Why Crude Oil Prices Must Go Up

Commodities / Crude Oil Feb 19, 2015 - 03:46 PM GMTBy: OilPrice_Com

It may be difficult to look beyond the current pricing environment for oil, but the depletion of low-cost reserves and the increasing inability to find major new discoveries ensures a future of expensive oil.

It may be difficult to look beyond the current pricing environment for oil, but the depletion of low-cost reserves and the increasing inability to find major new discoveries ensures a future of expensive oil.

While analyzing the short-term trajectory of oil prices is certainly important, it obscures the fact that over the long-term, oil exploration companies may struggle to bring new sources of supply online. Ed Crooks over at the FT persuasively summarizes the predicament. Crooks says that 2014 is shaping up to be the worst year in the last six decades in terms of new oil discoveries (based on preliminary data).

Worse still, last year marked the fourth year in a row in which new oil discoveries declined, the longest streak of decline since 1950. The industry did not log a single "giant" oil field. In other words, oil companies are finding it more and more difficult to make new oil discoveries as the easy stuff runs out and the harder-to-reach oil becomes tougher to develop.

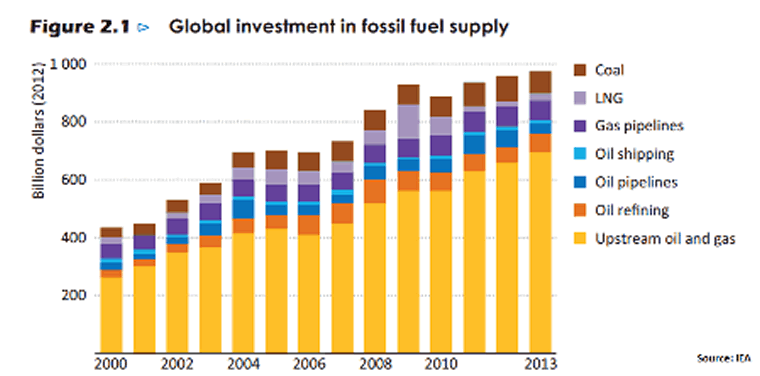

The inability to make new discoveries is not due to a lack of effort. Total global investment in oil and gas exploration grew rapidly over the last 15 years. Capital expenditures increased by almost threefold to $700 billion between 2000 and 2013, while output only increased 17 percent (see IEA chart).

Despite record levels of spending, the largest oil companies are struggling to replace their depleted reserves. BP reported a reserve replacement ratio - the volume of new reserves added to a company's portfolio relative to the amount extracted that year - of 62 percent. Chevron reported 89 percent and Shell posted just a 26 percent reserve replacement figure. ExxonMobil and ConocoPhillips fared better, each posting more than 100 percent. Still, unless the oil majors significantly step up spending they will not only be unable to make new discoveries, but their production levels will start to fall (some of them area already seeing this begin to happen). The IEA predicts that the oil industry will need to spend $850 billion annually by the 2030s to increase production. An estimated $680 billion each year - or 80 percent of the total spending - will be necessary just to keep today's production levels flat.

However, now that oil prices are so low, oil companies have no room to boost spending. All have plans to reduce expenditures in order to stem financial losses. But that only increases the chances of a supply crunch at some point in the future. Put another way, if the oil majors have been unable to make new oil discoveries in years when spending was on the rise, they almost certainly won't be able to find new oil with exploration budgets slashed.

Long lead times on new oil projects mean that the dearth of discoveries in 2014 don't have much of an effect on current oil prices, but could lead to a price spike in the 2020's.

All of this comes despite the onslaught of shale production that U.S. companies have brought online in recent years. U.S. oil production may have increased by 60 to 70 percent since 2009, but the new shale output still only amounts to around 5 percent of global production.

Not only that, but shale production is much more expensive than conventional drilling. As conventional wells decline and are replaced by shale, the average cost per barrel of oil produced will continue to rise, pushing up prices.

Moreover, with rapid decline rates, the shale revolution is expected to fade away in the 2020's, leaving the world ever more dependent on the Middle East for oil supplies. The problem with that scenario is that the Middle East will not be able to keep up. Middle Eastern countries "need to invest today, if not yesterday" in order to meet global demand a decade from now, the International Energy Agency's Chief Economist Fatih Birol said on the release of a report in June 2014.

In fact, half of the additional supply needed from the Middle East will have to come from a single country: Iraq. Birol reiterated those comments on February 17 at a conference in Japan, only his warnings have grown more ominous as the security situation in Iraq has deteriorated markedly since last June. "The security problems caused by Daesh (IS) and others are creating a major challenge for the new investments in the Middle East and if those investments are not made today we will not see that badly needed production growth around the 2020s," Birol said, according to Reuters.

If Iraq fails to deliver, the world could see oil prices surge at some point in the coming decade. Despite the urgency, "the appetite for investments in the Middle East is close to zero, mainly as a result of the unpredictability of the region," he added.

Source: http://oilprice.com/Energy/Oil-Prices/Why-Oil-Prices-Must-Go-Up.html

By Nick Cunningham for Oilprice.com

© 2015 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.