Watch the Skies... for Investor Profits

Companies / Technology Mar 02, 2015 - 04:31 PM GMTBy: Investment_U

Sean Brodrick writes: Here is one of the scariest data points I’ve seen this year: nearly 80% of consumers are willing to pay extra for drone delivery. We’re talking everything from books to pizzas.

Sean Brodrick writes: Here is one of the scariest data points I’ve seen this year: nearly 80% of consumers are willing to pay extra for drone delivery. We’re talking everything from books to pizzas.

I can just imagine what the skies over my little burg of Delray Beach, Florida, will look like.

And the noise! It will be like an armada of terrier-sized mosquitoes making Stuka dive-bombing runs.

Regardless, on February 15, the Federal Aviation Administration (FAA) officially opened Pandora’s Box. That’s when it announced its proposed rules for small commercial drones (those fewer than 55 pounds).

The proposed rules are considerably less strict than expected. Here are some concerning details:

- Commercial small drone operators will not need a commercial pilot license, just a special “Unmanned Aircraft Systems (UAS) operator certificate.” This will be much easier to get than a pilot’s license and will cost less than $300. A 17-year-old can get a UAS certificate.

- Small drones will not need to meet airworthiness standards. Just a quick preflight check by the operator will suffice.

- The FAA is considering a different set of rules for “Micro UAS” drones (drones under 4.4 pounds). These drones would face even lower regulatory hurdles.

The news isn’t all bad. A drone will need to be flown within an operator’s eyesight and can’t climb above 500 feet or go faster than 100 mph. Flights can be made only during daylight hours. They cannot be flown over people (though how will that be enforced?). And drones still can’t drop objects.

But to all this I add “for now.” Because once you open Pandora’s Box ‘o Drones, who knows where it ends?

The End of Backyard Privacy?

Look, I don’t mean to sound like a Luddite. I’m not against new tech. Far from it. I’m also not the guy who types up rants about kids these days (I save those rants for home). But anyone who can’t see the downside to fleets of drones flying through our neighborhoods needs to wake up and smell the drone-delivered coffee.

For one thing, it’s an end to backyard privacy. Period. And I’m not just talking about police snoops, though there will be plenty of those. How do you know when a drone is piloted by the police or your friendly neighborhood pervert? (Answer: You don’t.)

Then there are the hazards. It’s dangerous enough driving to work as it is. Just wait until some barely licensed idiot loses control of their drone over I-95.

And, again, there’s the noise. Yeah, I’m probably going to hate the noise the most.

The president is worried, too. And not just because some drunk recently landed a drone on the White House lawn. On the same day the FAA announced its small drone rules, Obama issued a presidential memorandum on “Promoting Economic Competitiveness While Safeguarding Privacy, Civil Rights, and Civil Liberties in Domestic Use of Unmanned Aircraft Systems.” It lays down guidelines on how long drone-gathered data can be kept and addresses other privacy concerns.

Of course, the problem with guidelines is they’re just guidelines.

Here Come the Lobbyists

Already, Washington is getting pushback on any serious drone regulations. Lobbyists representing Amazon (Nasdaq: AMZN) and Google (Nasdaq: GOOG), as well as aerospace firms and the news media, say they will try to convince regulators that some proposed limitations are unnecessary.

The reason, according to the drone lobby, is that cutting-edge technologies make drones inherently safe. And they might get their way…

Lobbying by drone special interests surged from $35 million in 2011 to more than $186 million in 2014. Could money triumph over the public good?

This big trend may be unstoppable. Here are some other fascinating facts:

- Only 12% of consumers say they wouldn't trust drone deliveries.

- A whopping 28% of U.S. consumers make Web-based purchases at least once a week.

- The number of drones in the U.S. is projected to hit 30,000 by 2020.

- Right now, the Air Force has between 65,000 and 70,000 people working to process drone-collected data and footage.

- Cape Canaveral is now a drone base. U.S. Customs and Border Protection fly drones on our northern, southern and southeastern borders. And few Americans even know it.

On the Bright Side: Profits Take Wing

Drone spending is on track to stretch to $98 billion worldwide in the next 10 years. About 12% of that should be for commercial purposes.

For example, farmers want to use drones for crop dusting and disease detection. Oil and gas companies want to use drones to inspect rigs and pipelines.

And news media companies, including NBC, The New York Times and Thomson Reuters are planning to test news-gathering drones in coming months.

So if you can’t beat ‘em, join ‘em. It turns out there are plenty of profit opportunities in drones.

How You Can Play It

There are a half dozen or so tradable drone stocks. Many of them are in the Robo-Stox Global Robotics & Automation ETF (Nasdaq: ROBO). The Robo-Stox ETF holds a basket of companies operating in robotics, high-tech automation and drones.

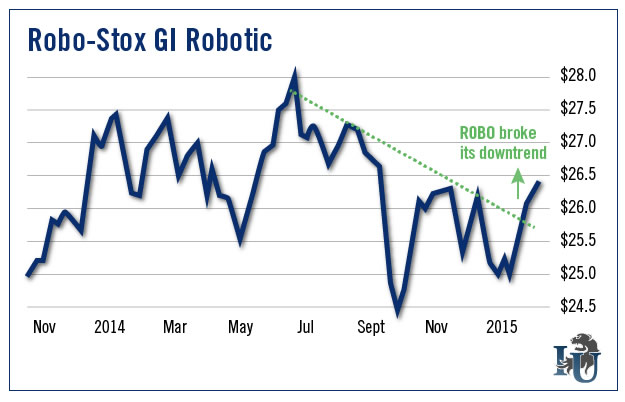

And if you look at the chart below, you can see that the Robo-Stox ETF is looking very bullish.

The ETF recently broke its downtrend. It pushed to the upside on high volume. That’s bullish.

The Robo-Stox ETF’s second-largest holding is AeroVironment (Nasdaq: AVAV). The company manufactures drones along with charging stations for electric vehicles. (Investment U’s Senior Research Analyst, Ryan Fitzwater, took a look at the stock back in January. You can check out his findings here.)

Another, smaller position is Elbit Systems (Nasdaq: ESLT), an Israeli drone manufacturer.

Sure, the Robo-Stox ETF has a lot of non-drone robot and automation stocks. But if drones are as big a trend as some say, this fund should be poised for liftoff. Just be aware that the expense ratio is rather high - at least for my blood - at 0.95%, or $95 per every $10,000 invested.

As always, be sure to do your own due diligence before buying anything.

All the best,

Sean

P.S. Drones are a hot-button issue for many people. But as defense expert PW Singer says, “At this point, it doesn’t really matter if you’re against this technology... it’s coming.” To help readers profit, Marc Lichtenfeld has produced a short video on drones and other cutting-edge technologies being implemented all over the globe. Click here to watch.

Good investing,

Sean Brodrick

Source: http://www.investmentu.com/article/detail/43908/faa-drones-uav-uas-amzn-avav-watch-skies-for-profits

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.