How Many More U.S. Recession Confirmations Do You Need?

Economics / Recession 2015 Nov 14, 2015 - 07:04 PM GMTBy: James_Quinn

Despite the bogus BLS employment report last week (so the Fed could raise rates before the next financial crisis hits), all economic data confirms an economic recession. Corporate profits are falling, and their forecasts for next quarter are worse. Global trade is slowing dramatically. Oil prices and other commodities are plummeting to multi-year lows. Manufacturing and Services surveys are flashing red. China, Japan and European economies continue to suck wind. Layoff announcements by major corporations are up 40% over last year. A global deflationary recession is underway. Only a CNBC bimbo, shill or Ivy League educated economist isn’t bright enough to see it.

Despite the bogus BLS employment report last week (so the Fed could raise rates before the next financial crisis hits), all economic data confirms an economic recession. Corporate profits are falling, and their forecasts for next quarter are worse. Global trade is slowing dramatically. Oil prices and other commodities are plummeting to multi-year lows. Manufacturing and Services surveys are flashing red. China, Japan and European economies continue to suck wind. Layoff announcements by major corporations are up 40% over last year. A global deflationary recession is underway. Only a CNBC bimbo, shill or Ivy League educated economist isn’t bright enough to see it.

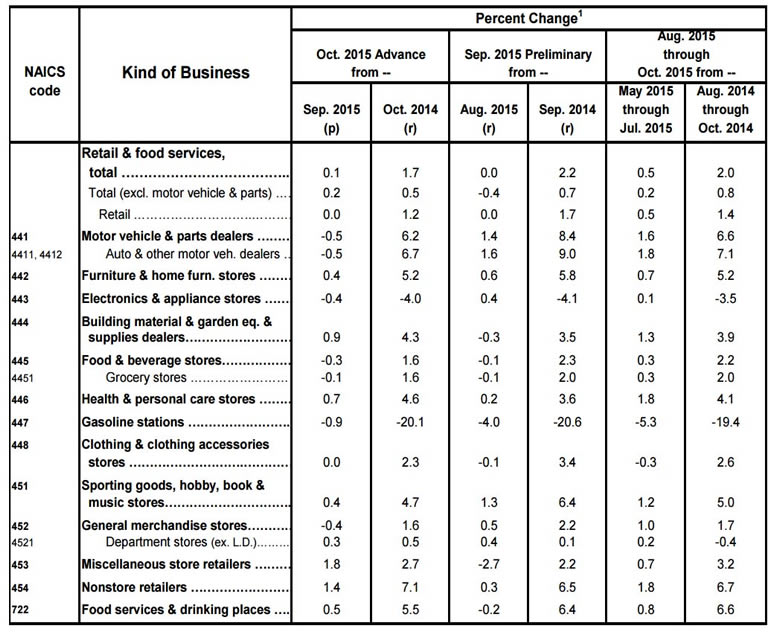

Retail sales came out this morning and they were worse than dreadful. They confirmed the horrific quarterly reports from Macy’s, Nordstrom’s, and Kohl’s. Total retail sales grew a minuscule 0.1% from September and only 1.7% versus last year. It’s even worse than it looks. When you back out the subprime auto loan spurred auto sales (long term rentals), retail sales grew only 0.5% over last year. That is far less than true inflation, so on a real basis retail sales are FALLING like a rock. This only happens during recessions. And it isn’t a one month thing. Retail sales, even including loan boosted auto sales, are flat over the last three months and up only 2.1% for the first 10 months of the year.

The decline in gasoline sales due to plunging prices has contributed to the lousy retail sales numbers, but the storyline of the economic bulls was how this was going to boost the spending of consumers across the board. That storyline is as dead as an Obamacare patient. It seems all the gasoline savings immediately went to pay for the soaring cost of Obamacare, even though the BLS says there is no healthcare inflation. There are a few areas that jump out at me and paint an even darker picture:

- Three of the strongest retail sales categories over the last year were auto sales, furniture sales, and building materials, with growth of 6.2%, 5.2%, and 4.3% respectively. The main reason these three areas have been relatively strong is because you don’t need cash, a minimal level of income, or even a job to make a purchase at these retailers. All you need is for the finance company employed by the retailer to approve you for a loan. The 7 year 0% auto loans go to those with decent credit. The subprime loans go to anyone that can fog a mirror. Every furniture retailer is offering 5 years with no interest payments for their Veterans Day sales. Lowes and Home Depot offer no interest for 12 or 24 months for any purchase over $500. It’s the Fed’s easy money 0% interest scheme that is producing this fake strength. The people “buying” those cars, sofas, and washing machines don’t have the money and when the bill comes due, the losses will be epic.

- The powers that be should really start worrying after seeing the auto sales crash, despite huge incentives being offered by the desperate car dealers, along with the easy credit. It seems they may have saturated the market by giving away brand new cars to anyone with a pulse. At least the Repo companies will be booming over the next few years and used car prices should crash.

- Another strong area has been restaurants and bars, with 5.5% year over year growth in October. This is significantly lower than the growth earlier in the year, but it is still decent. I believe this is the area that will be the last to crash. Older people are drowning their sorrows at bars. Young people, living with their parents, can’t afford houses, rent, or vehicles, but socializing with their friends using a credit card is still possible. Life has become so miserable for so many people, the only enjoyment they can find is going out to a restaurant or bar.

- The last strong area is internet retail, with a 7.1% growth over last year. Despite state governments doing their best to crush internet retailers by adding sales tax to most transactions, consumers are staying away from malls in droves. Who would possibly want to drive miles to a crowded decaying mall, venture into a Sears, Kmart, or JC Penneys and deal with the low IQ drone employees, find out what you wanted is out of stock, or pay more than you would on-line? Amazon and the rest of the on-line retail establishment will continue to destroy bricks and mortar retailers.

- Besides gas stations, only department stores and electronics stores have negative YTD sales after 10 months. The downward death spiral of Sears, Penney, Macys, Best Buy and many lesser retailers will not reverse. Their real estate is old, decrepit, and antiquated. After this Christmas season there will be announcements of hundreds of store closings, as ghost malls spook our suburban sprawl landscape.

Lastly, one final chart to show even the most brainless twit on CNBC that we are presently in a recession, despite the rhetoric and propaganda being spewed by the dying legacy media. Look closely at where retail sales peaked and began to fall. Quantitative easing stopped on October 29, 2014. Shockingly, retail sales began falling and haven’t stopped. The trillions of fiat printed since 2008 has solved nothing.

Doctor Bernanke and doctor Yellen injected a massive dose of adrenaline into a patient with cancer. The patient showed the appearance of recovery, but the cancer has metastasized and spread through the entire system. Competent doctors would have cut the cancer out by allowing bankrupt banks to liquidate and purging the system of cancerous debt. Instead they took steps to promote the proliferation and spread of the cancerous debt. Now the ptient is terminal.

If it looks like a recession, walks like a recession and quacks like a recession, it’s a recession.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.