Another Corporate Giant Is Leaving the U.S. – What This Means for You

Companies / Corporate News Feb 04, 2016 - 05:48 PM GMTBy: Casey_Research

By Nick Giambruno

By Nick Giambruno

Try getting in shape for a marathon on an all-McDonald’s diet...

You wouldn’t be surprised to come in dead last. After all, you didn’t put in much effort. Actually, you went out of your way to make yourself less competitive. So you would expect to lose.

It’s just common sense.

But this is exactly what U.S. politicians have been doing for years: passing tax laws that sabotage the country’s global economic competitiveness.

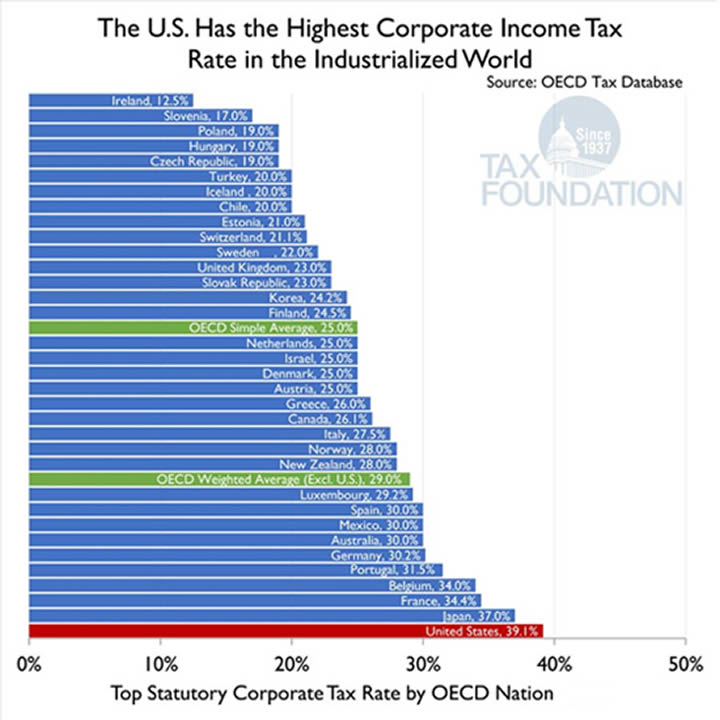

As you can see in the chart below, the U.S. has the highest effective corporate income tax rate in the developed world. This is a major reason why the U.S. is lagging behind in the global economic marathon.

These “worst in the developed world” tax laws are clearly hurting the global competitiveness of U.S. companies.

Oppressive U.S. corporate tax liabilities make doing business similar to trying to swim in a lead jacket. So it’s no surprise that an increasing number of productive people and companies are trying to rip off that lead jacket so they can stay afloat.

At this point, it’s more than just a trickle. It’s an increasing trend.

Putting the Beast on a Diet

Over the past couple of years, dozens of high-profile U.S. companies have moved abroad to lower their corporate income tax rate. No surprise, this makes them more globally competitive.

Medical manufacturer Medtronic moved to Ireland.

Telecommunications giant Liberty Global moved to the UK.

DE Master Blenders—the tea and coffee arm of Sara Lee—moved to the Netherlands.

Omnicom Group, the largest U.S. advertising firm, also moved to the Netherlands.

Burger King moved to Canada.

And these are just a few of the most prominent companies breaking the shackles.

The strategy these companies use is called an inversion. It’s where a U.S. company merges with a foreign company in a country with lower corporate taxes and reincorporates there.

Meddling politicians and the mainstream media like to howl and shriek about inversions. They say the practice is “unpatriotic” or “un-American.” That’s nonsense. The fact is, inversions are perfectly legal. Nothing in the current incarnation of the U.S. Tax Code prohibits them.

Chuck Grassley, a Republican senator from Iowa has said, “These expatriations aren’t illegal. But they’re sure immoral.”

I beg to differ.

Why would anyone give the thieving bureaucrats in DC a penny more than they legally have to?

As far as I’m concerned, there is nothing ethically or morally wrong with inversions. Moreover, they are vital for starving the Beast.

I say, the less money available to politicians and bureaucrats, the better. It means they have less to spend on mischief like provoking wars or bribing voters with more welfare.

Johnson Controls is the latest high-profile company to put the Beast on a diet.

Johnson Controls is a Milwaukee-based $23-billion manufacturing giant. On Monday, the company announced plans to merge with Tyco International and reincorporate in Ireland.

The move will save the company over $150 million in taxes every year.

It’s really a no-brainer.

Neither Johnson Controls nor any other U.S. company has an obligation to fill government coffers. But they do have an obligation to their shareholders to avoid waste. That’s why they’re moving to Ireland, away from the worst corporate tax environment in the world.

What Comes Next…

Contrary to government propaganda, the companies trying to stay competitive aren’t the villains in this story.

The villains are the wasteful politicians who passed the “worst in the developed world” tax laws in the first place.

Right now, it is highly unlikely politicians will reduce the onerous U.S. corporate tax burden. Given the current political dynamics—ramped-up spending on welfare and warfare policies, as well as an “eat the rich” mood—taxes have nowhere to go but up. This means the corporate exodus will continue.

It’s never good when a country drives away its most productive companies and people. It’s making the U.S. economy even more fragile.

These foolish policies will actually make the U.S. government more financially desperate. That’s because they will ultimately result in fewer tax dollars.

Like most governments that get into financial trouble, I think the U.S. will keep choosing the easy “solution”…money printing on a massive scale.

This has frightening implications for your financial security. These politicians are playing with fire and inviting a currency catastrophe. This is a big reason why I think everyone should own some gold.

Gold is the ultimate form of wealth insurance. It has preserved wealth for millennia through every kind of crisis imaginable. It will preserve wealth during the next crisis, too.

But, if you want to be truly “crisis-proof”, there is more you can do...

Most people have no idea how bad things can get when an economy collapses, let alone how to prepare…

How will you protect yourself in the event of a crisis? This just-released video will explain what you need to know to get started. Click here to watch it now.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.