Will Gold Price Drop Below $1000 Soon?

Commodities / Gold and Silver 2015 Nov 23, 2015 - 03:49 AM GMTBy: Brad_Gudgeon

First of all I would like to say that last week was our best trading profit week ever since we began trading NUGT and DUST on August 19th of this year. Using e-wave, cycles, technical indicators and astrology, we were able to catch the bottom on GDX Wednesday around $13, expecting a move to cover the gap near $14.08 by Thursday or Friday (it tagged $14.06 on Thursday and on Friday $14.07). We then shorted the miners via DUST when GDX went above $14 a share. GDX ended Friday at $13.40.

First of all I would like to say that last week was our best trading profit week ever since we began trading NUGT and DUST on August 19th of this year. Using e-wave, cycles, technical indicators and astrology, we were able to catch the bottom on GDX Wednesday around $13, expecting a move to cover the gap near $14.08 by Thursday or Friday (it tagged $14.06 on Thursday and on Friday $14.07). We then shorted the miners via DUST when GDX went above $14 a share. GDX ended Friday at $13.40.

The answer to the gold question is a resounding YES! All indications point to another leg lower for gold into around December 2nd to just below $1000 an ounce (targeting around $975 ). The correlation between the precious metals and the stock market is important at this juncture, as everything looks to be lining up for a commodity lead drop (think especially the oil sector) that will affect more economic sectors. This could lead to a rise in volatility ahead as we see a rotation out of dollar sensitive sectors and into others that will benefit more from a stronger dollar.

I believe by reading the 'astro tea leaves', a rise in interest rates is coming back to the foreground again (think FED special closed door meeting Monday), and this points to a higher dollar and deflation concerns. The balancing act the FED is playing (between inflation and deflation) can last only so long before we either have a deflationary economic collapse or an inflationary boom that will result in even a bigger collapse.

I my opinion, if we see increased volatility in the next 2 months like we saw in December '14 to early February '15, the inevitable bigger drop (than the late May to August 24 drop) next year will be postponed by 3-6 months, but is inevitable in any case. If we see a lack of greater volatility going forward, with a failing Dec 15th top and a shallow retracement going into early December, the piper will likely be paid sooner rather than later. Also, if the expected drop next comes later rather than sooner next year, it will likely be larger than if sooner. The time frame I'm speaking about runs from about mid spring to mid fall of 2016.

Overall, I don't expect anything huge yet (like what happened in 2007-09) until around 2017-2020. I believe that time frame will see a much larger bear market than what occurred in 2007-09, rivaling the 1929-32 stock market bear (my bear market target is 443 on the S&P 500 and around 3650 on the Dow Industrials based on Elliott Wave Theory).

Gold's 8 year cycle low is due in mid/late 2016. We could see gold go as low as the 2008 bottom near $667. A stronger dollar will likely be the cause. The US based multinational corporations will suffer from a stronger dollar, imploding sales and should keep a lid on overall stock market growth. In a nutshell, I don't see much higher prices in the stock market than where are right now. However, I do believe we will see new highs next year, just not much higher.

It is my opinion that the "buy and hold" retail investor will again suffer through another choppy, toppy market like we had last year.

Below are charts of the SPX, GDX and GLD with commentaries:

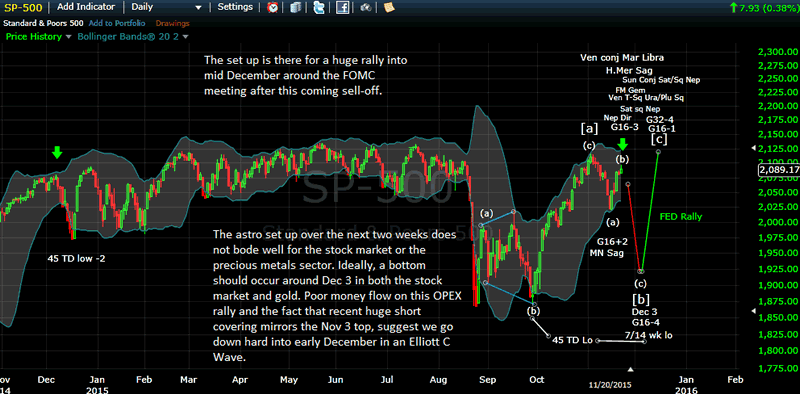

S&P500 Daily Chart

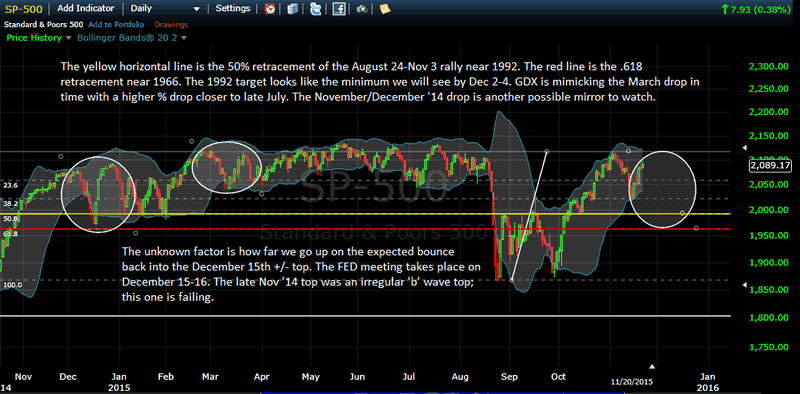

S&P500 Macro Daily Chart

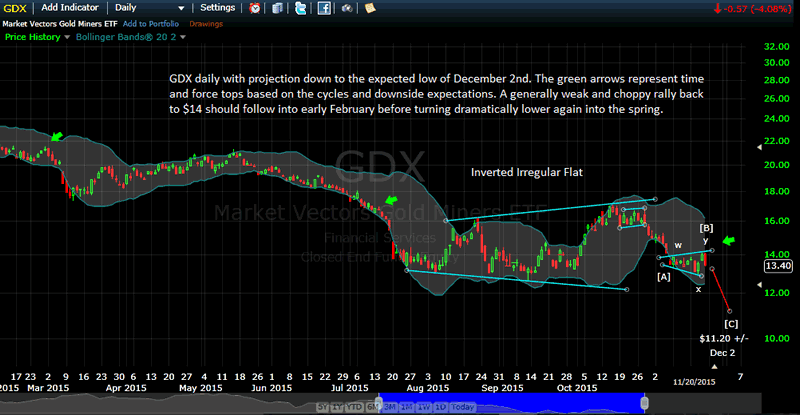

GDX Daily Chart

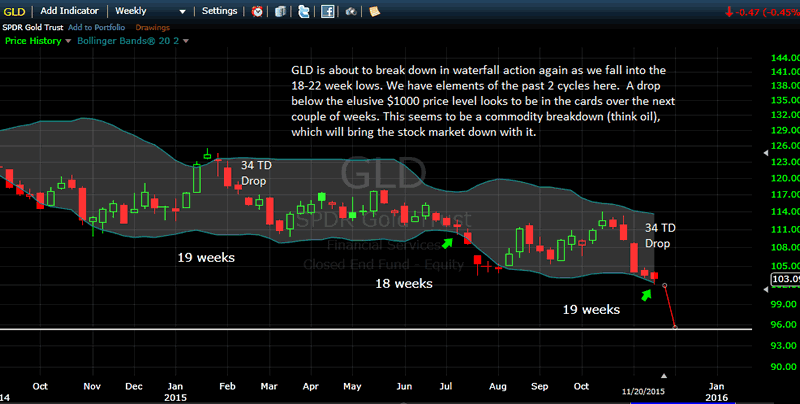

Gold Trust Weekly Chart

My C2 verified BluStar3XGold trading signal is +109.9% as of August 19, 2015. I correctly called for bear rally strength later in the week last week for GDX and a bullish week in the stock market. My original November 25 call for a top in the stock market has been shortened to November 20th.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.