Is Europe Worth the investment?

Stock-Markets / European Stock Markets Apr 22, 2015 - 03:35 PM GMTBy: GoldSilverWorlds

Europe has often been portrayed as a drag on the world economy. Although it had - and still has - its fair share of problems, are things really as gloomy as they seem? In this article, we aim to analyze Europe more, examine how things really are, and answer the question of whether an investment in European equity markets makes sense or not.

Europe has often been portrayed as a drag on the world economy. Although it had - and still has - its fair share of problems, are things really as gloomy as they seem? In this article, we aim to analyze Europe more, examine how things really are, and answer the question of whether an investment in European equity markets makes sense or not.

First: The Economy

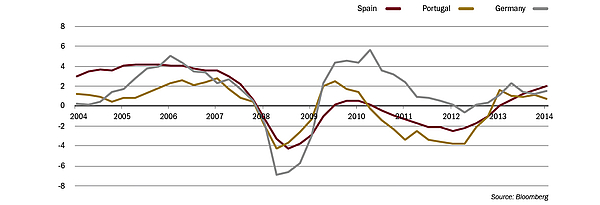

Although real GDP growth estimates for the US are currently at around 2.9% for 2015 and thereby higher than the ones expected for Europe, which stands to grow by 1.6%, there are some indicators that suggest that the situation in Europe is improving. The improvement can be especially seen in the southern European countries, such as Portugal or Spain, that were in a recession up until 2013 and have now started growing again. Portugal, for example, whose economy in 2013 was shrinking by -1.3%, is now expected to grow by 1.5%. Similarly, Spain was able to move from a contraction of -1.2% to an expected growth rate of 2.2% this year. We are also starting to see some (marginal) improvements in the unemployment figures.

Although it is definitely too early to say that Europe is back on track, in our view, things in Europe are less gloomy than they are often portrayed by the media.

We should reiterate, however, that our long-term outlook is still not positive. Meaningful long-term improvement in Europe, as in most developed countries, may only be possible when structural reforms are allowed to get out of their infantile stages.

Figure 1: Year on Year Real GDP Growth in Selected European Countries in Percentages

QE flood will benefit the markets

In March 2015, the ECB started its QE program which is scheduled to go until at least September of 2016, whereby a total of around EUR 1.1 trillion worth of bonds will have been purchased. What impact will this have on Europe? First, we expect exports to rise. Since the announcement of the QE program, the EUR has lost around 9% of its value and almost a fourth of its value in the past 12 months. The cheaper Euro will especially support companies/countries like Germany exporting to destinations outside of the Eurozone. Companies repatriating gains from outside the Eurozone will also see their profits rise, at least as long as the Euro remains weak.

Another important aspect is that the ECB’s current purchasing of sovereign debt is in accordance with the capital keys of the respective countries in the ECB’s capital. This means that a lot more of the capital coming from the QE program will enter larger countries in the Eurozone, such as Germany, France, Italy and Spain. In March, around 70% of the total QE bond purchases were sovereign bonds from those countries. It is therefore likely that their bond yields will decrease more strongly than in other European countries, thereby increasing the demand for cash-flow generating equities.

Inflation in Europe is forecasted to be around 0.14% in 2015 and is not expected to reach the targeted 2% inflation rate anytime before 2018. This gives the European Central Bank more leeway to continue with its liquidity injections.

What about the Euro?

As we have mentioned before, the Euro has lost substantially against the US dollar in the last year. On the one hand, we don’t expect the strong downward movement of the EUR to continue, especially because the FED has already raised concerns regarding the European QE program. They are urging Europe to implement fiscal policies and not rely so heavily on monetary measures to try to get their economy back on track.

US companies repatriating profits from outside the US are going to be hit by the strong dollar and are likely to complain about its strength. On the other hand, the stock of US dollar debt owed by non-financial borrowers outside America, especially in emerging markets, has grown by 50% since the financial crisis. According to the Bank of International Settlement, it now stands at USD 9 trillion.

As the dollar rises, this debt becomes more expensive to service in local currencies. In order to stop this critical situation, borrowers could be tempted or even forced to early redemptions of their debt. This would create demand for the US dollar and, keeping in mind the enormous amount of outstanding debt, could result in a significant upside pressure on the US dollar. So it needs to be closely monitored as to which of the driving forces for the US dollar will prevail and if the potential strong demand for the US dollar from emerging markets will impact the USD/ EUR exchange rate also.

Is Greece a risk?

In recent weeks, Greece started making headlines again, especially after the new Prime Minister Alexis Tsipras, the leader of the left wing Syriza party, took office in January. Having promised an end to austerity during the campaign, the Greeks are now looking at their newly-elected government to make good on their promises. We believe that under this new government, a Greek exit from the Eurozone has become increasingly likely.

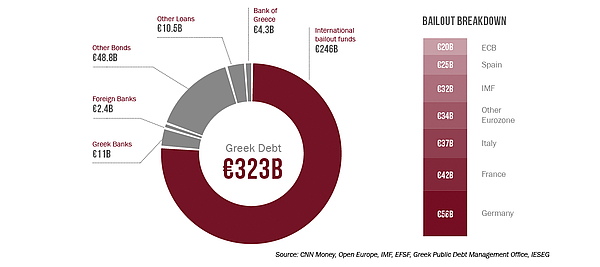

However, a lot has changed since 2011 when the Eurozone crisis first erupted. A Grexit might cause some short-term volatility in the equity markets, but would be perceived essentially as a non-event by market participants. Around 80% of Greece’s total debt of about EUR 323 billion is held by state institutions or institutions backed by the state. The European banking system would be able to absorb a default without any stability risks. Losing the “weakest-link” in the Eurozone might even be positive for the value of the Euro.

Figure 2: Who do the Greeks actually owe?

How can I profit as an investor?

As we already highlighted in the last issue of our BFI InSights, we believe that European equity markets as a whole are somewhat cheaper than the markets in the US. When we take a cautiously optimistic expectation, the likely impact of the QE program, and the weak Euro into account, we believe that overweighting European equities as a tactical move makes sense over the coming quarters. We would concentrate our investments on strong European exporters, who are the most likely to gain.

This article is an excerpt from BFI Insights Q2 2015 which appeared on Mountain Vision, the portal from BFI Wealth Management.

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.