Truth of the US Dollar Devaluation Behind Bernanke's Words

Currencies / US Dollar Jun 14, 2008 - 02:37 PM GMTBy: Andy_Sutton

This week we have seen a textbook verbal campaign touch off a long-awaited rally in the Dollar, firmly supported by data to suggest that the Federal Reserve should at least hold a hard line on rates. We have even heard some Federal Reserve governors, most notably Philadelphia Fed President Charles Plosser calling for an immediate increase in interest rates. It has been my opinion since we first heard this verbal campaign begin nearly two months ago that the Fed's goal was to do nothing but talk. So far, I have not been disappointed. Here are some notable quotes from this week:

This week we have seen a textbook verbal campaign touch off a long-awaited rally in the Dollar, firmly supported by data to suggest that the Federal Reserve should at least hold a hard line on rates. We have even heard some Federal Reserve governors, most notably Philadelphia Fed President Charles Plosser calling for an immediate increase in interest rates. It has been my opinion since we first heard this verbal campaign begin nearly two months ago that the Fed's goal was to do nothing but talk. So far, I have not been disappointed. Here are some notable quotes from this week:

“We will strongly resist any waning of public confidence in stable prices” – Ben Bernanke on June 9th

“We will strongly resist any waning of public confidence in stable prices” – Ben Bernanke on June 9th

“I would never rule out currency intervention” – Henry Paulson, Treasury Secretary on June 9th

“ The Central Bank is paying very close attention to the US Dollar” – Timothy Geithner, NY Fed President on June 9th

Of these, Bernanke's comment is the most interesting. It would seem there has already been a significant erosion of the public's confidence in stable prices. Almost everyone we talk to expects higher prices. And even if confidence hasn't been eroded, what exactly is Bernanke going to do to stop prices from going higher? He can raise rates all he wants, but until he stops creating money from thin air, prices are going to continue to rise. And we know he isn't going to stop doing that! So what can Ben really do? The answer is he can talk and that's about it.

Too much too fast?

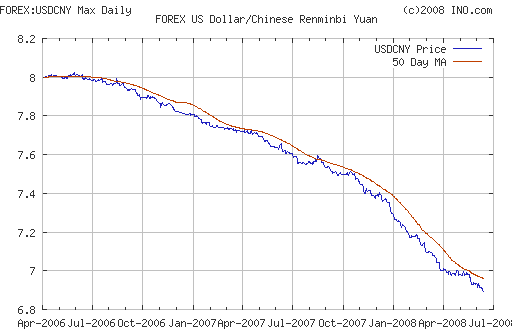

It should be noted that while Ben Bernanke and Hank Paulson preach strong Dollar rhetoric in this country that they are pushing China to allow their pegged currency to appreciate even faster than they are now. By definition, they are begging China to help make the Dollar worth less. The chart below represents the Chinese Yuan versus the US Dollar. This might be on of the smoothest charts in the history of the world. The Dollar has been devalued by around 13% against its Chinese counterpart just since April of 2006.

(Note the opposite direction of the charts due to the expression of the currency pairs)

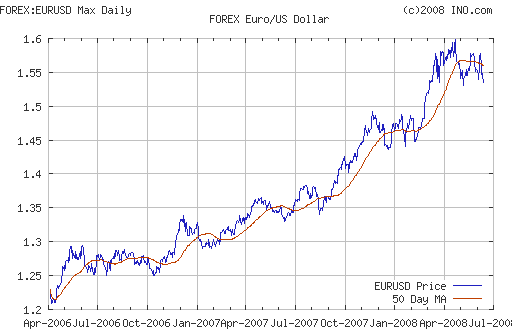

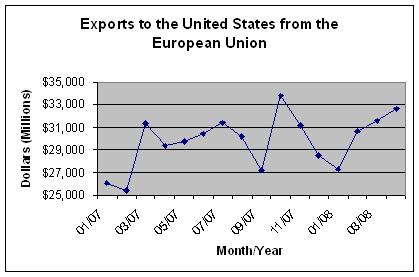

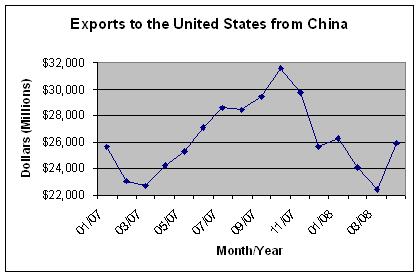

Much in similar fashion, the Euro has been increasing dramatically versus the US Dollar. But the move in the Euro has been much more dramatic making us wonder, is it too much too fast? During the same period, the Euro has appreciated by 27% amid calls from the European community that it was hurting their export competitiveness. The charts below track exports to the United States from the European Union and the People's Republic of China (adjusted for currency fluctuations) by the US Census Bureau who compiles the data on a monthly basis:

It is pretty easy to see from the two charts that the Chinese have a lot more to lose by continued devaluation of the Dollar than the Europeans. Despite a dramatic increase in the Euro over the past 2 years, exports to the United States have remained stable to higher. China on the other hand has seen exports peak in November 2007, then fall precipitously. A continued appreciation of the Yuan is very likely to erode export numbers even further as Chinese goods continue to become more expensive in terms of US Dollars.

A recession in the US is not helping matters any from either the European or Chinese perspective. The take home message here is that the Europeans have comparatively little to complain about in terms of export status to the US . Clearly, at some point in the future a weaker Dollar will hurt their exports, but we're not there yet. Why then all the posturing from EU officials regarding the Dollar? Why is France 's G8 representative Christine Lagarde happy about the fact that the Dollar is appreciating versus her native currency? The answer is too much, too fast. It has slipped out numerous times that it is fine if the Dollar falls, but it needs to be gradual and orderly.

Friendly inflation Data

It has been obvious for some time that our economic data is very accommodating to both current and future monetary policy. We got another dose of more of the same this week as the May CPI was .6% (7.2% annualized). The core CPI (ex-food and energy) came in at a relatively predictable .2%. Low consumer price numbers would have forced the Fed to focus on growth (or the lack thereof). Ironically enough, consumer prices took a break while the Fed was busy lowering interest rates and pumping up the money supply. However, the current focus is on inflation and the Dollar. This constant shift of focus is laughable. We have been discussing rapidly rising consumer prices AND slowing growth for over 2 years now in this column and mapping out strategies in The Centsible Investor since last year. It cannot possibly be fathomed that somehow these two underpinnings of our economic health managed to fly under the radar of Ben Bernanke.

Approximately two months ago we sniffed out this shift in the Fed's focus and wrote about it on April 25th. At that point, they shifted from focusing on growth to focusing on inflation.

Clearly it is easy to see how a country benefits from a strong currency. It buys more overseas and promotes stable consumer prices at home. The problem is that a strong currency requires a level of discipline that those in political office have never been able to attain. They have always capitulated towards excess monetary creation then claiming they are fighting the very problem they themselves created.

While this is common sense, it is important to understand the mechanics of the verbal campaign. Our currency needs officials to bullhorn its position of superiority around the globe since it has been stripped of its merits over the generations by reckless monetary policies and political gerrymandering. There has no doubt been some level of alarm this past year as the Dollar has quick-stepped its way to irrelevance. The precipitous decline even has Main Street talking about the weak dollar, mostly in the context of higher gasoline and food prices. The Dollar's recent decline has awakened the beast central bankers often refer to as ‘inflationary expectations', the mortal enemy of a fiat monetary system.

Good cop, bad cop

What we are seeing now is the policymaking version of good cop, bad cop. Bernanke and NY Fed President Timothy Geithner are on the ‘wait and see' bandwagon while Plosser and others are pushing for higher rates now, despite already record foreclosures and growing levels of default across the entire credit spectrum. One thing we have not seen is anyone at the Fed concerned about economic growth as is evidenced by the relative lack of response to a now 5.5% unemployment rate. Truth told, the Fed must save some of their interest rate ammo. Even though real interest rates are negative essentially across the full range of maturities, the Fed cannot reasonably go below 1% on the Fed Funds rate or the gig is up. That leaves them just 2 more emergency 50 basis point cuts should they be unable to prevent the next phase of the credit crisis from taking center stage. That is not much ammo considering the amount they used to soothe Wall Street during Round 1.

America is on sale

This past week, Dubai was reported to be negotiating a 75% stake in the Chrysler Building in NYC for approximately $800 million. The very next day, the Sorgente Group, an Italian real estate investment firm was reported to have purchased a large share of the “Flatiron” building also in NYC which is reported to have a total value of $180 million. Ironically, the tone of both mainstream news articles portrayed this action as good since foreign real estate purchases are helping prevent an all out collapse in real estate. It must be remembered though that there are long term ramifications. Bottom line and the take-home point here is that a weaker dollar makes American assets cheaper for foreigners. Given their propensity to buy up American assets, a weak Dollar is in their best interests and will allow them to gobble up our assets more quickly and in greater amounts.

Foreigners have the makings of a win-win situation. If the Dollar goes up, they can hope to increase their exports to the debt-laden American consumer, who despite common sense, rising food and gas prices, and a recession is STILL spending. If the Dollar falls, they can purchase the country. Clearly from our country's perspective, we'd prefer the former. Unfortunately, awful fundamentals and a continued unwillingness to make any meaningful changes; policy or otherwise, it would seem as though we're going to get the latter.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.