Currency Wars, the Devaluation Delusion

Currencies / Currency War Mar 29, 2016 - 12:00 PM GMTBy: Steve_H_Hanke

In 2010, Brazil’s Finance Minister, Guido Mantega, coined the phrase “currency war” when he complained about the “cheap” Chinese renminbi (RMB). Mantega claimed this gave China an unfair trade advantage. As he put it to the Financial Times, “we’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness.”

In 2010, Brazil’s Finance Minister, Guido Mantega, coined the phrase “currency war” when he complained about the “cheap” Chinese renminbi (RMB). Mantega claimed this gave China an unfair trade advantage. As he put it to the Financial Times, “we’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness.”

That was then. Now the Brazilians are conspicuously silent, because the shoe is on the other foot. The Brazilian real has lost a whopping 25% against the RMB since January 2015. The currency wars continue and are every bit as intense as they were back in 2010, when Mantega coined the phrase.

But, the conventional wisdom about the wonders of weak currencies long predates Mr. Mantega - economists and political leaders have been deceiving the public on the advantages of currency devaluations for centuries

The advertised goal of a devaluation is to increase the price of foreign produced goods and services and decrease the price of domestically produced goods and services. These changes in relative prices are supposed to switch domestic and foreign expenditures away from foreign produced goods and services towards those produced domestically. This is supposed to improve the devaluing country’s international trade balance and balance of payments.

For the public, this argument has a certain intuitive appeal. After all, a devaluation is seen as nothing more than a price reduction for domestically produced exports, and price reductions are always seen as a means to increase the quantity of goods sold. When it comes to currency devaluation, the analysis is not that simple, however. Even if we use a narrow, Marshallian partial equilibrium model (one consistent with the common man’s economic intuition) to determine the effects of a devaluation, the analysis becomes quite complicated. Contrary to the common man’s conclusion, a devaluation will often result in a reduction of exports and a deterioration in a country’s trade balance and balance of payments. When the models become more general and inclusive, a light shines even more brightly on just how confusing and contradictory the arguments favoring devaluations are. Calls for devaluations, as popular as they might be, are a delusion.

But, without entering the technical weeds of economic analysis, it is clear why a devaluation strategy is a loser’s game. In 1947, the famous Cambridge don Joan Robinson penned “Beggar-My-Neighbor Remedies for Unemployment.” She not only coined the phrase “beggar-my-neighbor,” but concluded that so-called competitive devaluations would be unsuccessful in achieving their advertised objectives. Among other things, Robinson wrote that a devaluation would prompt a retaliation in the form of a competitive devaluation. Thus, the initiator of a currency war could, and would, always be neutralized – checkmate.

The case against devaluations is even stronger than this. In spite of their continued popularity, both economic theory and evidence fail to support them. Let’s take a look at the evidence. Real devaluations are supposed to lead to export booms. Real devaluations occur when the rate of a nominal devaluation exceeds the rate of inflation. To grasp the intuition of this relationship, consider the case in which the rate of inflation is allowed to catch up with the rate of the devaluation. In that case, everything after the devaluation would be exactly the same as before it, except the rate of inflation would be higher.

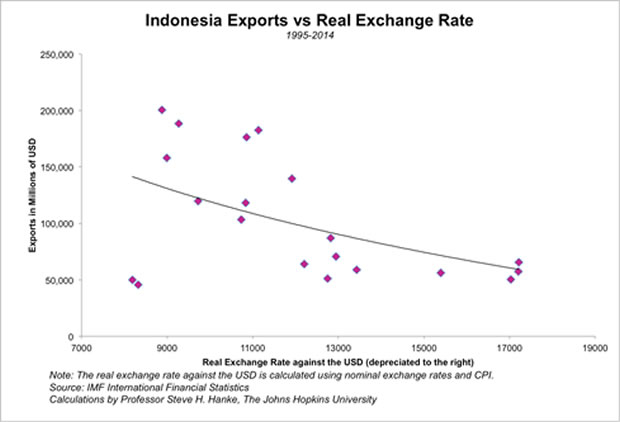

Evidence from Indonesia, for the 1995 – 2014 period, is typical. When the rupiah depreciated in real terms against the U.S. dollar, lower levels of exports were realized. On the other hand, exports were higher when the rupiah appreciated in real terms (see the accompanying chart). This is exactly the opposite of the relationship advertised by those who embrace devaluation strategies. They claim that real devaluations will make exports boom, and that currency appreciations will kill them.

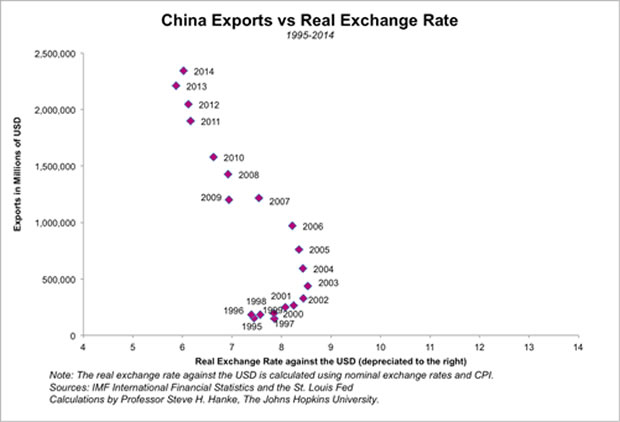

The case of China, like that of Indonesia’s, runs counter to conventional wisdom. China, from 1995 – 2014, is of particular interest and importance because the RMB is at the center of the so-called currency wars. As the accompanying chart shows, the RMB, in real terms, has mildly appreciated against the greenback, and Chinese exports have soared. These data not only poke a hole in the layman’s notions about the wonders of weak currencies, but also illustrate why most politicians are ignorant of the basic facts, and could be successfully prosecuted for false advertising.

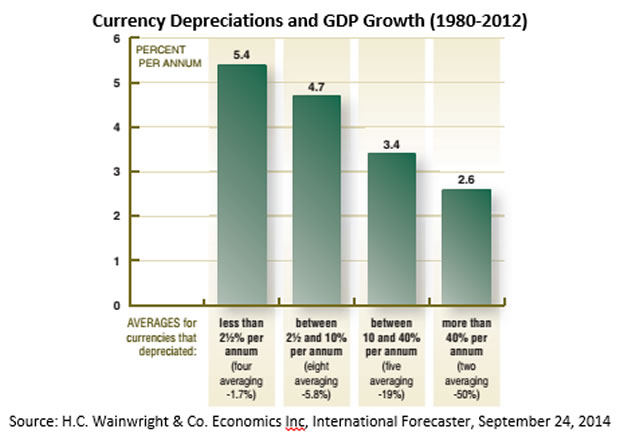

When we move beyond a country’s exports to its GDP, we find the same picture: currency devaluations are associated with slower GDP growth. David Ranson studied the relationship between currency devaluations and GDP growth for nineteen countries in the 1980 – 2012 period. The results are clear: to slow down economic growth, call for a currency devaluation (see the accompanying chart).

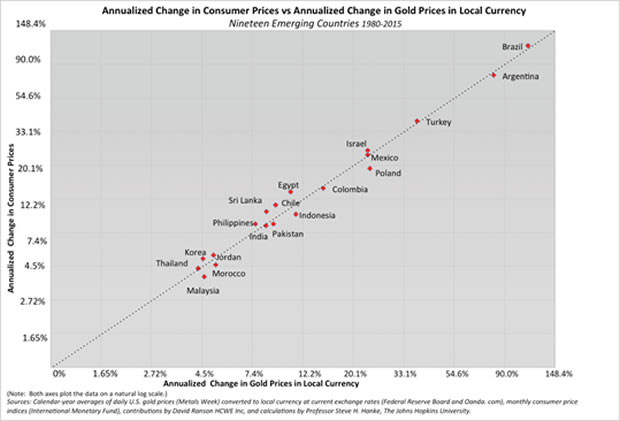

So, if devaluations fail to deliver more trade and higher GDP growth rates, what do they deliver? Well, one thing devaluations deliver is inflation. If we measure the strength of local currencies by the price of gold in those currencies, a virtual one-to-one relationship between the increase in the price of gold in a local currency (a weakening currency value) and a country’s annualized inflation rate exists. The accompanying chart for nineteen developing countries, over the 1980 – 2015 period, shows the tight link between a weaker currency and higher inflation rates.

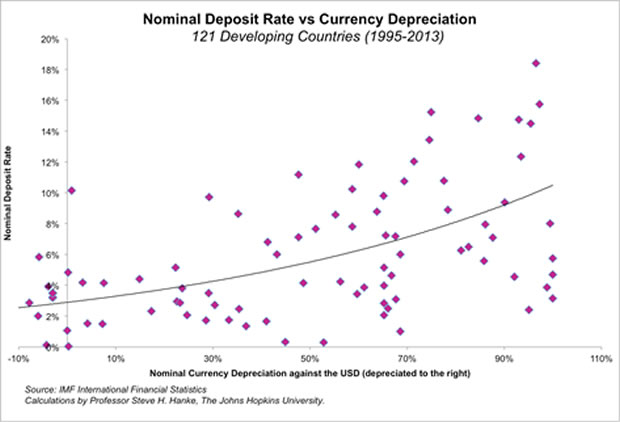

In addition, devaluations deliver higher interest rates, as the accompanying chart illustrates. When developing countries’ currencies are devalued against the U.S. dollar, interest rates in those countries go up. This results because people with assets denominated in currencies that are depreciating demand higher interest rates to compensate for the local currency’s loss in value relative to the U.S. dollar.

The arguments supporting currency devaluations are utterly confused and contradictory supported by neither economic theory nor empirical evidence.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2016 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.