More Ritholtz on Gold, and Another Response

Commodities / Gold and Silver 2015 Jul 29, 2015 - 05:09 PM GMTBy: Gary_Tanashian

Anyone who has been bearish on gold for the last 4 years has been right. They have been right in Euros and though the trend appears to have been gently changing over the last year or two, they have been right in Canada & Aussie (i.e. commodity currencies) dollars as well. Certainly, they have been right that gold as measured in most global stock markets has been (and remains) bearish.

Anyone who has been bearish on gold for the last 4 years has been right. They have been right in Euros and though the trend appears to have been gently changing over the last year or two, they have been right in Canada & Aussie (i.e. commodity currencies) dollars as well. Certainly, they have been right that gold as measured in most global stock markets has been (and remains) bearish.

They have also been right in that gold as a hedge against the kind of inflation that global policy makers have promoted non-stop for years now, has utterly failed. And for gold as an insurance and value asset, a small phase like 4 years is like a blip. Yet still, so many people throw their hats into the ring on gold, constantly micro-managing its every twist and turn.

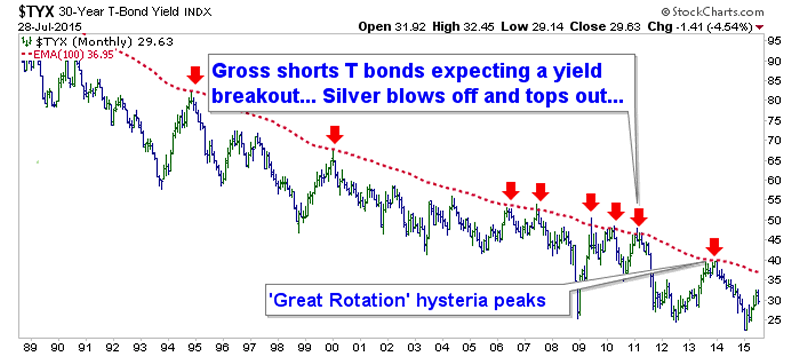

In 2011 it was what we used to call the “Gold Generals” touting hyper inflation, even as the second to last arrow was about to be inserted on our ‘Continuum’ © chart, indicating that anyone taking an aggressive inflationary stance in their investments was also taking a big chance that it would be different this time and the Continuum would break the limiter AKA the 100 month EMA. It wasn’t and it didn’t.

This brings me to Barry Ritholtz again. His piece at Bloomberg titled Good Luck Bargain Hunting for Gold Miners at Bloomberg is more about the valuations of the miners vs. the metal, but it is some of the wording that I want to address here.

The primary reason is straightforward: Gold is bought and sold based on a narrative that has turned out to be patently untrue. As we move further away from the great credit crisis of 2008-09, the global financial system has stabilized, undercutting the appeal of gold as a hedge against catastrophe. The U.S. economy is improving, as are those of many other countries. The wild inflation and collapse of the U.S. dollar that was going to lead to the demise of civilization and make gold an essential for investors? None of that has happened. Instead the world has low inflation or even deflation and the dollar, the world’s reserve currency, has risen to multiyear highs.

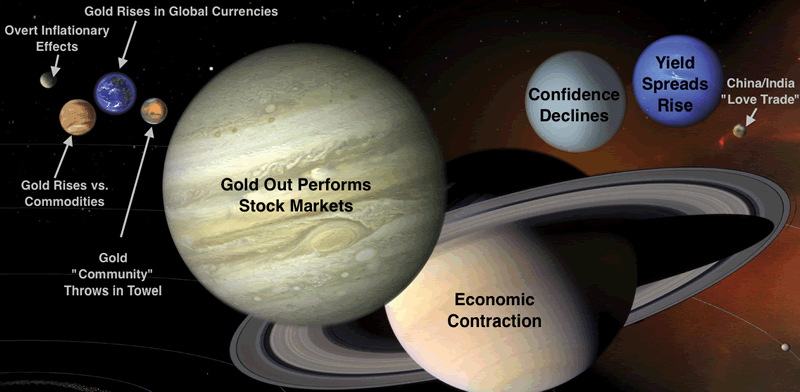

He is right to criticize the hyper inflationist ‘death of the dollar’ contingent of the gold bug “community”, itself a word that belies group-think and susceptibility to bias reinforcement by the group. Did you catch the little ‘Overt Inflationary Effects’ planet in our handy Macrocosm graphic (don’t take its planetary guide literally, it was mostly for fun) from last weekend? There is a reason that I assigned that gold input to the second tiniest planet in the Macrocosm; because it was a wrong headed thesis when Uranium, Crude Oil, Copper and Silver were proven to be bubbles (with relentless inflationist touting of the ‘resources’ and ‘hard assets’ sectors in each case) and it is obviously still wrong now.

This is not to say that inflation cannot be a fundamental input for gold. It has often been a major input. But on this cycle the inflation is not manifesting in rising prices, at least not in relation to the stock market, investment in which can be seen as a ‘hedge’ against price inflation bubbling up in certain services sectors of the economy.

The commodity bubble is all done. The inflation, with the aid of a persistent and powerful global deflationary force, is working in a ‘Goldilocks’ manner and flowing into risk ‘ON’ speculation in paper of all kinds and in some hard assets, just not the kinds that traditional commodity and resources gurus had foreseen. Mainly, the public is doing just fine buying and selling appreciating homes. Who needs several tons of Copper sitting in the garage?

Anyway, back to Barry Ritholtz…

“Gold is bought and sold based on a narrative that has turned out to be patently untrue”

Agreed; the majority of gold bugs have believed the wrong narrative. It was wrong in 2008 and it was wrong again in 2011, and you are using an incorrect narrative as the foundation of your stance in these mainstream media articles that are so cartoonish even the public can understand it.

“the global financial system has stabilized, undercutting the appeal of gold as a hedge against catastrophe”

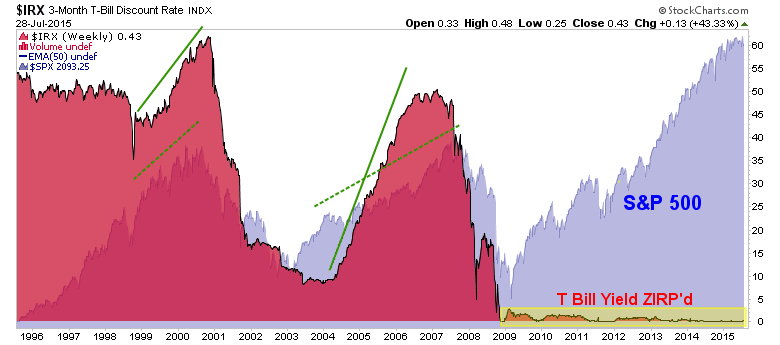

Again, agreed. The system has stabilized but how many times do we have to review this chart before we can all agree that it has taken extraordinary (and incredibly, ongoing) measures with the implication being that neither you Barry, nor I, know how the fallout is going to go based on embedded distortions that no one can fully understand? You call gold a “hedge against catastrophe”. I have never called it that because I don’t see it that way. I have always called it monetary value (which can fluctuate depending on market sentiment) and insurance. Period.

“The wild inflation and collapse of the U.S. dollar that was going to lead to the demise of civilization and make gold an essential for investors? None of that has happened.”

Barry (not that you read this little out of the mainstream website, but work with me here), do you see the larger planets in the Macrocosm above? They represent the kinds of things that drive people to liquidity and a risk ‘OFF’ stance. What is the ultimate risk ‘OFF’ hard asset in a monetary world that while still working fine, has gone utterly mad in its pushing of traditional policy boundaries? Why, it’s gold. But what is the first and most intense repository of that liquidity? It is none other than dear old Uncle Buck, for US citizens and the way things are currently structured, much of the rest of the world as well.

I have criticized the ‘death of the dollar’ and ‘hard assets/resources’ promotions every which way from Sunday for years now and it is due to a view that before the US dollar falls apart it is likely to totally annihilate hyperinflationists first (per Prechter and Hoye to name two). Hence the big planets above are economic contraction, gold rising vs. stock markets, confidence declining and yield spreads indicating systemic stress (inflationary or deflationary). This is why I have remained completely out of the way of the gold sector destruction for 4 years now, with my market report well in tune with that stance.

So yes Barry, “none of that has happened”; thankfully, or I’d have been wrong in my own thinking (always a possibility). But I have seen nothing to dissuade me yet that I am, as a once and future gold bull (and constant valuer of gold as insurance), on the right course. Several macro fundamental aspects need to come into line and we need to find a bottom technically, sure. But your article adds another input to the bullish camp because you are teaching people who should not be in the gold market (mainstream public) at a real bottom lessons based on the same incorrect assumptions made by the Gold Bug “community” that you seem to provoke.

Maybe you even enjoy stirring the pot and getting the hate mail. I can relate to that. While he did not give me permission to reprint his email, a long-term gold bull emailed me the other day noting my “subjective, gold bashing rhetoric” and my “delusional, fiat money bliss” (ha ha ha). This despite the fact that he and I are of the same long-term orientation. It’s just that our inputs are different and so he sees me as basically one step above Satan (what does that make you Barry? Just kidding, but you get my point).

Misconceptions are everywhere and the stuff you base your articles on do not help that situation. I write that as the other side of the coin that gives much critique to misconceived pro-gold promotions.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.