Apple Major New Gold Buyer - Propel Gold Price Higher?

Commodities / Gold and Silver 2015 Mar 06, 2015 - 12:27 PM GMTBy: GoldCore

- There is a major new buyer in the gold market – Apple

- There is a major new buyer in the gold market – Apple

- New Apple watch could use up to one third of total annual gold supply

- Apple expects to sell one million gold watches per month

- Each watch to use up to two ounces of gold

- May have enormous ramifications for gold market and propel prices higher

Apple may consume up to 746 metric tonnes of gold per year in the production of its new luxury Apple watch, due for release in April. This equates to roughly one third of gold’s total annual global mine supply.

The watch will come in three varieties – the entry level “Sports” model, the mid-tier “Apple Watch” and the upper end “Apple Watch Edition” which the company says will be made of 18k (75% pure) gold and is estimated to retail from anywhere between $4,000 and $10,000.

Apple ( APPL ) have ordered their manufacturing plants in Asia to produce between 5 and 6 million units. Around half of these will be the Sports model which is expected to retail for $349.

Around one third of the order will be made up of the mid-range watch leaving an estimated one sixth of the order to be comprised of the gold edition.

Tidbits, the independent blog discussing all things Apple have estimated that each watch will use 2 ounces of gold.

While this may be an over-estimation – a watch made of 75% gold would be be quite bulky if it used a full two ounces – it is not impossible, especially if buyers were to opt for a gold bracelet with the watch.

Apple’s reported expectation to shift one million units of the Edition model will be a tall order. In the end it will probably come down to the price. Even at the lower end estimate of $4,000 it’s hard to imagine Apple shifting one million units each month.

However, Apple’s ability to generate a buzz or hype, depending on your perspective, cannot be under-estimated.

While details concerning the actual function of the Watch do not suggest a “must-have” motivation for buying it – at least on technological grounds – Apple raving fans may create the massive demand the company expects.

It does not have the element of indispensable usefulness that one could associate with the iPhone or iPad. The major attraction of the ‘Watch’ will be a fashionable one and be about being part of the Apple ‘tribe.’

This is not a terrain in which we would normally expect a technology company to operate in comfortably. However, Apple have recruited the former CEOs of Yves Saint Laurent and Burberry to make up for their lack of expertise. It will be interesting to see how this synergy works out.

We wonder how many people would be willing to shell out for a jewelry and technology hybrid with an expected usefulness of roughly five years when the most expensive element in it, is its gold content.

These types of purchases are normally made with a view to it being useful and having sentimental value for a lifetime. Perhaps Apple will offer upgrades where the interior of the watch can be replaced while keeping the same gold exterior.

If the Watch Edition is to be successful it will require quite a leap in the psychology of jewelry buying. However, we would be hesitant to bet against the capabilities of the Apple marketing machine and the loyalty of Apple buyers in this regard.

Should the Watch Edition retail at $4,000 it should leave Apple reasonable room to manoeuvre in the event of a spike in the price of gold. If Apple were to use a full two ounces of gold it would currently cost them roughly $2,400.

Assuming other costs are not much greater than those involved in producing the Sports model which is expected to retail at $349, we can assume that Apple will have a buffer of around $1,200, to absorb a gold price spike of 50%. These figures don’t include marketing costs or expected profits.

The CultofMac blog speculates that Apple would need to wrest 45% of the share of luxury watches from the likes of Rolex and other high-end Swiss watches to meet its target. It is, however, likely that Apple will attract lot of customers who would not normally be in the marketplace for luxury watches.

One million units per month using 2 ounces of gold would amount to the 746 tonnes of the metal mentioned above.

While Apple may not use that amount of gold per unit and may not shift its expected volume of units, what is important is that there is a major new buyer in the gold market. Where Apple goes – others may follow creating additional sources of demand.

The ramifications for the gold market based on these estimates are significant. Currently, China is already buying more than 1,500 metric tonnes annually or more than 50% of global supply.

Creditor nation central banks, particularly the Chinese, are diversifying their gold reserves and accumulating large amounts of bullion on an ongoing basis.

Many central banks, including Germany, Austria, the Netherlands, Belgium, are repatriating their own gold reserves from the Federal Reserve and the Bank of England. Many analysts believe that this is forcing their counter-parties into the market to regain gold that should be in their possession but was dumped onto the market as part of the gold-suppression scheme.

With an enormous buyer like Apple coming into the market, supply is going to have to come from existing stocks of gold. That is to say, supply does not exist to meet this new demand.

Assuming Apple are successful in pitching their new watch to the very rich and trendy, in the real world, where markets are driven by supply and demand fundamentals as opposed to central bank dictats and manipulation, this can only translate into higher gold prices.

We expect to see demand and supply fundamentals to reassert themselves in 2015 and we believe that the demand provided by Apple may push prices higher this year and more importantly in the coming years.

Our long held, long term price target of the real record high, inflation adjusted, $2,400 per ounce remains in place. Gold at $1,196/oz is currently just half the price it was in real terms in 1980. There are few if any other assets in the world that represent such good value.

Having said that, crystal ball gazing and price predictions are a mugs game. What is important is that savers do not have all their eggs in one basket -bank deposits and investors are properly diversified globally with a range of assets and have an allocation to physical gold as a hedging instrument and safe haven asset.

Updates and Award Winning Research Here

MARKET UPDATE

Today’s AM fix was USD 1,196.50, EUR 1,090.60 and GBP 787.85 per ounce.

Yesterday’s AM fix was USD 1,199.75, EUR 1,082.67 and GBP 786.46 per ounce.

Gold fell 0.12% percent or $1.40 and closed at $1,198.00 an ounce yesterday, while silver climbed 0.19% or $0.03 to $16.21 an ounce.

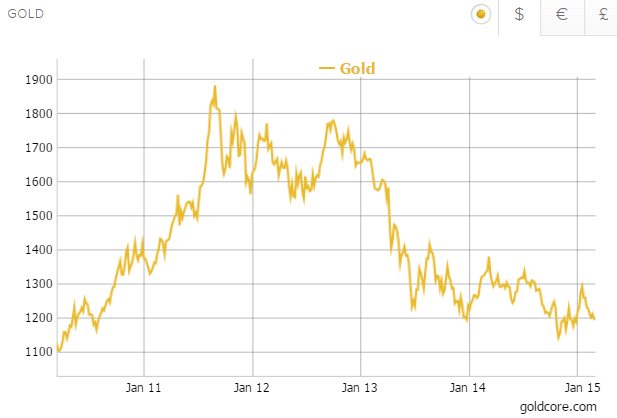

Gold in US Dollars – 5 Years

Gold dipped under $1,200 an ounce this morning and looks likely to rack up its fifth weekly drop in six weeks, while the U.S. dollar climbed near eleven year highs before the U.S. nonfarm payrolls report at 1330 GMT.

Silver looks set for a second weekly drop in three weeks, while platinum is on track for a sixth weekly drop in seven weeks.

A Reuters poll of analysts expect U.S. payrolls to have increased 240,000 last month and the jobless rate to have fallen from 5.6 percent from 5.7 percent.

Spot gold in late morning trading in London was off 0.3 percent at $1,194.70 an ounce. Comex U.S. gold for April delivery was down $1.30 an ounce to $1,194.90.

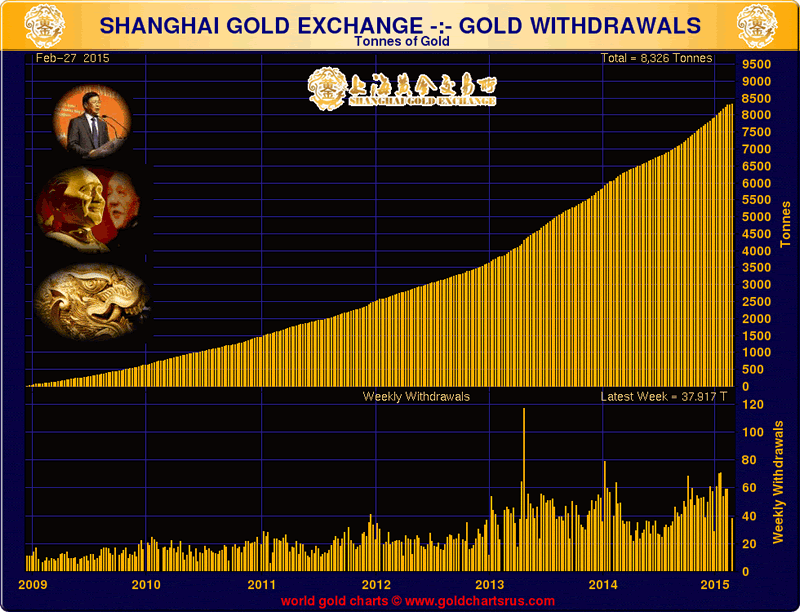

Chinese gold prices were about $4-$5 an ounce higher than the global benchmark at the Shanghai Gold Exchange (SGE) showing demand remains robust in China.

Chinese gold withdrawals on the SGE were robust at 37.917 tonnes for the week and are continuing at a run rate which suggests another 2,000 tonnes of demand in 2015.

Draghi said yesterday that the ECB’s monetary experiment of EUR 1.1 trillion of bond buying in the euro zone will begin next Monday, March 9, and will continue until Sept 2016. This has led to the euro falling further against the dollar and sterling.

The pound hit a more than seven-year high against the struggling euro today, as interest rate differentials moved in favour of the British pound and the ECB confirmed it is set to launch its ‘bazooka’ euro debt monetisation programme.

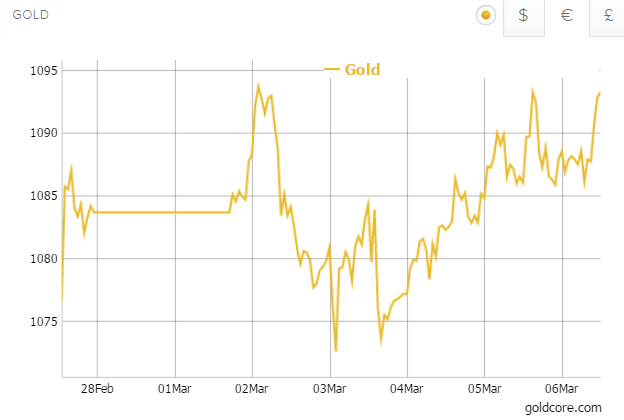

Gold in Euros – 5 Days

The pound, though, fell against the dollar, easing to near four-week lows ahead of a U.S. jobs report, with concerns about a potentially unsettling British election in May also weighing.

Thus, the euro has fallen against gold and euro gold eked out small gains this week (see chart).

Significant risks in the Euro zone are being ignored for now. Greece cannot rely on the European Central Bank to raise the limit on Athens’ issuance of short-term debt, Draghi warned yesterday.

He also said the rules meant the ECB could not buy Greek bonds under its new asset-buying programme. Asked about the short-term debt limitations at a news conference following the ECB’s meeting in Cyprus, Draghi said that the bank was prohibited by European rules from direct or indirect financing of governments. “The ECB is a rule-based institution. It is not a political institution,” Draghi said.

All eyes are on the jobs number today for signs of how the U.S. economy is doing. A positive or better than expected number should lead to gold falling in price and conversely a worse than expected number could see safe haven bids come into the market.

From a technical perspective, gold looks very vulnerable as it it appears set for a second lower weekly close after a lower monthly close in February. With gold heading for a lower weekly close and a close below the psychological $1,200/oz, further liquidation is likely to be seen in the market as traders get nervous regarding the deteriorating technicals.

Support below $1,170 per ounce is at $1,140 per ounce.

Geopolitical risk remains high. Russia has called the arrival of U.S. military trainers in western Ukraine a “provocation” and warned the Ukraine government that they should rethink the consequences of hosting American forces.

Silver slid to its lowest price in two months at $15.89 an ounce, while palladium dipped 0.2 percent to $821.75 an ounce and platinum was down 0.1 percent at $1,175 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.