Gold Prices Are Set To Jump or Maybe Not

Commodities / Gold and Silver 2015 Sep 23, 2015 - 10:39 AM GMTBy: Sol_Palha

Hasten slowly and ye shall soon arrive. ~ Milarepa

We were very bullish on gold starting from 2002 and our bullishness continued until the beginning of 2011. In 2011, we started to voice concern as the Gold camp was chanting "Kumbaya my love", and almost every Tom, Dick and Harry in the Gold market were all busy issuing higher targets. Towards the middle of 2011, there were many signs that all was not well. Key technical indicators were issuing negative divergence signals, the dollar was generating strong signals that a bottom was close at hand, and as we already stated the Gold camp was simply too ecstatic for our liking. We advised our clients to close the bulk of their bullion positions and to embrace the dollar as it was getting ready to break out; the rest as they say is history.

From 2011 to the present day, gold experts have continued to proclaim that a bottom is close at hand; on each occasion their dreams failed to materialize. Divorced from reality they continued to grip onto the illusion that just because the Fed was printing more money, Gold was destined to soar to new highs. If this were true, then Gold should already be trading north of $3,500. Since its inception, its sole function, albeit indirectly while boldly proclaiming to do other good deeds was to destroy the dollar. The only difference between yesteryear and today is that the Fed has decided to turbo charge the process. What one needs to understand is that Gold is very much like any other market out there. This means that like all markets, it needs to let out some steam. As it experienced a very strong run up, it was only natural to anticipate Gold that Gold like any other market, would eventually experience back breaking correction. During the market sell off, in August, Gold performed rather dismally as noted in the following statement.

During the market sell off, Gold performed rather dismally and the trend did not strengthen. All this indicates that a bottom might not be fully in place yet. Market update Sept 1st, 2015

How do things stack up now?

Gold has let out a lot of steam, so the downside risk is rather limited from here. Shorting Gold at these levels would be an imprudent decision. The risk to reward ratio is simply not favorable.

Many contrarians, including some Elliot wavers are predicting that Gold is ready to mount a stunning turnaround; we do not share the same sentiment. We would like to, but what you want and what you will get are two different things altogether. Embracing the illusory does not mean it's going to become reality. We do feel that the downside action is limited from here, and if you have not put any money into Gold than deploying some now would not be a bad idea if you are a long term investor; at this point, only put money into bullion. If you have a long-term view, then gold is definitely going to be trading a lot higher three years from now.

Consider the money you are putting into Gold bullion now as a form of insurance against some possible future event. As the world is in the midst of a massive currency war or what we like to fondly refer to as the "devalue or die era", it goes without saying that we will experience another currency crisis at some point in the future. Again, there is no point pandering to the naysayers who claim the world is going to end or that we are going to experience a financial catastrophe, the likes of which we have never seen. This same pathetic broken record has been playing for decades and the world is still here. We agree that another financial type disaster is bound to occur, but we would rather view that as opportunity knocking in disguise, then treat it as a call to flee and hide in a bunker. Disaster is the secret code word for opportunity. The astute understand this and wait for these pristine moments to present themselves. Next time opportunity comes knocking be ready to grab it, instead of slapping it in the face and slamming the door on it. When you take insurance, you do not purchase the insurance because you are sure the house is going to burn down. You purchase it so that you are protected in case it burns down.

Technical Outlook

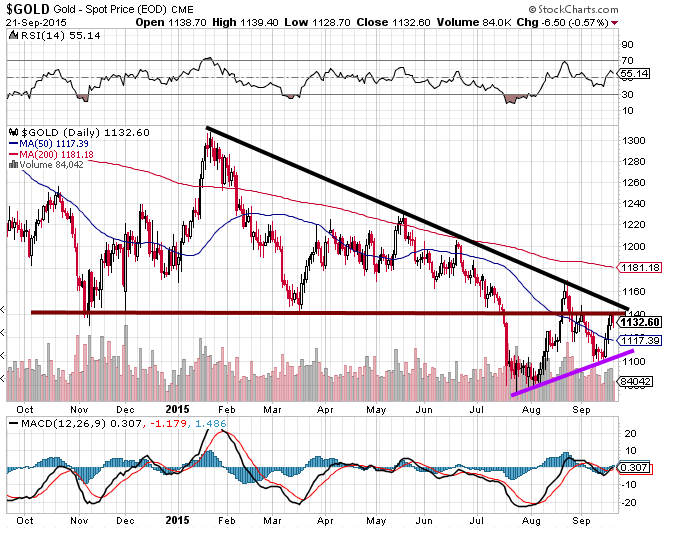

First off, the trend is still not positive and until it turns positive, Gold is going to have a hard time making any significant headway. As we stated before, the risk to reward ratio does not favor shorting the gold markets. From a long term perspective, deploying some money into Gold bullion would be the prudent thing to do. The short term chart above illustrates that Gold is currently hovering around a zone of resistance. It needs a weekly close above the $1150-$1660 ranges (preferably $1160) to suggest that it has a chance of testing the $1200 ranges. As long as Gold does not trade below $1100 on a closing basis, the short term uptrend will remain valid. A close below $1100 will break the higher low formation that Gold is presently attempting to maintain and indicate that further retest of the lows is highly likely. If Gold can close above $1160 on a weekly basis, it will set up the path for a test of the $1220 ranges.

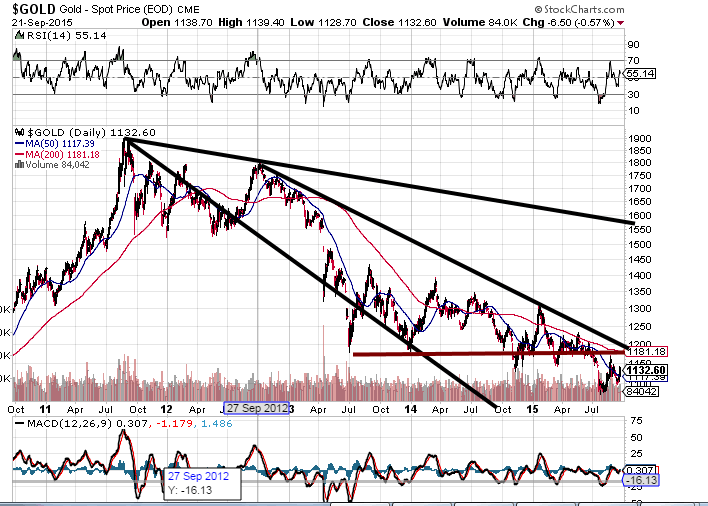

The five year chart perfect depicts the brutal correction Gold has experienced. Different levels of resistance come into play here. Gold needs a monthly close above $1200 to indicate that a long term bottom is in place. Until this is achieved every rally most likely fail. The second key and important level of resistance that one should pay attention to falls in the $1550 ranges. Only when Gold trades above this line, will it be ready to surge to new highs. We expect gold to face sizeable resistance in this zone, but it will make for an important inflection point. Astute traders should take note of this zone. When Gold overcomes this hurdle, the upward trajectory will pick up speed. A monthly close above this level should set the path up for a fast and rapid move to the $1850-$1900 ranges. Gold is not trading remotely close to this level at the present moment, so there is no point discussing higher targets now.

Conclusion

Gold is not gearing up to soar (at least not yet) as it has not revealed any signs of strength. However, as the downside risk is rather limited in nature, deploying some money into Gold could not be construed as a foolish move. If you take this road, you should do so with the intent of buying more if Gold drops below $1100. In terms of Gold stocks, we would hold off a bit longer them, until Gold bullion has bottomed out. If you are okay with volatility then you could look at some of the bigger player's such as NEM, ABX, and the GLD, the Gold ETF.

Man who stand on hill with mouth open will wait long time for roast duck to drop in. ~ Confucius

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.