Stock Market Short Sellers Back In The Saddle: Q&A With Bearing Asset Management

Stock-Markets / Stock Markets 2016 Jan 21, 2016 - 10:59 AM GMTBy: John_Rubino

The improbable success of The Big Short, a scathing and hilarious tutorial on making money during a financial crisis, probably has a lot of people thinking that now might be a good time to start betting against the current bubble(s).

The improbable success of The Big Short, a scathing and hilarious tutorial on making money during a financial crisis, probably has a lot of people thinking that now might be a good time to start betting against the current bubble(s).

That’s a well-timed thought because it comes after three long years in which shorting was really, really hard. Why was it hard? Because easy money — at first — floats all boats. When interest rates are low and financing is readily available, even the crappiest companies can pay their bond interest and support their share price with debt-fueled share repurchases. The uniformity of the past few years’ bull market was so extreme that buying the most heavily-shorted stocks — on the assumption that those companies would have access to sufficient capital to support their market value, thus forcing the shorts to cover at ever-higher prices — was a successful and widely-practiced strategy.

But as Warren Buffett likes to say, when the tide goes out you see who’s swimming naked. And in the past year, as the US stopped quantitatively easing, China stopped buying commodities and oil tanked, the tide has gone out with a vengeance. Already, the Russell 2000 index of small-cap stocks is down 22 percent from its cycle high and fully half of the S&P 500 is down more than 20%.

Long-suffering short sellers, as a result, now find themselves in a target-rich environment reminiscent of The Big Short’s final act. Dallas-based Bearing Fund is a case in point. After a “humbling” couple of years, partners Bill Laggner and Kevin Duffy have ridden some high-profile short positions (including SunEdision, Wynn Resorts and Valeant) to big gains, with — if this bubble deflates according to the standard script — much more still to come. Here’s a short Q&A compiled from an exchange of emails:

DollarCollapse: The past few years have been tough for short sellers. But during 2015 that changed in a big way. What happened?

Laggner and Duffy: The commodity bubble actually began to crack in 2011, led by deterioration in China and the first convincing signs of governments losing control. But speculators continued to stay at the casino, especially in the US where short-term interest rates remained at zero. So unlike the last bubble where real estate was the main collateral, this series of echo bubbles included any kind of financial asset.

After the commodity sector was hit, other related countries’ stocks and currencies began to falter, led by Brazil and Russia. The last shoes to drop were various sectors of the US economy as endless intervention finally exhausted itself and nonfinancial operating profits peaked. By the end of 2015, 52% of the stock market was down 15% or more.

DC: You maintain a list that’s a mirror image of those that most money managers compile, because yours — the Bearing Short Index — is made up of things that you expect to go down. How has it performed historically and recently?

L & D: When we created the Bearing Credit Bubble Index in 2004 our goal was to demonstrate where the real distortions were playing out from central bank largess. Those sectors eventually declined by 70%-80%.

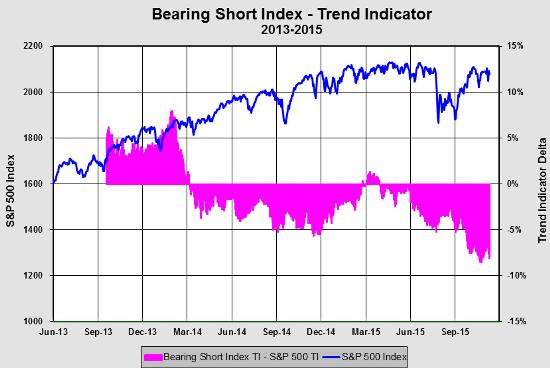

About 18 months ago we constructed an equal-weighted index of our short selling universe at the time, 53 stocks. From its all-time high on June 23, the Bearing Short Index was down 20.3% by mid-December. Over the same period, the S&P 500 was -4.8%. Of the 53 stocks in the index, 11 were down over 40% from their 52-week highs while 5 were down over 60%.

In other words, the past six months have been ideal for short sellers and miserable for a number of high profile hedge funds which have been long many of these formerly highflying stocks.

The coordinated central banking interventions this cycle led to numerous distortions in a variety of sectors and over the last 12 months the Bearing Short Index has declined at roughly 4X the rate of S&P 500. So clearly we’ve identified some of the more egregious actors.

DC: What are your main themes? In other words, what parts of the global economy do you expect to do most badly from here?

L & D: Prolonged ZIRP has fueled the biggest bubble since ’00. China led the charge by expanding debt by over $18 trillion since ’09, so unwinding that means lower commodity prices and Chinese bank solvency problems.

Meanwhile, the infatuation with anything offering yield like REITs, MLPs, junk bonds, alternative energy “yieldcos” will end in tears once the commodity carnage is recognized by the market.

Finally, much of the debt from the prior two bubbles was never allowed to deflate. So excess everything (derived from cheap credit) will ultimately lead to contraction in economic activity/profits, driving most asset prices back below fair market value.

DC: Right now the world is in chaos and most categories of financial assets are falling hard. How long do you see this continuing and how will you know when a bottom is in?

L & D: Well, we know that getting here [since the 2008-2009 crisis] took almost $63 trillion in new debt globally and a tremendous level of financial engineering/leverage, so with pieces of the commodity cycle crashing to earth we would say this is the top of the second inning. Bottoms take time and unfortunately moral hazard created by bailouts/stimulus has encouraged many to await the next rescue mission experiment. Of course, margin clerks are getting busy and many of the speculators are playing with rented merchandise, so selling begets selling.

At the bottom you will see despair, frustration, and obviously no discussions at cocktail parties about stocks or real estate investing.

DC: What role do precious metals play in the world you see coming? How do you choose among the various ways of owning/betting on gold and silver?

L & D: Gold is unencumbered money so owning gold is really just insurance in the event fiat currency systems end badly. Of course owning gold miners is much more challenging as the industry became distorted from suppressed interest rates and related malinvestment. We’ve tried to find good operators in relatively safe jurisdictions with lows costs. The recession in mining coupled with low energy costs has allowed many of these companies to lower all-in sustaining costs so gold miners look attractive again.

DC: You’re both followers of the Austrian School of economics. How does this inform your decision making?

L & D: The economy is a complex adaptive system similar to the brain, the Internet, and ant colonies. The connections are important and information gets transmitted via the price system. Austrians recognize that interfering with freely determined market prices (by central command) sends the wrong signals to economic actors. When a central bank suppresses the price of credit – interest rates – bad things happen. To quote Jim Grant, “This is like turning all the traffic lights green.” One possible result of this is inflated asset prices and an unsustainable boom.

Austrian Business Cycle Theory tells us that the depth of the bust will be proportional to the boom. Since we just witnessed a tripling of stock prices over a 6 year period, we expect the ensuing bust to be historic. As Austrians, we also know to look for areas of malinvestment on the short side, typically long-term grandiose projects (like record high skyscrapers in China) or consumer goods where long-term financing is offered (such as 7 year auto loans). On the long side, it suggests we keep it simple and invest in basic necessities like food and affordable luxuries like beer. “When the going gets tough, people eat, drink and smoke.”

Full disclosure: Bearing and DollarCollapse have an advertising relationship.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.