Corporations Are The Ultimate Dumb Money

Companies / Global Debt Crisis 2015 May 05, 2015 - 09:55 AM GMTBy: John_Rubino

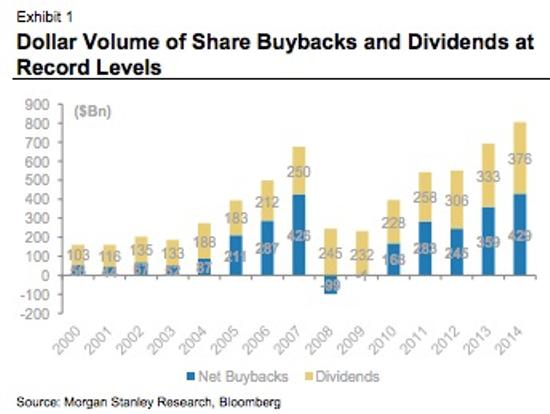

David Stockman just published a chart so compelling that he didn't feel the need to add any commentary.

But there are a few things to be said about the tendency of public companies to repurchase their shares at the very top:

"Peak buyback" is a sign that executives are seeing fewer opportunities to generate positive returns by building new factories or hiring new people, and so choose to give their free cash back to investors. This is NOT a good thing for the future of the business.

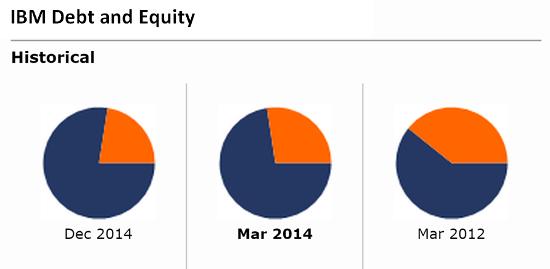

Low interest rates turbo-charge this process by making it profitable to buy back shares with cheap borrowed money. The result is soaring debt for the companies with the biggest repurchase programs. Here, for example, is a chart of IBM's debt (blue) and equity (orange) compiled by Morningstar. As recently as 2012 Big Blue's balance sheet was fairly solid, with about 40% equity. In two short years equity fell to less than 25%:

Obviously this process is limited by the finite amount of equity outstanding. Another three years like the last two and IBM will have completed a leveraged buyout and become a private company.

The best data point on Stockman's chart is 2008 when, one year after the achievement of peak buyback, companies not only stopped repurchasing shares but started issuing new shares -- in a plunging market. In other words, public companies spent three years buying back shares at ever-higher prices only to sell $99 billion of them back at a discount. This is typical dumb money behavior, akin to the margin calls that decimate individual brokerage accounts during bear markets.

The second best data point is 2014 when share repurchases exceeded their 2007 level. Now the question is which of the next few years will reprise 2008.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.