Why Stocks Could Fall 50% if the Fed Makes the Wrong Move

Stock-Markets / Stock Markets 2015 Aug 27, 2015 - 02:55 PM GMTBy: Casey_Research

By Justin Spittler

By Justin Spittler

One of the most brilliant investors in the world just made a stunning call…

Ray Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund. Dalio manages nearly $170 billion in assets. He has one of the best investing track records in the business. When he speaks, we listen.

Dalio has been saying for a long time that governments and businesses around the world have borrowed far too much money. He thinks their high levels of debt have created an extremely fragile and dangerous situation.

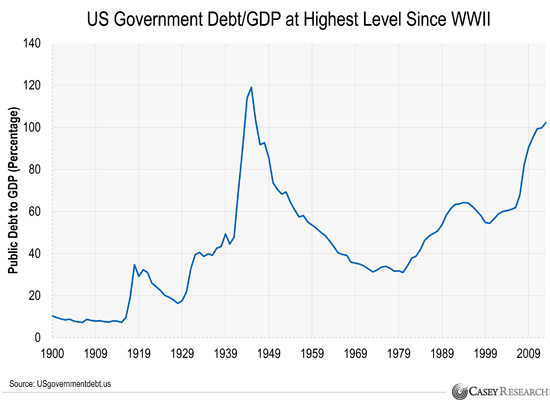

The stats back up Dalio’s view. In the United States, government debt as a percentage of gross domestic product (GDP) is 102%...its highest level since World War II.

Countries around the world are in a similar position. Japan’s debt-to-GDP ratio is at 226% and climbing. In Italy, government debt/GDP jumped from 100% in 2007 to 132% in 2014.

Dalio explained how these extreme debt levels are one reason for the recent market volatility we’ve been telling you about…

These long-term debt cycle forces are clearly having big effects on China, oil producers, and emerging countries which are overly indebted in dollars...

• In an article published yesterday, Dalio said the Fed should start another round of quantitative easing…

Quantitative easing (QE) is when a central bank buys bonds or other assets to lower interest rates and boost asset prices. It’s mostly just another name for money printing.

The Fed started QE in a desperate attempt to stave off disaster during the 2007-2008 financial crisis. It launched the first round in November 2008…a second round in November 2010…and a third round in September 2012. It stopped its last round of QE last October.

The first three rounds of QE fueled a big bull market in US stocks. The S&P 500 has gained 113% since the Fed started QE in 2008.

Dalio thinks the Fed should bring QE back. It’s a bold call, and one that most economists disagree with. Most economists expect the Fed to raise rates soon. Raising rates would tighten monetary conditions…essentially the opposite of QE.

• Dalio is worried the Fed won’t get it right…

Dalio thinks the Fed will raise rates, even if it’s just to “save face.” He pointed out that the Fed has threatened to raise rates so many times that not raising rates would hurt its credibility.

Dalio’s big concern is that the world is too indebted to handle a rate hike. He thinks it could cause a financial disaster like a stock market crash, or worse.

In a letter to clients earlier this year, Dalio made a comparison to 1937, when the world was in a similar situation of having way too much debt. He explained that the Fed made a huge mistake by raising rates, and it caused the stock market to plummet 50%.

The danger is that something similar could happen if the Fed raises rates today.

• We asked Dan Steinhart, executive editor of Casey Research, for his take…

Here’s his response…

I don’t know what the Fed’s going to do. That’s a guessing game. What’s important is Dalio’s point that we’re in an extremely fragile situation. The world has too much debt, and the Fed’s margin for error is tiny. If it takes a wrong step and stocks plummet 50%, it could cause a bigger financial crisis than in 2008.

So the real question is, do you trust the US government and the Fed to manage this dangerous situation?

I don’t. This is the same Fed that blew two huge bubbles in the last twenty years. First the 1999 tech bubble…then the even bigger housing bubble, which almost took down the whole financial system when it popped in 2007.

And keep in mind – this is all a gigantic experiment. The Fed is using tools, like QE, that it had never used before the financial crisis. No one in the Fed, the US government, or anywhere else knows how this is going to work out.

Who knows…maybe the Fed will surprise us and successfully guide the economy through this dangerous period. But that’s not an outcome I’d bet my savings on.

Dan went on to explain two things you can do to prepare for another financial crisis…

One, own physical gold. Unlike stocks, bonds, or cash, it’s the only financial asset that has value no matter what happens to the financial system.

Two, put some of your wealth outside the “blast radius” of a financial crisis. We wrote a new book with all of our best advice on how to do this. And we’ll send it to you today for practically nothing…we just ask you to pay $4.95 to cover our processing costs. Click here to claim your copy.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.