Mamas, Don’t Let Your Babies Grow Up to Be Pension Fund Managers

Personal_Finance / Pensions & Retirement Feb 16, 2015 - 04:26 PM GMTBy: John_Mauldin

We do not have to look to Greece to find massively underfunded obligations. Here in the US we can find hundreds of examples, willingly created by politicians and businessmen who proclaim they are working for the public good. We call them pension funds, but they’re just another form of unfunded debt. A sovereign bond is a promise to pay a certain amount of money over time. A defined-benefit pension fund is a promise to pay a certain amount of income over time. The value of either is determined by the ability of the government or the pension fund (or its sponsor) to pay.

We do not have to look to Greece to find massively underfunded obligations. Here in the US we can find hundreds of examples, willingly created by politicians and businessmen who proclaim they are working for the public good. We call them pension funds, but they’re just another form of unfunded debt. A sovereign bond is a promise to pay a certain amount of money over time. A defined-benefit pension fund is a promise to pay a certain amount of income over time. The value of either is determined by the ability of the government or the pension fund (or its sponsor) to pay.

I am in the Cayman Islands as I write this letter, to speak at an alternative investment conference attended by the management of some of the largest pension funds in the US and Europe, both public and private. Being here has motivated me to write this week’s letter on the problems that pension funds face. The pension fund managers I have talked with take their fiduciary obligations seriously, and they face some serious challenges.

I was on the stage with Nouriel Roubini (who makes me come off as the optimist), and we were talking about macroeconomic risks. I was asked what other sorts of risks people should be thinking about, and I cited a recent report about how pension fund obligations had dramatically increased because of a small change in mortality tables. There has been a very steady increase in life expectancy over the last almost 100 years. It is a fairly well-defined trend. The actuarial accountants whose responsibility it is to track these things updated the life expectancy tables for a 65-year-old male, who can now expect to live an additional 21.6 years, two years longer than in the old table. I pointed out that this trend toward longevity is very well established and is likely to accelerate as new technologies and medicines become available, which means that underfunded pension plans are even more underfunded than we think.

I pointed out that while living longer is a very high-quality personal problem to deal with, if your pension plan doesn’t live as long as you do, that could be an issue. Some pension plan managers approached me afterwards to talk about this issue, and it is apparent that others are confronting it head on. Matt Botein, global co-head and CIO, BlackRock Alternative Investors, later talked about how he helped pension funds to hedge their “mortality risk” (the odds that pensioners will live longer) by buying a large life insurance company. The value and profits of a life insurance company will rise if the people they have insured live longer. That is a very creative way to deal with the exposure that pension funds have to the obligations imposed by longer lifespans.

Mamas, Don’t Let Your Babies Grow Up to Be Pension Fund Managers

Today we briefly look at four very large problems facing pension funds. With a nod to Willie Nelson, I’m not sure I want my babies to grow up to be pension fund managers. It’s going to be a very challenging occupation, given all the headwinds they face. Not that the ones I know don’t seem relatively happy and well-adjusted, but they do face a Sisyphean task.

Expected Returns, Realistic Expectations

Most public and private pension funds project returns of between 7½ and 8% on their investment portfolios. Let’s analyze how realistic that is.

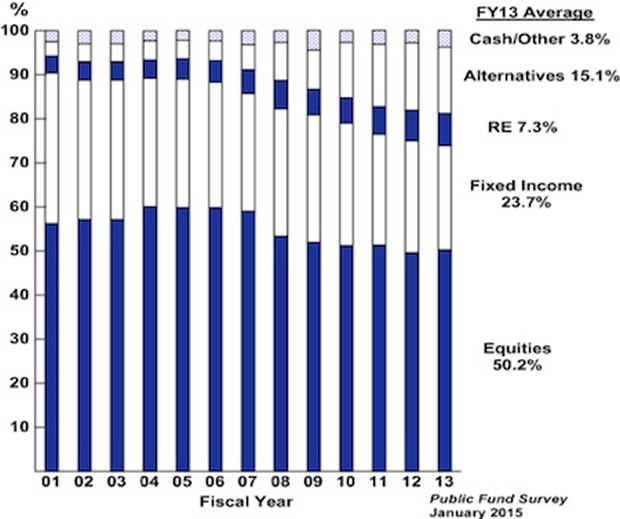

First, if you look back over the last six years, pension funds actually returned 6.8%. Not bad until you consider that we’ve been in a roaring bull market for the entirety of those six years. The average return for the largest public pension funds in the US in the recent decade was closer to 3.2%. Pension fund returns are highly correlated to stock market indexes, which is not surprising when you look at the typical allocation pattern of pension funds. This survey is from publicfundsurvey.org.

Note that hedge funds have recently underperformed equities; but on average they do somewhat better over the long term, depending, of course, upon which funds you are in. Accounting for the equity-like returns that many hedge funds achieve and the fixed-income returns that many real estate portfolios yield, the typical public pension fund portfolio looks like 55 to 60% equities, 30% fixed-income, and 10 to 15% alternatives.

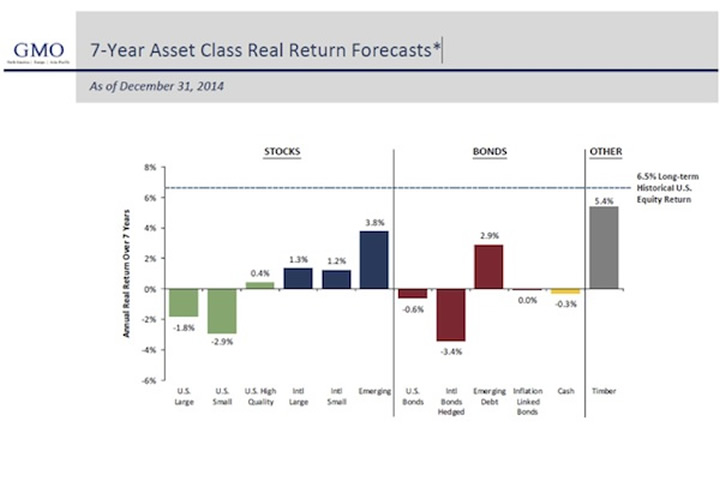

As every prospectus states, and as I remind readers all the time, past performance is not indicative of future results. Jeremy Grantham at GMO has given us a forecast for seven-year real returns of various asset classes. This chart is as of December 31, 2014. Note that the long-term real return for US equities has been 6.5% (for newbies, when we say “real” return we mean net adjusted for inflation. Got it?)

Such forecasts are made in various ways but are generally based on how a particular asset class performed at a given level of valuation. It is well understood that if stocks at the beginning of a period have a lower valuation (there are several different ways to measure valuation, but generally we think of the price-to-earnings ratio), then their longer-term returns are going to be higher, often significantly higher, than the returns when equity valuations are high at the beginning of a period. Equity valuations are generally in the high range today (though not in historical nosebleed range – there is room for them to go higher).

Thus GMO’s forecasts are not very optimistic in terms of equity returns. And neither do they expect much from bonds.

This does not bode well for pension funds, which are heavily weighted to US equities. Given that the 10-year US Treasury is yielding under 2% and that some of us feel it may approach 1% before the end of the decade, the probability that any fund will be able to obtain 7-8% total returns over the next seven years doesn’t seem very high. Even hoping to get 4% might be stretching it.

If this all sounds pessimistic, I suggest you go to www.CrestmontResearch.com and look at historical returns on the equity and bond markets for the last 100 years. There were periods when US equity returns were negative for 20 years.

Further, it has been almost seven years since the last recession. Given that the longest we’ve gone without a recession is close to 10 years, it seems likely that we will see a recession within the next five years. The average stock market correction in a recession is in the 40% range, and recessions almost always mean that interest rates go even lower, which makes the challenge of achieving even 4% over the next seven years even more daunting.

The difference between compounding at 4% and 8% is huge. You can go to various websites that will help you calculate compound interest rates on your assets over time. I went to money-rates.com. The difference between compounding at 4% and 8% for 10 years is impressive: $1,000 grows to $1,480 at 4% and to $2,159 at 8%.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.