and exposing the US fiat scam.

The best answer as to when will gold and silver rise to values that are reflective of the perverse distortion of their role as a known and accepted store of value, except for the elites running their fiat currency Ponzi scheme on the rest of a compliant world, is: not a day before the end of the moneychangers control over the existing fiat system so deeply entrenched and accepted for its existence. Once you recognize this factor as being in dominant control over gold and silver, you will better realize and accept it as sad reality, but it is what it is.

Consider how much information you have read and digested about gold and silver over the past few years [since the highs]. What has been the impact on the market? Zero, in fact negative. What has been the impact on your thinking? False, actually more misleading, beliefs about expectations. If some of the strongest known fundamental demand for gold and silver has had no effect on price, the question has to be, why not?

The simple and only answer is the elite's protecting its Ponzi fiat scheme, for they can never allow gold and silver to be considered as an alternative to their fiat paper issue. All they can do is what they have been doing for over 100 years, manipulate gold and silver, crushing them as viable alternatives to the "dollar" [more accurately, Federal Reserve Note], and the Euro dollar.

It serves no purpose to bemoan or regret all purchases of physical gold and silver, especially since the high, and we are on record as buying and recommending buying physical all the way down, even buying more physical silver just last week. The purpose has not been to make money but to preserve purchasing power via the most reliable form over time. How has that been working? Not very well over the past few years, but keep in mind the time frame, just the past few years.

It is a certainty, a certainty based on history that all known fiat systems fail, and the existing system is no exception. Likely within the next few years, all purchases made, including those made at the highs, will look prescient. Did the precious metals community get suckered in? Absolutely! There are probably only a relative handful who anticipated the power of the moneychangers over the PMs market to suppress price to levels not thought possible. This is hindsight for investors in gold and silver. We shall see who eventually gets the last laugh, as it were, and it will not be the moneychangers.

There is one thing and one thing only that buyers of physical gold and silver can do, and that is to bide time until this failing power struggle by the moneychangers comes to its inevitable demise. Common sense tells you that a country that has increased its money supply to ethereal levels cannot be sustained.

We said back in the earlier half of 2014 that it could well be a repeat of 2013, in terms of unrealized expectations for much higher PM price levels. While true in terms of time, we were not on target as to how low price would go. To our credit, we did continue to advise to stay out of the long side of the paper futures market for as long as the trend was down. That came from an obvious read of the charts.

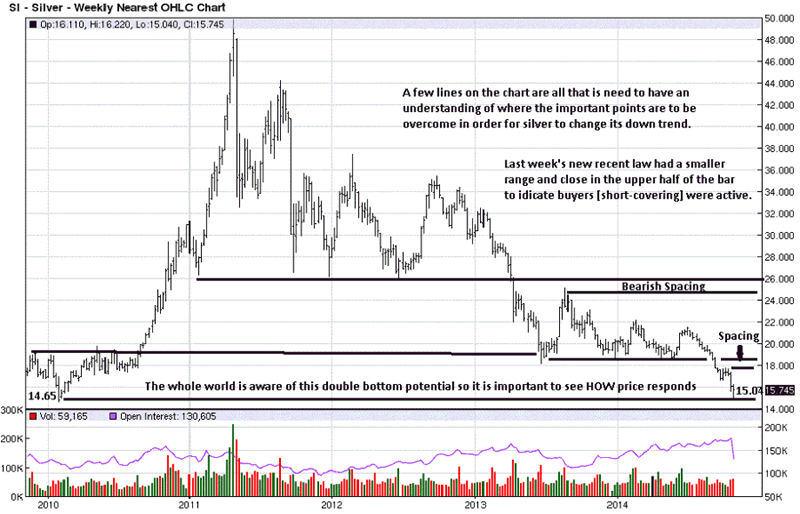

The silver chart has not improved on its lack of ability to show some kind of bottom being formed. The recent break of support has squelched those efforts, for now. 15.04 was last week's low, forming a potential double bottom. It is not important that 15.04 hold as an absolute low. What is more important is how market activity develops for whatever the eventual low price becomes, whether it is last week's price, 14.65, or any other number, 14.50, 14.32, etc. [Maybe even lower?]

There will be evidence, through price and volume, that is low is in place. It may take several weeks to confirm that a low is in, so it will not pay to try to be "first in." Let the market prove its intent, and then one can be in a more informed and comfortable position to make better decisions from the long side, should one want to trade paper futures, if there is even a viable futures market in which to trade, and there may not be.

Continue to monitor the way in which price responds or reacts to these lower levels. If there is no strong rally higher, on increased volume and upper range closes, then it will indicate that the bottoming process will take much more time. Be patient and allow your thinking to let the market develop as it will, for the controlling forces remain in place.

Silver Weekly Chart

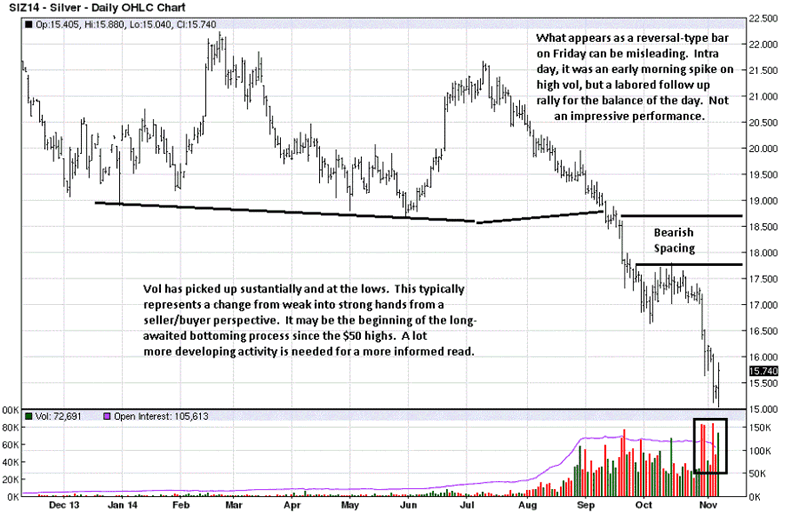

The daily chart shows another layer of bearish spacing as silver continues to weaken relative to gold. At some point, either once a low has been established or once a trend higher begins, silver is likely to outperform gold over the next several years.

When silver was in the low 20 area, we said prices are likely at generational lows. While now lower, the sentiment remains equally true. This artificial manipulation may go on beyond what most expect or want, but it will come to an end, and then even $50 silver will look like a great buy. Keep a level head in the face of recognized artificial adversity.

Silver Daily Chart

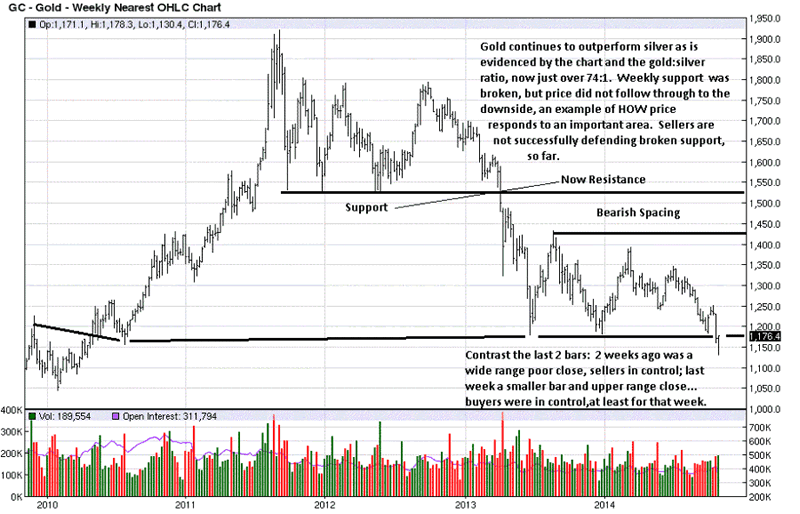

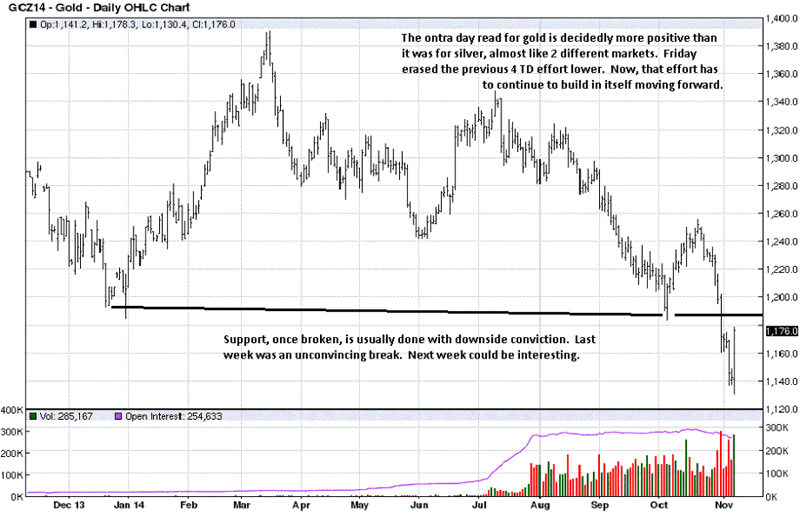

Compare the difference in how gold is developing around its barely broken support, with that of silver to get an idea of what to look for when one market more successfully holds an area versus one that fails to hold in similar circumstances. All that can be said of gold, while stronger than silver, is that the trend remains down, and that is the most important piece of information to know, for now.

Gold Weekly Chart

Here is more of the same, just observing how price responds to this critical support area. If there is more deterioration to come, how strongly does it impact price to the down side? There are so many ways in which market activity can develop that it does not pay to try and outguess how price reacts. Let it react, and then you are in a better position to react to what is known without having to guess. Keep it simple.

Gold Daily Chart

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.