Gold Analogue: Then and Now

Commodities / Gold and Silver 2015 Oct 29, 2015 - 11:24 AM GMTBy: DeviantInvestor

1970s: Gold rallied from about $35 in 1970 to nearly $200 in December 1974, and then fell to about $100 in August 1976.

1970s: Gold rallied from about $35 in 1970 to nearly $200 in December 1974, and then fell to about $100 in August 1976.

So what?

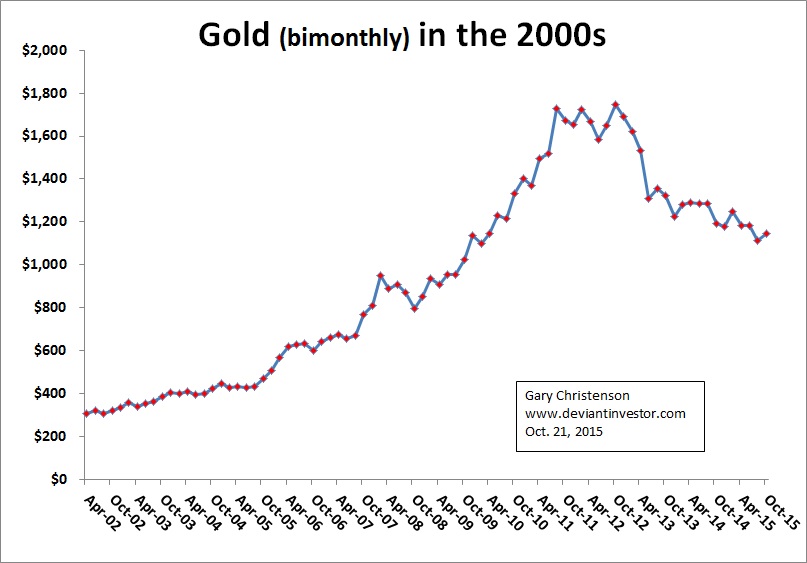

Examine the graph of average monthly gold prices Jan. 1970 – Sept. 1976. Compare it to the graph of gold prices from April 2002 – October 2015. Note that the second graph was prepared with the same number of data points, but the time scale was doubled – each point is a two month average price. Note the similarity in form. The first is scaled $0 to $200 and the second $0 to $2,000.

What we see:

- Gold prices increased by a factor of almost six from 1970 to 1974, and then fell by about 45%.

- Gold prices increased by a factor of about six from April 2002 to August 2011, and then fell by about 45% from the peak.

- Both the rally and correction in 2002 – 2015 took about twice as long as in the 1970s.

- Subsequent to the 1976 bottom, gold prices increased by a factor of about eight in a massive bubble inspired by, among others, inflation worries, fear, and loss-of-confidence in government and central banks.

What does this prove? Well … it proves nothing. But it suggests a few observations.

- Gold prices can be amazingly volatile, especially when fear increases and a majority of people lose confidence in debt based fiat currencies, central banks, and politicians.

- If the analogue continues for several more years, we might see gold prices increase by a factor of five to ten into the $5,000 to $10,000 range in five to seven years (double the 3.5 year rally in the 1970s).

- We should not expect this analogue to predict gold prices, but we should NOT discount the possibility of a similar pattern unfolding.

Why?

- In the late 1970s the US had lost international prestige due to a weak President (Carter), massive inflation and excessive debt.

- Today the US has lost considerable prestige in the Middle-East, Europe and Asia, has excessive debt, no capacity to balance the budget, and has twice elected a President who is …. (your choice of complaint).

- The late 1970s inflation was partially a consequence of massive spending on the Vietnam War – which benefitted few besides military contractors and bankers.

- Today the US has yet to experience and pay for the consequences of wars in Afghanistan, Iraq, Libya, Syria, and Ukraine, but unpleasant consequences will occur. Those wars primarily benefitted military contractors and bankers.

- Central bankers and politicians lost considerable respect in the late 1970s.

- Central bankers and politicians have lost considerable respect in the past several years.

- Debt based fiat currency, backed by nothing but faith, hope, delusions, and taxing authority was deeply devalued in the late 1970s.

- Debt based fiat currency, backed by nothing but faith, hope, delusions, and taxing authority will be deeply devalued in the coming years.

CONCLUSIONS:

There are similarities between the late 1970s and present day. Gold rose substantially for 3.5 years in the late 1970s and increased in price by a factor of about eight. Something similar could (probably will) happen again.

NONSENSE – such as deficit spending, massive debt, excessive leverage, unindicted fraud, pervasive corruption, derivative contracts with minimal margin, hope and delusions, bond monetization, suppressed interest rates, levitated stock markets, forever wars, and so much more – encourages people to think:

- People want to be prepared with the 4 G’s: God, gold, guns, and grub.

- The politicians and central bankers created most of the problems so it is foolish to believe they will solve current problems. Expect more fiscal and monetary nonsense, devaluation of currencies, inflation, and higher gold and silver prices.

- War pays extremely well – if you are a military contractor, banker, or politician – so expect more war. More war creates much more debt, inflation, and fiscal and monetary nonsense.

- The US Congress has a low approval rating – for good reason.

- Debt cannot grow to infinity nor can interest rates remain near zero forever.

- The “silly season” when the US elects a new president is not a time to expect serious and intelligent discourse or change toward fiscal and monetary sanity.

- Time to prepare may be quite short.

- Paper dies, gold thrives.

- Paper dies, silver thrives.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.