Silver Longs Still Vulnerable

Commodities / Gold and Silver 2015 Jun 07, 2015 - 04:58 PM GMTBy: Dan_Norcini

About a week ago, I wrote a short piece detailing the excessively lopsided long position in the silver market noting at that time, that anyone who has long needed to be paying very close attention to their positions. (see that article here: http://traderdan.com/?p=4972)

About a week ago, I wrote a short piece detailing the excessively lopsided long position in the silver market noting at that time, that anyone who has long needed to be paying very close attention to their positions. (see that article here: http://traderdan.com/?p=4972)

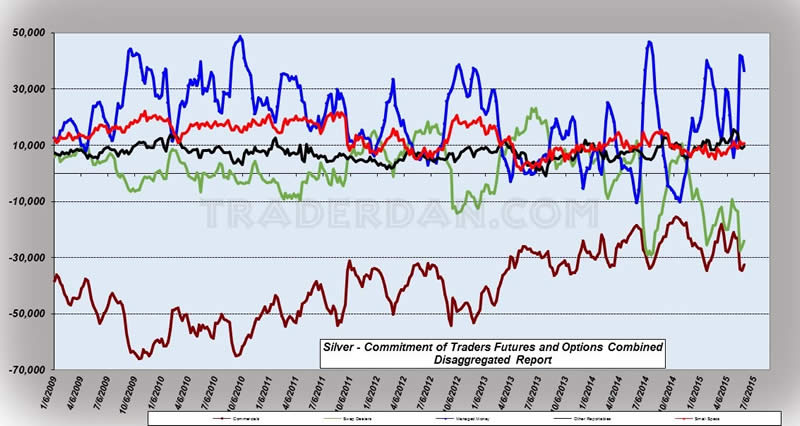

In going over this week's Commitments of Traders report, I see that some of that long position being held by the hedge funds has indeed been whittled down somewhat, but unless a lot more of them bailed out from Wednesday through Friday of this week, that position is still very large and still lopsided.

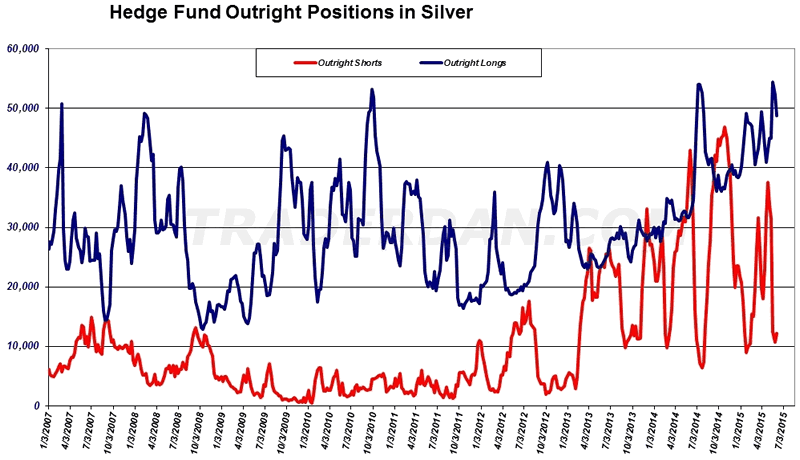

Here are two more charts noting both the NET POSITIONS of the players and the OUTRIGHT POSITIONS of the hedgies.

Silver COT

Hedge Fund Outright Positions in Silver

As you can see on both charts, there has been some lessening of the imbalance but both remain very elevated in spite of the fact that silver is breaking down on the charts again.

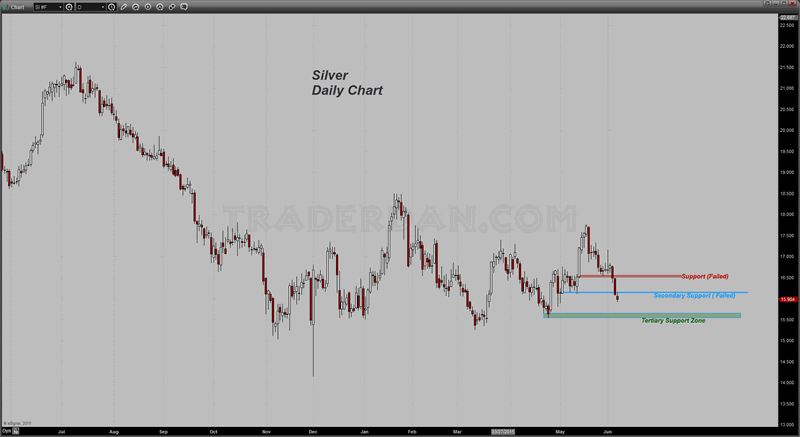

Silver Daily Chart

Two support zones were clearly violated this week. The thing is, both violations occurred AFTER the cutoff date for the Commitments of Traders report which covers only though Tuesday. On Wednesday, the zone near $16.50 caved in. That was followed by a breach of the Secondary support zone on Thursday as $16.20 was broken. Friday then confirmed the breach of both as the market closed below round number, psychological support at $16.00.

I would therefore suspect that a lot more of the grossly imbalanced and lopsided long position of the hedge funds have been dumped. The question is, how many more of these LOSING long positions are they still sitting on?

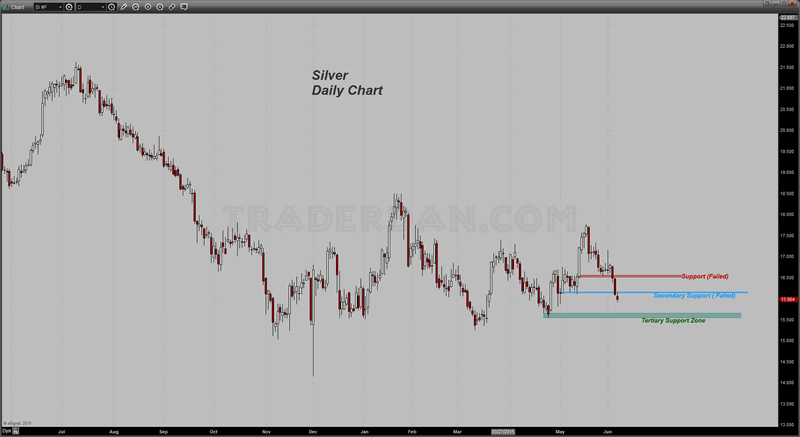

Silver Daily Chart

Based on what I can see, there does not appear to be much more in the way of downside support until one begins to approach the $15.50 level. My goodness, if that were to fail for any reason, silver should easily fall to $15 as those longs trying to hold on are forced out.

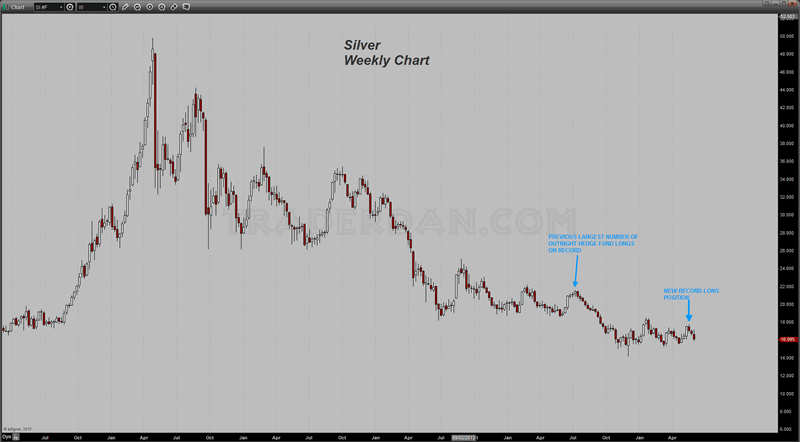

Silver Weekly Chart

Take a look at the intermediate term chart (Weekly). I have noted the previous recent peaks in outright hedge fund long positions. I find it rather interesting to see how many longs the hedgies built in silver back in the summer of last year, which they then had to cough up as the price imploded lower by some $7.00 in the next 5 months. I am not saying this is going to happen again, but the setup is eerily similar. What really sent them packing last year was the breach below $18.50. This time around, it would take a breach of $15.20-$15.10 to set off a cascade lower.

In the past I have noted that Silver is essentially a playground for the funds. If they are buying, it rises and can rise in a big way. If they are selling, it crashes, and it can crash in a big way. They are living up to their reputation as dominating this sand box.

Also, in my view, silver is a play on inflation. A lot of hot money loves to chase it higher if inflation fears dominate the sentiment of the investing world. IN a deflationary environment, it is a great sell.

Its current problem is that inflation is still a long way off in the minds of many large investors. They look around and see the efforts of the Central Banks of the West (and the government of China) to provide some sort of stimulus and understand that this is having the effect of generating some growth and staving off the deflationary headwinds, but also that growth is not yet strong enough to produce any serious inflation.

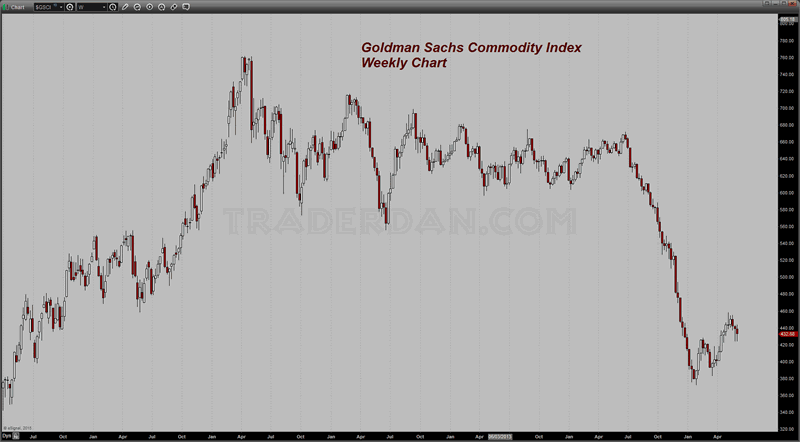

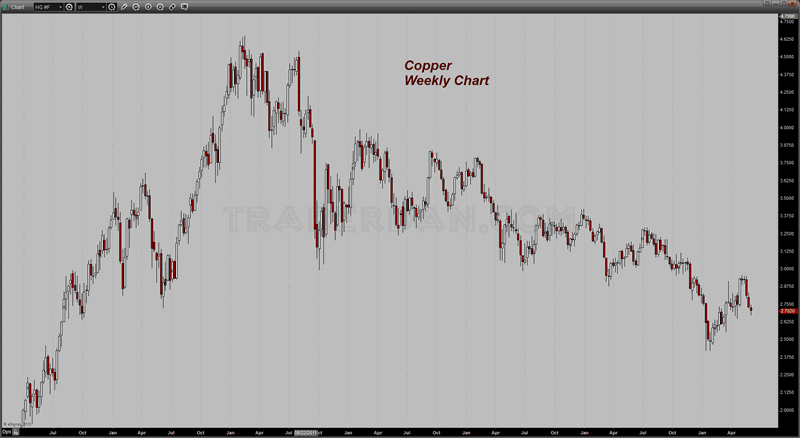

After all, it is hard to argue with the fact that the various commodity indices are moving sideways above a long term bottom. If they were shooting rapidly higher, it would be one thing but how can anyone take silver seriously as an inflation hedge when the copper price is falling to flat-lining and the GSCI is moving sideways. If there is any inflation in the commodity sector/hard assets, it sure ain't showing up on the price charts!

Goldman Sachs Commity Index Weekly Chart

Copper Weekly Chart

The question then becomes, "why in the world I would want to waste precious capital and tie it up in an asset that is a play on inflation" when there is no serious sign of inflation? Yet, we had a huge rush of hedge fund money into silver on the long side, perhaps in expectation of the inflation genie rearing its head, that has now grown increasingly vulnerable to the rude surprise that the rest of the commodity complex is not seeing any serious inflows of hot money playing the "buy tangibles" theme.

That money is now coming out as the chart breaks down with the result that silver is now back to exactly where it was at the end of April. Never mind that as soon as it popped up in May, the usual huckster crowd was back out in full force regaling us all with more outlandish claims of huge silver gains just ahead.

What I find so perverse about that crowd, is that they are the same ones constantly screaming about how poor the economic data really is, and how none of the numbers can be trusted and that the economy is really in much worse shape than the "bogus" government numbers would suggest. Okay - fine - I often doubt many of these same numbers myself but here is the problem with their discombobulated mind process - in order for inflation to take hold in a big way, the economy MUST GROW and it must grow rapidly, especially producing big gains in wage increases. Wage growth is what gives consumers spending or purchasing power and seeing that consumer spending is 70% of the US economy, without it, the economy is never going to grow fast enough to produce the kind of serious inflation in which silver thrives.

So on the one hand we have this crowd of illogical ninnies telling us silver is heading to the moon while at the same time they are poo-poohing any economic data that might happen to suggest signs of real economic growth???

Does anyone besides myself see the utter absurdity of this "analysis". Sadly, there are actually people paying outrageous sums of money for this sort of claptrap.

I want to end this discussion by coming back to the Dollar. It is my personal view that the US should do whatever it can to foster "King Dollar". A strong dollar increases the purchasing power of the US consumer because it allows us to buy foreign goods at a lower cost. It also keeps inflation at bay and puts downward pressure on commodity prices. Personally, I like having my food and energy costs low. I also like being able to go into an electronics store and buying these new TV's and other incredible products more cheaply than I might otherwise be able to do if the Dollar were crashing lower.

Once upon a time, in a galaxy far, far away, a strong currency was considered to be in the best interests of a nation. I would like to hope that we still have some potential political leaders and some FOMC members who actually understand this.

The point to all this is that the stronger the US Dollar becomes, the more contained any serious inflation problems will become. In such an environment, those making a case for a surging silver price are going to be hard pressed to make the least bit of sense.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.