Stocks Levitating,Silver Good Support - Basic Truths and Consequences

Stock-Markets / Financial Markets 2015 Jan 06, 2015 - 05:13 PM GMTBy: DeviantInvestor

Most normal individuals believe these basic truths.

Most normal individuals believe these basic truths.

We cannot borrow our way out of debt.

We cannot spend our way into prosperity.

We cannot tax ourselves into wealth.

More specific versions of these essential truths are:

We can’t fix an excessive debt problem with more debt.

We can’t support a larger and increasingly more expensive government with a decreasing work force.

Paper money always returns to its intrinsic value – zero.

Or, as Ayn Rand said two generations ago, “We can ignore reality but we can’t ignore the consequences of ignoring reality.”

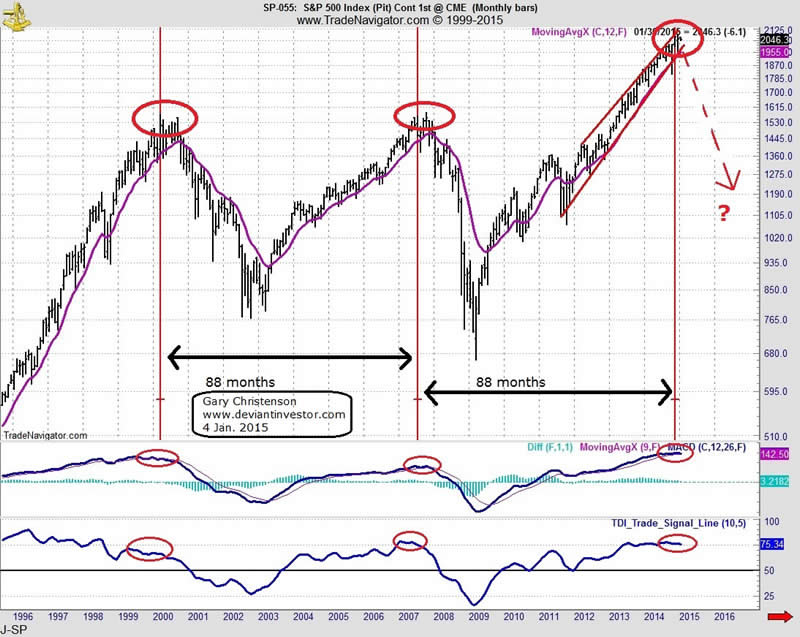

Now look at some Basic Charts! Monthly S&P 500 Index since 1996:

The chart of the S&P shows a levitated market – thanks to multi-generational low interest rates, massive creation of new debt, stock buybacks, and outright “printing” of historic quantities of dollars, yen, and euros. The S&P rally is nearly six years old and looks tired.

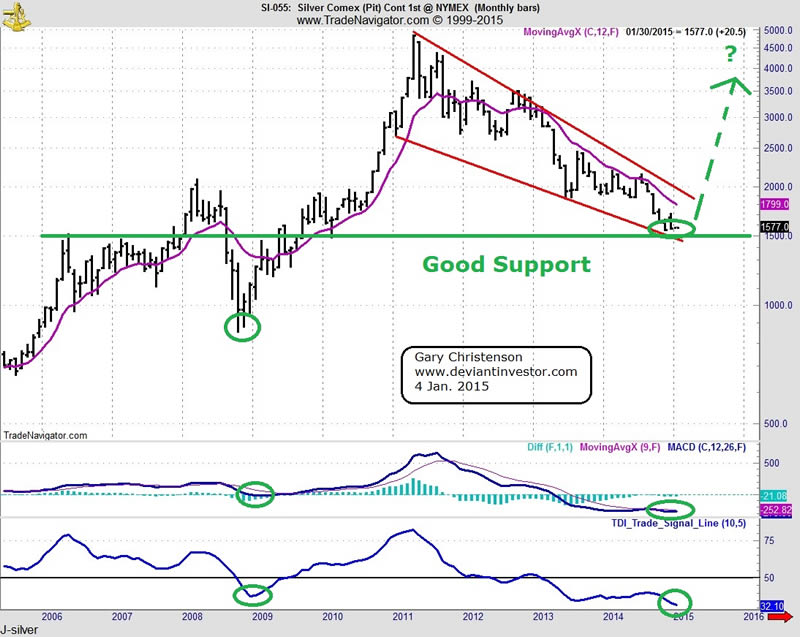

Silver Monthly since 2006:

Silver has languished since April 2011 – nearly four years, thanks to heroic efforts to manage prices downward, and the correction of silver’s 2.5 year run up from under $9 to over $48. Will the last bull turn out the lights when you leave the building?

The insanity of debt, derivatives, and outright bond monetization in the US, Europe and Japan could cause us to question basic truths and the consequences of ignoring reality.

What if our basic truths no longer work?

or

What if we CAN ignore the consequences of ignoring reality?

RECONSIDER:

We cannot borrow our way out of debt. Correct for you and me, but not for TPTB (the-powers-that-be). The US government has borrowed incessantly and has increased official debt, on average, 9% per year since 1913. Such borrowing may have impoverished voters, but the elite have benefitted handsomely. Clearly, the public borrows to pay for practically everything, the elite benefit, their net worth increases, and they CAN pay their way out of debt. Voila!

We cannot spend our way into prosperity. Correct for you and me, but TPTB have been doing it since 1913 and have clearly prospered. Ask the banking cartel or military contractors if they think that extra spending increases their prosperity. Clearly we CAN spend our way into additional prosperity for TPTB. Voila!

We cannot tax ourselves into wealth. The political and financial elite control the tax laws, create increased taxes for the middle class and exemptions for themselves. Clearly they CAN tax other people into wealth for themselves.

Does the average person realize the above?

- Since the recession/crash/money printing extravaganza from 2008 onward the elite have prospered and the bottom 95% have been hurt financially. Walmart sales are down but Ferrari’s are selling well.

- Approval ratings for congress are approximately 10%, admittedly far higher than they deserve, but still LOW. The American public does understand.

- Food stamps (SNAP) are distributed to nearly 50,000,000 Americans. The American public does understand.

Or, as Ayn Rand said two generations ago, “We can ignore reality but we can’t ignore the consequences of ignoring reality.”

The consequences of ignoring reality will be:

- A stock market correction that might extend into a crash.

- A dollar index that has crashed before and could do so again. When? When the last bear has left the room.

- A silver market spike to far higher prices caused by the realization that the dollar is vulnerable to the multiple realities of massive unpayable debt, excessive “money printing,” and the eventual loss of global reserve status. Declining mining supply, increased industrial demand, and considerably increased investment demand will eventually overwhelm the “price fixers.”

- A gold bull market mania that spreads, like a modern day pandemic, from China to Russia to Europe and finally to North America. When? When we can no longer ignore the consequences of ignoring reality.

But until reality catches up with markets and our financial systems, and we no longer can ignore the reality of insane debt creation, new and expanded wars, massive manipulations, multi-generational low interest rates, and central bank money printing, we should expect:

- More wealth for TPTB. (Thanks to the Federal Reserve.)

- Congress will continue to accept checks from generous individuals who wish to purchase favors and support good government.

- The POTUS will continue sinking 3 foot putts.

- The Kardashians will dominate domestic news.

- Reality can be pushed off for a while longer.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.